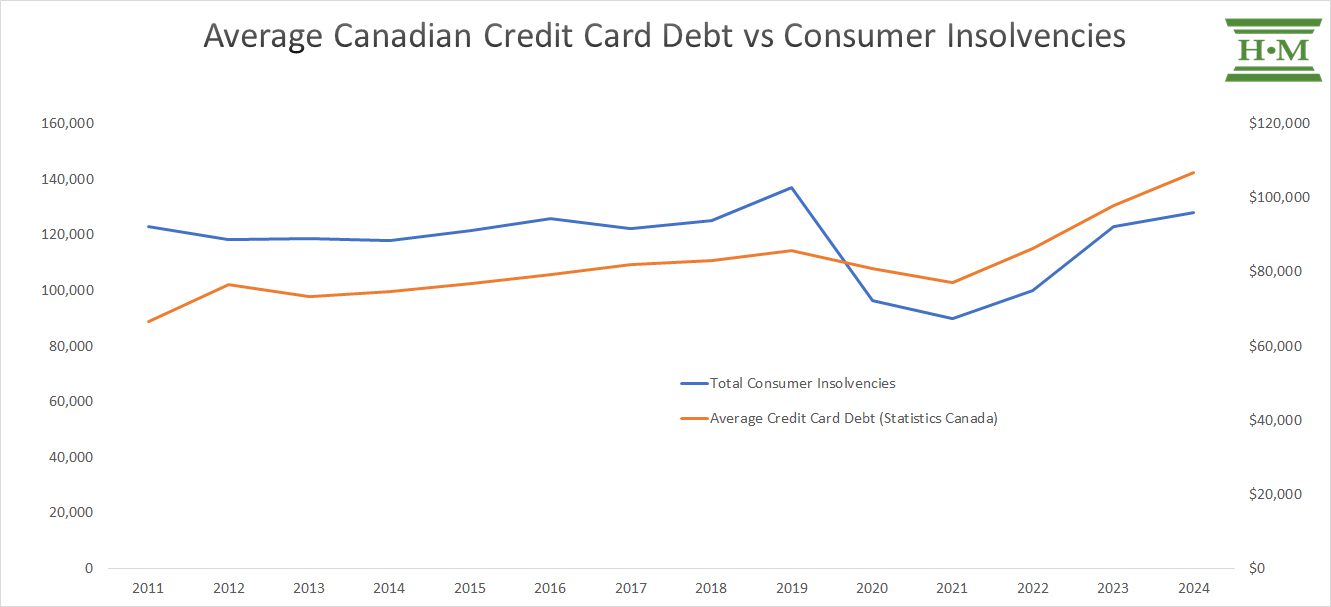

In 2024, Canadian consumer insolvencies increased by 11.4%, reflecting growing financial stress among households. This study offers insights into who files for insolvency in Canada.

Methodology

As required by law, we gather information about each person who files a consumer proposal or personal bankruptcy with us. We examine this data to develop a profile of the average consumer debtor who files for relief from their debt (we call this person “Joe Debtor”). We use this information to gain insight and knowledge as to why consumer insolvencies occur. Our 2024 consumer debt and bankruptcy study reviewed the details of 3,500 personal insolvencies in Ontario from January 1, 2024, to December 31, 2024, and compared the results of this profile with study results conducted since 2011 to identify any trends.

