Struggling with Debt? LITs Are Here to Help.

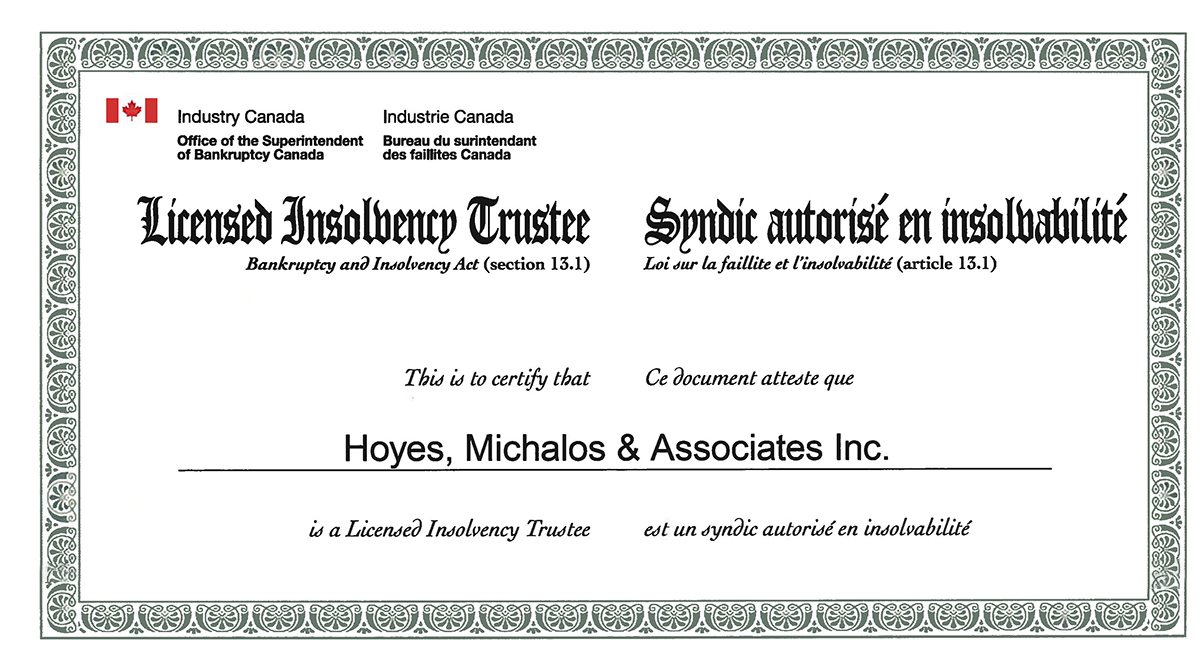

Choosing the right debt advisor is a crucial step towards a fresh financial start. At Hoyes Michalos, we understand the stress that comes with overwhelming debt, and we’re here to help you find the right solution. As Licensed Insolvency Trustees (LITs), we’re not just debt advisors — we’re federally regulated professionals dedicated to helping you regain control of your finances.

What is a Licensed Insolvency Trustee

A Licensed Insolvency Trustee is the only debt professional in Canada licensed and regulated by the federal government to help you manage and eliminate debt. LITs are qualified to administer legal debt solutions like bankruptcies and consumer proposals under the Bankruptcy & Insolvency Act.

The LIT designation requires rigorous training and education. To become a Licensed Insolvency Trustee individuals must pass a comprehensive oral examination which requires knowledge and experience.

Why Choose Hoyes Michalos?

- ✅ Trusted Since 1999: We’ve been helping Ontarians achieve debt relief for over 25 years.

- ✅ Expert Guidance: Every consultation is with a Licensed Insolvency Trustee — no middlemen, no salespeople.

- ✅ Empathy First: We understand the emotional toll of debt. Our goal is to provide solutions without judgment.

- ✅ Free, No-Obligation Consultations: Talk to us about your debt relief options — with no pressure and no upfront fees.

What is the Role of A Licensed Insolvency Trustee?

Think of a Licensed Insolvency Trustee as the referees in the debt relief process. We ensure fairness for everyone involved — you, your creditors, and the legal system. Our job is to guide you through the process, helping you explore all your options so you can make the best choice for your situation.

