At Hoyes, Michalos & Associates we have helped over 200,000 people in Ontario find relief from their debt by considering bankruptcy or filing a consumer proposal. We know that this is not the solution for everyone. In fact, of all the people who call us, only 1 in 5 will end up filing bankruptcy or a consumer proposal. The other 4 out of 5 can be helped with other options. Our objective is to help you review the advantages and disadvantages of declaring bankruptcy in Ontario so you can make a choice that works for you.

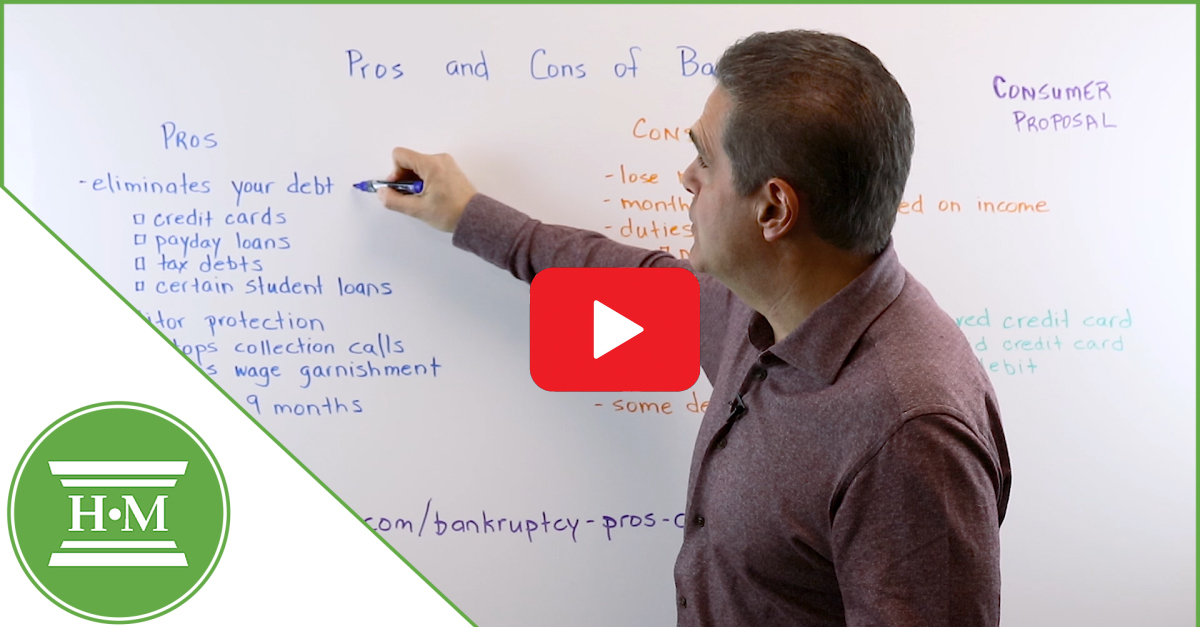

Advantages of Bankruptcy

Filing bankruptcy is not the solution for everyone but there are times when it makes sense. Here are the top benefits of filing bankruptcy with an Ontario bankruptcy trustee:

- Relief from overwhelming debt: Most unsecured debts are eliminated when you complete your bankruptcy. This includes credit card debt, lines of credit, payday loans, and other unsecured debts that may be causing financial stress.

- Stay of proceedings: The ‘automatic stay’ provided by the Bankruptcy & Insolvency Act means all collection calls stop, wage garnishments end, and creditors can no longer take legal action against you.

- Quick process: A personal bankruptcy can be over relatively quickly. In most cases, you can receive an automatic discharge in 9 months.

- Cost effective option: For those with limited income and few assets, bankruptcy can cost less than other debt relief options.

- Retention of essential assets: While some assets may need to be surrendered, you can keep basic necessities including household furniture, clothing, tools needed for work, and a vehicle worth up to a certain value. Most RRSPs are also protected (except contributions made in the last 12 months).

Disadvantages of Declaring Bankruptcy

Bankruptcy should be the option of last resort. Not everyone should declare bankruptcy and there is a downside.

- Surplus income payments: If your income increases during bankruptcy, your monthly payments will also increase. You’re required to pay more when you earn above the government’s surplus income threshold.

- It doesn’t discharge all debts. Bankruptcy does not release alimony, child support, fines & some student loans. It also does not deal with secured debts like mortgages.

- You lose non-exempt assets. While some assets are exempt, a Licensed Insolvency Trustee will need to sell non-exempt assets to repay creditors. This includes any equity in your home, investments and tax refunds.

- Negative impact on credit. A record of bankruptcy will appear at an R9 credit rating on your credit report and remain for 6 years after discharge. You will also lose all credit cards.

- Employment considerations. Declaring bankruptcy may impact employment if you are in charge of money or trust funds. In additional you are forbidden from being a director of a company while bankrupt.

Learn more about the effects of filing bankruptcy in Ontario.

Advantages of a Consumer Proposal Over Bankruptcy

In addition to considering the pros and cons of filing bankruptcy, you should also consider a consumer proposal as an alternative to bankruptcy before making a decision on how to deal with your debt problem.

A consumer proposal is a legally binding debt settlement arrangement between you and your creditors. Like bankruptcy, it’s administered by a Licensed Insolvency Trustee but it allows you to repay a portion of your debt while avoiding many of bankruptcy’s drawbacks. Here’s how a consumer proposal can help:

- You keep all assets: Unlike bankruptcy, a consumer proposal allows you to keep your assets, such as your home or car.

- Less impact on your credit score: Filing a consumer proposal has a less severe impact on your credit score. It results in an R7 rating, while bankruptcy results in an R9 (the lowest rating).

- Fixed payments: Payments in a consumer proposal are fixed, and you do not need to surrender any future income.

- No surplus income payments: In bankruptcy, higher income may lead to additional payments (surplus income). A consumer proposal doesn’t have this requirement.

- Longer repayment period: A consumer proposal allows you to spread payments over up to five years, which may make monthly payments more manageable.

- Creditor protection: You negotiate a settlement with your creditors, which may involve paying back only a portion of your debt. You receive the same creditor protection as is available by filing bankruptcy.

- Less restrictions: You can continue as a company director and most professional designations are not impacted by a consumer proposal as long as you provide disclosure to your regulatory body.

- Fewer duties: While you must attend two credit counseling sessions, you don’t need to report monthly income or keep detailed records as required in bankruptcy.

Should You Declare Bankruptcy?

There is a cost to declaring personal bankruptcy however if you are receiving harassing calls from creditors, facing a potential wage garnishment or unable to pay your debts in full, you may need a formal debt relief solution only available through the Bankruptcy and Insolvency Act.

Consider Bankruptcy If:

You need immediate creditor protection

You have limited assets to protect

Your debts are very high compared to your income

You’re dealing with tax debt or older student loans

Consider a Consumer Proposal If:

You want predictable payments that won’t change

You have assets you want to protect

You have stable income to support a repayment plan

You want to minimize the impact on your credit rating

Get Professional Advice

Every situation is unique. Our Licensed Insolvency Trustees will help you understand all your options and choose the best path forward.

If you are struggling with debt, talk to one of our licensed Ontario bankruptcy trustees about how to declare bankruptcy and whether it is the right option for you.

Your first consultation is always free.