Key Findings

Credit Card Debt Among Insolvent Debtors Surges 26% in 2024

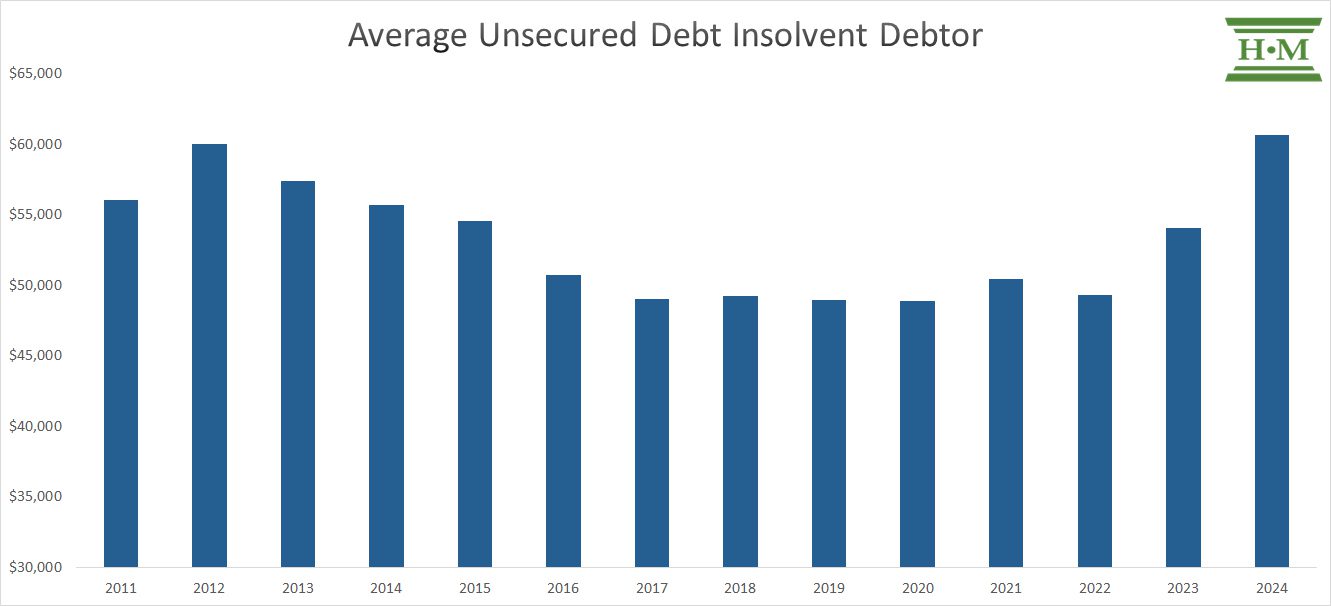

The average insolvent debtor owed $60,678 in unsecured debt in 2024, an increase of 12.2% from 2023—the largest annual rise since our study began in 2011.

Driving this surge is a sharp rise in credit card debt, with average balances increasing by 25.9% to $20,398, now accounting for 34% of total unsecured debt. While balances rose across all age groups, millennials experienced the steepest increase, with their credit card debt climbing by 35.0%. Senior debtors (aged 60+) carried the highest average balances at $27,543.