How We Help You:

- Review Your Financial Situation: We meet with you and take a comprehensive look at your debts, income, and expenses to understand your unique situation.

- Explore All Options: From debt consolidation to consumer proposals and bankruptcy, we explain every option available.

- File Legal Documents: If you choose a consumer proposal or bankruptcy, we handle all paperwork and communication with creditors.

- Protect You from Creditors: Filing with an LIT triggers a legal stay of proceedings — stopping wage garnishments and collection calls. We notify your creditors, accept and review claims and handle all future communication with the people you owe money to.

- Support You Through the Process: From start to finish, we guide you every step of the way to ensure a successful debt solution. We ensure you complete all necessary duties to obtaining your discharge or completion certificate so your debts are eliminated.

In the end, the important point is that the professional you work with is licensed and has the training and experience needed to help you eliminate your debt. Licensed Insolvency Trustees are just those experts.

8 Reasons to Work with a Licensed Insolvency Trustee

There are a lot of different types of debt advisors in Ontario and across Canada including federally Licensed Insolvency Trustees, accredited not-for profit credit counsellors to for profit debt consultants. Here are 8 reasons why you should consider contacting a Licensed Insolvency Trustee:

- Unmatched Expertise: Our LITs undergo rigorous training and are some of the most qualified debt professionals in Canada.

- We Offer More Than Bankruptcy: Many clients avoid bankruptcy by filing a consumer proposal — a government-approved debt settlement program.

- No Upfront Fees: Consultations are always free, with no obligations.

- Affordable Debt Solutions: Consumer proposals often settle debts for as little as 20-30% of what you owe — with no interest.

- You’re Protected: We’re regulated by the government and follow strict ethical guidelines.

- We Work for You — Not Your Creditors: Our role is to ensure fairness, not to side with creditors.

- We Make It Simple: Debt relief can be overwhelming — we simplify the process.

- We Care: Our team approaches every case with empathy and understanding.

Frequently Asked Questions

-

Who Regulates Licensed Insolvency Trustees?

LITs are licensed and overseen by the Office of the Superintendent of Bankruptcy (OSB), a branch of the federal government.

The OSB sets policy and procedures for the industry, like rules around surplus income limits, court proceedings, even a code of ethics for trustees. It is the licensed insolvency trustee’s job to administer bankruptcy and consumer proposals in accordance with these policies and procedures.

It is important to realize that an LIT is not a government employee. Many are accountants by trade that have specialized in dealing with debt and have completed an extensive program of training and examination to become licensed insolvency trustees.

Many are also licensed credit counsellors and become Chartered Insolvency and Restructuring Professionals (CIRP), passing and maintaining these designations through the Canadian Association of Insolvency and Restructuring Professionals (CAIRP).

-

Who Does an LIT Work For?

Licensed Insolvency Trustees do not work for the creditors. LITs act as impartial officers of the court, ensuring fairness for both debtors and creditors.

An LIT has a duty of care to all stakeholders involved in the insolvency process. This includes the debtor, the creditors or lenders and the OSB. Licensed insolvency trustees are officers of the Court and, as such, are held to a higher standard of responsibility than the average debt adviser. If you file a bankruptcy or consumer proposal, LITs handle creditors on your behalf but are really intermediaries or ‘referees’ in the bankruptcy system.

-

How Does a Licensed Insolvency Trustee Get Paid?

LITs are paid through the proceeds of your bankruptcy or consumer proposal, meaning there are no separate fees you need to pay out of pocket. Fees are regulated by the Office of the Superintendent of Bankruptcy and come out of your bankruptcy or proposal payments. Effectively, your creditors pay the cost of administering your bankruptcy or proposal.

-

Is Bankruptcy My Only Option?

Absolutely not. An LITs duty is to explain all your debt relief options. Many of our clients avoid bankruptcy through consumer proposals or other debt solutions.

Hoyes Michalos — Trusted Licensed Insolvency Trustees Across Ontario

Proudly helping Ontarians achieve debt freedom since 1999.

You don’t have to face debt alone. Whether you’re considering bankruptcy, a consumer proposal, or just need advice, Hoyes Michalos is here to help.

Contact us today for your free no-obligation consultation with a Licensed Insolvency Trustee.