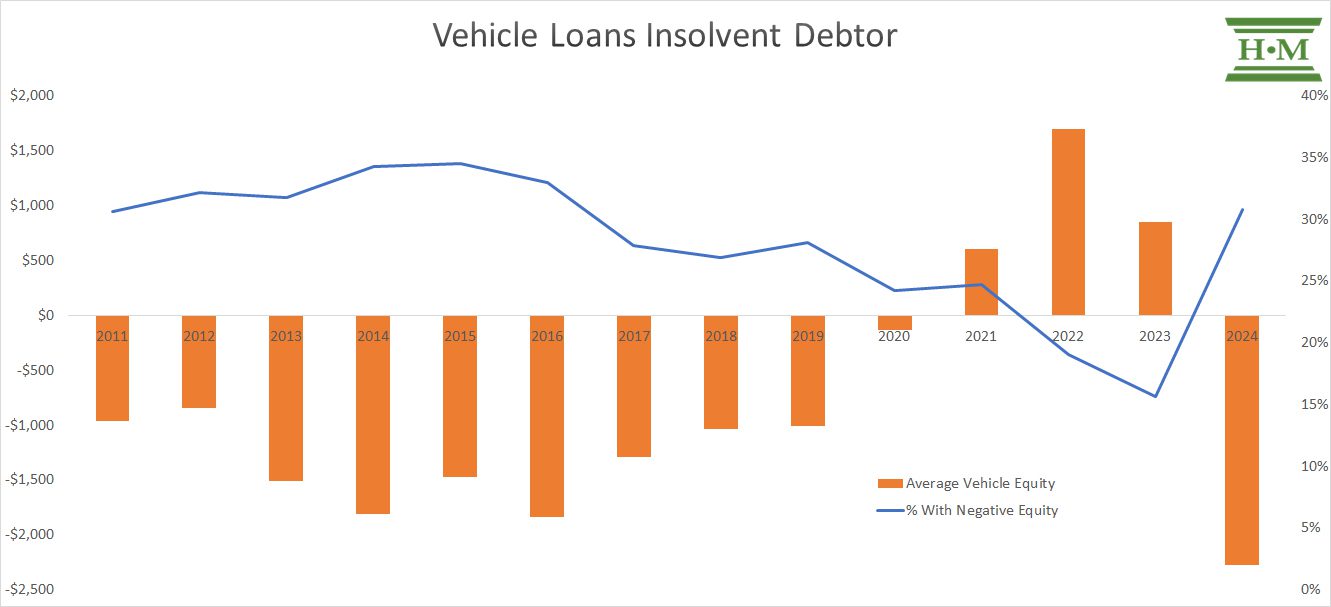

Insolvent homeowners faced a significant erosion of home equity in 2024, with average equity falling from 21% to 10%, and 14% of homeowners experiencing negative equity. Vehicle loan shortfalls also re-emerged, with 31% of financed vehicles now underwater—a level not seen since 2016.

Looking ahead, we expect consumer insolvencies in Canada to rise by 20–30% in 2025, driven by rising unemployment, record-high credit card debt, financial stress from elevated mortgage renewal rates, and challenges in the pre-construction condo market. New interest rate caps on high-interest lending may further limit access to emergency credit, intensifying the strain on already distressed individuals.

The remainder of this report delves deeper into the profile of the average insolvent debtor in 2024.

Who Files Insolvency in Canada?

2024 Insolvent Debtor Profile

The typical insolvent debtor in 2024 was 42 years old, relatively evenly distributed by gender, and half lived in a single-person household. Joe Debtor owed an average of $60,678 in unsecured debt and an additional $12,255 in non-mortgage secured debt (primarily a car loan or lease).

Below is a summary of debtor characteristics from our 2023 insolvency study.

| Joe Debtor | 2023 | 2024 |

|---|---|---|

| Personal Information | ||

| Male | 51% | 51% |

| Female | 49% | 48% |

| Gender unreported | 1% | 1% |

| Average age | 42.8 | 42.3 |

| Marital status | ||

| Married/Common-law | 34% | 35% |

| Divorced or Separated | 19% | 19% |

| Widowed | 2% | 1% |

| Single | 45% | 45% |

| Average family size (including debtor) | 2.1 | 2.1 |

| Single-person household | 49% | 49% |

| Likelihood of having dependent(s) | 35% | 37% |

| Likelihood of being a lone-parent | 17% | 17% |

| Average monthly income (debtor) | $3,085 | $3,237 |

| Total unsecured debt | $54,084 | $60,678 |

| Consumer debt-to-income | 174% | 188% |

| Likelihood they own a home | 4% | 5% |

| Average mortgage value (homeowner) | $473,575 | $555,853 |

AGE

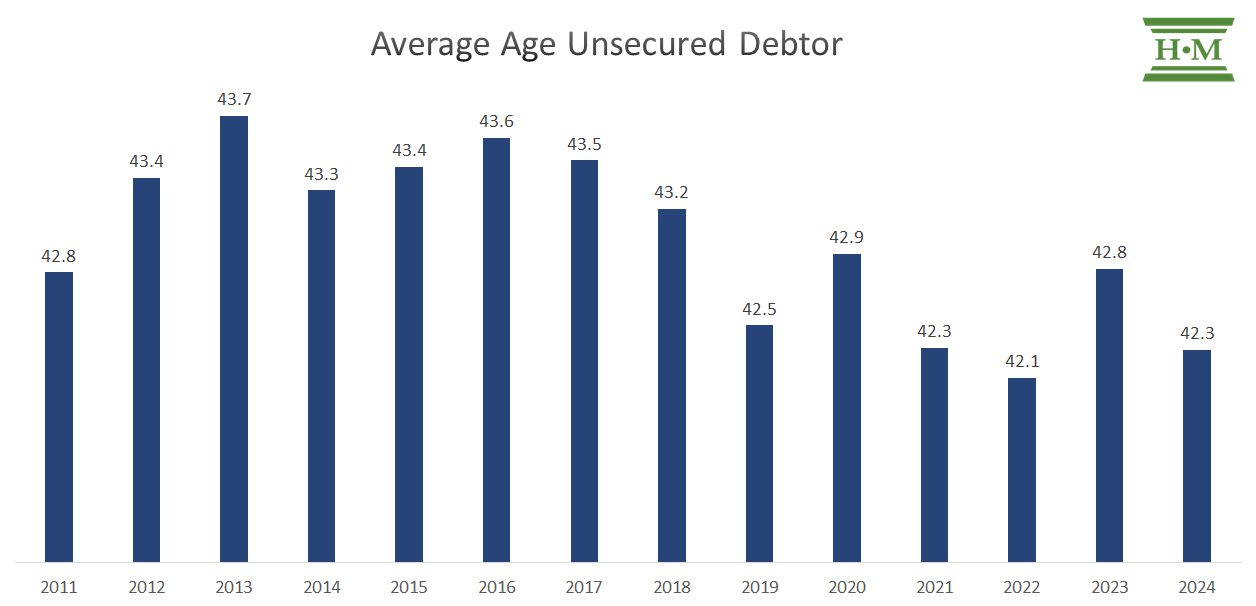

In 2024, the average age of insolvent debtors was 42.3 years, down from 42.8 in 2023.

The slight decrease primarily reflected an increase in debtors aged 40-49 and a decline in those aged 50 and older.

| Age Distribution | 2022 | 2023 | 2024 |

|---|---|---|---|

| 18-29 | 15.3% | 15.0% | 15.1% |

| 30-39 | 33.8% | 31.7% | 32.0% |

| 40-49 | 24.2% | 24.3% | 25.6% |

| 50-59 | 15.6% | 17.4% | 16.3% |

| 60+ | 11.2% | 11.7% | 10.7% |

Millennials (aged 28-43) now make up half of all insolvency filings (50.1% in 2024). Their average unsecured debt climbed by 16.4% to $60,148 in 2024, while their credit card debt saw a staggering 35.0% increase, the largest increase of all cohorts.

GENDER

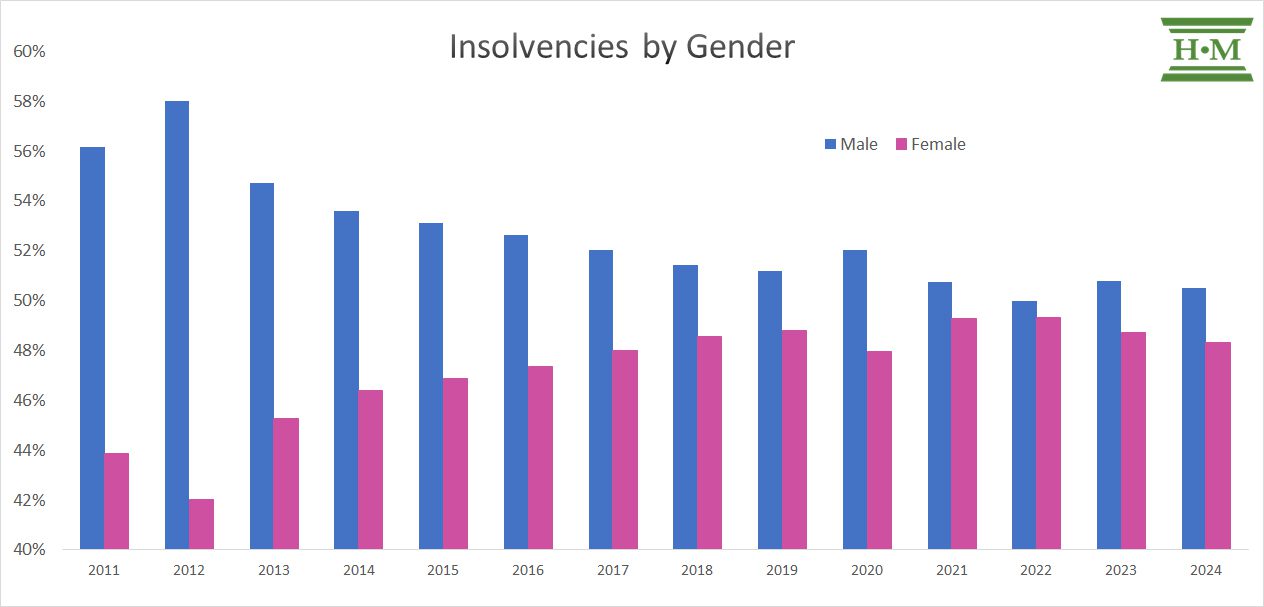

In 2024, insolvencies were almost evenly split by gender, with males accounting for 51%, females for 48%, and 1% unreported, consistent with 2023 figures.

Male debtors owed, on average, $66,247 in unsecured debt, 20.2% more than female debtors ($55,117).

- Male debtors are slightly younger (42.1) than the average female debtor (42.7).

- Both genders saw a staggering rise in credit card debt (female +25.3%, male +24.8%)

- Male debtors are more likely to have tax debts (46% versus 39%).

- Female debtors are more likely than male debtors to be divorced or separated (22% versus 16%), more likely to have dependents (43% versus 31%) and are more likely to be single parents (25% versus 10%).

- Female debtors are also more likely to struggle with student debt (30%) than male debtors (17%).

| Jane/Joe Debtor | Female | Male |

|---|---|---|

| % of all debtors | 48% | 51% |

| Average age | 42.7 | 42.6 |

| Unsecured debt | $55,117 | $59,005 |

| Non-mortgage secured debt | $10,213 | $11,217 |

| Average debtor income | $3,129 | $3,194 |

| Average household income | $3,654 | $3,764 |

| Consumer debt-to-income | 174% | 183% |

| % employed | 82% | 85% |

| % single | 44% | 46% |

| % married | 32% | 38% |

| % divorced | 22% | 16% |

| % with dependant(s) | 43% | 28% |

| % lone-parents | 25% | 9% |

| % with student debt | 30% | 18% |

| Average student debta | $17,202 | $14,633 |

| % with payday loan debt | 35% | 49% |

| Average payday loan debta | $7,693 | $12,348 |

| % with tax debt | 39% | 49% |

| Average tax debta | $16,124 | $26,248 |

| a – those with student loans, payday loans, or tax debt |

MARITAL STATUS AND HOUSEHOLD SIZE

Nearly half (49%) of all insolvency filings in 2024 were from single-person households, unchanged from 2023.

| Marital Status | 2022 | 2023 | 2024 |

| Single | 48% | 45% | 45% |

| Married / Common Law | 30% | 34% | 35% |

| Divorced / Separated | 20% | 19% | 19% |

| Widowed | 2% | 2% | 1% |

The average household size was unchanged, but the percentage of filers with dependents continued to increase, reaching 37% in 2024, indicating a growing financial strain among families.

| Household Size | 2022 | 2023 | 2024 |

|---|---|---|---|

| 1 | 53% | 49% | 49% |

| 2 | 21% | 21% | 21% |

| 3 | 11% | 14% | 13% |

| 4 | 10% | 10% | 10% |

| 5 | 4% | 5% | 4% |

| 6 or more | 1% | 2% | 2% |

| Average household size | 2.0 | 2.1 | 2.1 |

| % households with a dependent | 34% | 35% | 37% |

| % lone-parents | 18% | 17% | 17% |

| % two-income households | 16% | 21% | 21% |

EMPLOYMENT STATUS AND INCOME PROFILE

In 2024, 83% of insolvent debtors were employed at the time of filing, yet financial distress continues to affect Canadians at all income levels. Of those working, 11% reported as self-employed, up from 9% in 2023, reflecting the work profile for many millennials and GenX.

| Employment Status | 2022 | 2023 | 2024 |

|---|---|---|---|

| Employed | 81% | 82% | 83% |

| Unemployed | 7% | 6% | 7% |

| Retired | 5% | 5% | 5% |

| Disability | 5% | 5% | 3% |

| Other | 2% | 2% | 1% |

The average monthly income of insolvent individuals rose by 4.9% to $3,237 in 2024, while average household income increased by 5.0% to $3,798. These modest gains have failed to alleviate financial pressures as debt-to-income ratios worsened across all income groups.

| % by Debtor Income Profile | 2022 | 2023 | 2024 |

|---|---|---|---|

| $0 – $1000 | 6% | 4% | 5% |

| $1,001 – $2,000 | 17% | 13% | 13% |

| $2,001 – $3,000 | 37% | 35% | 29% |

| $3,001 – $4,000 | 26% | 30% | 30% |

| $4,001 + | 14% | 18% | 24% |

The most notable trend is the continued shift towards higher-income earners filing for insolvency. In 2024, 54% of all filers had a net monthly income over $3,000, up from 48% in 2023 and 40% in 2022. Credit reliance, unsustainable debt levels, inflation, and higher interest rates have eroded financial stability across all income brackets, especially middle-class Canadians.

On average, insolvent debtors in 2024 were left with just $288 to cover interest and principal payments on $60,678 in unsecured credit. With interest alone exceeding $2,450 per month for the average debtor, managing monthly payments is impossible, exacerbating financial distress. This inability to keep up with obligations traps debtors in a cycle of borrowing to meet basic expenses, compounding their financial problems. Reliance on high-cost credit like credit cards and payday loans and the accumulation of interest further accelerate the erosion of disposable income. Breaking free from this debt cycle becomes increasingly difficult, which results in debtors filing insolvency as a necessary financial reset.

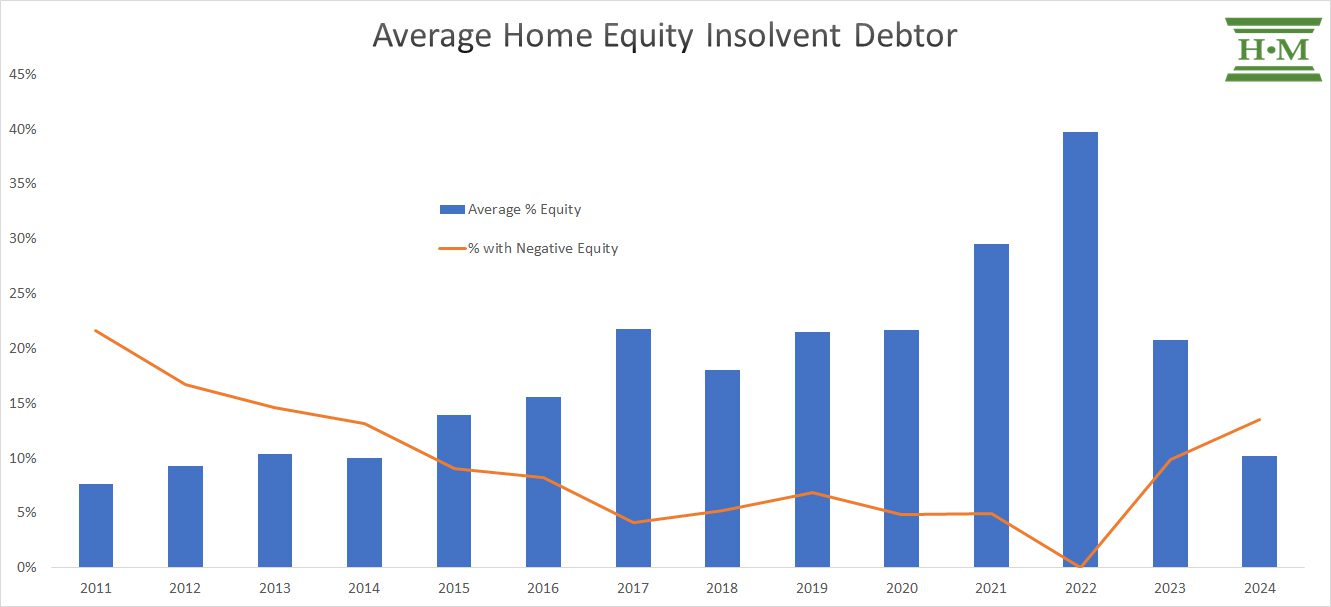

HOMEOWNERS

The percentage of insolvent debtors who owned a home remained low at 5% in 2024, up from 4% a year earlier.

What we did see, however, was a dramatic drop in average home equity available for the benefit of creditors. The average insolvent homeowner in 2024 carried a mortgage of $555,853 with an average equity value of just 10%, down from 21% a year earlier. One in seven (14%) experienced negative home equity.

On top of this, the average insolvent homeowner owed $99,429 in unsecured credit and $34,108 in non-mortgage secured debt.

DEBT PROFILE OF THE AVERAGE INSOLVENT DEBTOR

The average insolvent debtor in 2024 owed $60,678 in unsecured debt, marking a 12.2% increase from 2023—the largest year-over-year rise since 2011. When adjusted for inflation, the real increase in debt levels was more than 9%. This surge in debt obligations highlights the intensifying financial pressures faced by households.

Credit card debt was the leading driver, with average balances increasing 25.9% in 2024. While credit cards dominate, student loan debt increased 3.5%. Reliance on payday loans also decreased, with the proportion of insolvencies with a payday loan dropping from 40% in 2023 to 34% in 2024.

| Consumer Debt Profile | 2022 | 2023 | 2024 |

|---|---|---|---|

| Personal loans | $20,707 | $22,298 | $22,681 |

| Credit card debt | $13,848 | $16,199 | $20,398 |

| Tax debts | $8,109 | $9,364 | $9,092 |

| Student loans | $3,675 | $3,835 | $3,968 |

| Other unsecured debt | $2,978 | $2,388 | $4,539 |

| Average unsecured debt | $49,316 | $54,084 | $60,678 |

| Other secured debt | $9,033 | $10,490 | $12,255 |

| Total consumer credit | $58,349 | $64,574 | $72,933 |

Credit Card Debt Is the Leading Debt Driver

In 2024, credit card debt jumped from $16,199 in 2023 to $20,398, marking an increase of 25.9%. Credit cards now account for 34% of total unsecured debt, up from 30% the previous year. This sharp rise reflects the growing reliance on credit cards to manage daily expenses.

| Credit Card Debt by Age Groupa | 2024 | % change |

|---|---|---|

| 18-29 | $14,967 | 21.5% |

| 30-39 | $20,594 | 28.9% |

| 40-49 | $24,186 | 31.9% |

| 50-59 | $25,937 | 21.0% |

| 60+ | $27,543 | 18.2% |

| a – insolvent debtors with a credit card |

Every age group experienced increases in credit card balances, but the 40-49 age group saw the largest surge, with balances rising by 31.9%. Notably, individuals aged 60 and older carried the highest average credit card debt at $27,543 reflecting the growth of credit card debt over time once someone begins to carry a balance.

Personal Loans Rise Moderately

Personal loans include loans from traditional lenders, financing companies, new online or fintech lenders, traditional payday lenders and private loans. They include overdrafts, lines of credit, installment loans, payday loans and vehicle loan shortfalls.

Personal loans increased a modest 1.7% to $22,681 in 2024. While still small in dollar amount, we have noticed an increase in Buy Now Pay Later loans among borrowers.

Vehicles Loans: A Return to Shortfalls

More than 2 in 5 (41%) insolvent debtors have a vehicle loan when filing.

For the first time since 2020, the average debtor with a vehicle loan faced a vehicle shortfall. The average value of a financed vehicle was $20,740, against which they had a secured loan of $23,071. Used car prices have fallen since their highs during the pandemic, with older vehicles facing the steepest decline. The percentage of financed vehicles with a shortfall rose to 31%, rates not seen since 2016.

Decline in Payday Loan Usage

While average payday loan amounts decreased, their prevalence remains concerning, particularly among vulnerable households.

In 2024, just 34% of insolvencies involved payday loan debt, down from 40% in 2023. Average balances for payday loan borrowers fell 5.6% to $7,700.

While this appears to be good news, the reality is that indebted borrowers simply shifted their debt burden to other available credit including credit card debt, lines of credit and Buy Now Pay Later loans.

Tax Balances Rise

The percentage of insolvent debtors with tax obligations declined from 46% in 2023 to 43% in 2024. However, for those who did owe taxes, the average tax debt increased by 3.9%, reaching $21,280.

Stabilization of Student Loan Debt

The prevalence of student loan debt was unchanged in 2024, at 23% of all insolvencies. For those carrying student loan debt, average balances increased 3.6% to $16,978. Student debtors are still predominantly female (62%), with female student debtors owing an average of $17,202 compared to $16,517 for males.

Insolvency Predictions for 2025

As we look ahead to 2025, we expect consumer insolvencies in Canada to continue to rise by an estimated 20-30%. This projection reflects ongoing economic pressures and evolving debt profiles across several key areas:

Rising Unemployment: Higher unemployment rates correlate with increased insolvencies, particularly bankruptcies, as prolonged job loss forces consumers to rely on credit.

Increasing Credit Card Debt: Record-high credit card debt and rising delinquency rates are expected to be significant drivers of insolvency growth in 2025.

Mortgage Renewals Financial stress among homeowners is expected to escalate due to higher mortgage renewal rates, potentially doubling the proportion of homeowner insolvencies to 8-10%.

Pre-Construction Market Stress: Struggles in the pre-construction condo market may contribute to rising real estate insolvencies as appraisals fall below original purchase prices. Investors can include any shortfall as an unsecured debt in a consumer or Division I proposal.

Regulatory Changes: New interest rate caps on high-interest lending may accelerate insolvencies by limiting access to emergency credit, a traditional stopgap for distressed individuals. The lack of short-term lending may pull many insolvencies forward.

This outlook highlights the many economic pressures burdening indebted Canadians, which we expect will continue to drive a substantial rise in insolvency filings in 2025.

Media Inquiries

If you would like to request an interview or need background information, please contact:

Email Doug: doug@hoyes.com

Email Ted: ted@hoyes.com

or phone 1-866-747-0660.

How to cite: Hoyes, Michalos & Associates Inc. Annual Bankruptcy Study, 2021. Published February 10, 2025. https://www.hoyes.com/press/joe-debtor/

Douglas Hoyes, CPA, Licensed Insolvency Trustee, Co-founder Hoyes Michalos.

Doug was inspired to bring his financial experience to work by helping individual people not corporations rebuild their financial future. Doug advocates for consumers needing debt relief to ensure they receive a fair and respectful debt management solution. He regularly comments in the media including publications and networks such as Canada AM, Global News, CBC, The Globe and Mail, The Toronto Star, Business News Network, The Financial Post and CTV News. Doug also posts regularly to our blog, on Twitter, Google+, and Huffington Post Canada.

Ted Michalos, CPA, Licensed Insolvency Trustee, Co-founder Hoyes Michalos

Ted Michalos strongly believes that debt management advice should be delivered without gimmicks and without tricks. He is enthusiastic about ensuring clients understand all of their options and that Hoyes Michalos helps them develop a custom-tailored plan to deal with their debts. Ted is a prolific writer, contributing answers and advice on our blog and on several insolvency and debt relief sites, including Advisor.ca. He has appeared as an expert on bankruptcy and debt-related matters including appearances on CBC News, Global TV and Business News Network.

Company Background

Hoyes, Michalos & Associates Inc. is a Licensed Insolvency Trustee firm that has provided personal bankruptcy and consumer proposal services to individuals in Ontario since 1999. Co-founded by Doug Hoyes and Ted Michalos, we are one of the largest firms in Canada practicing exclusively in the area of personal insolvency. With offices throughout Ontario, Hoyes Michalos provides real debt management solutions to help Ontarian’s climb out of debt.

Get Industry Insights

Hoyes Michalos issues monthly consumer insolvency updates delivered straight to your inbox. Sign up for future releases and our annual Joe Debtor study.

You can unsubscribe from e-alerts at any time. Read our privacy statement here.

You have been added to our industry insights list. We will notify you as we publish monthly consumer insolvency updates, as well as, share our annual bankruptcy study.

If you would like to request an interview or need background information, please contact:

Email Doug: doug@hoyes.com

Email Ted: ted@hoyes.com

or phone 1-866-747-0660.