Payday loans become the loan of last resort for a lot of people struggling to keep up with credit card and other debt payments. In fact, 4 in 10 of our clients use payday loans on top of other unsecured debt. If you are caught in the payday loan trap, which option is better – credit counselling or a consumer proposal?

If you have payday loans on top of credit card debts, student loans and other debt, or you carry multiple payday loans, a consumer proposal is usually the better solution for debt elimination.

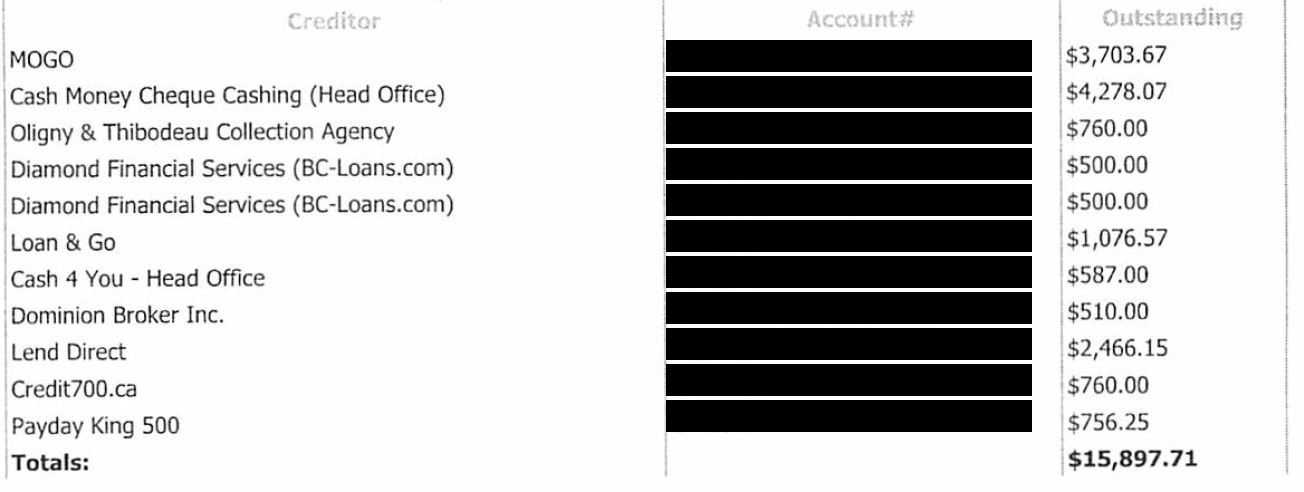

Here is one actual client example to explain why. We’ve hidden and changed the name of the client, and some details, for confidentiality.

Mary visited a credit counselling company in 2018, struggling under the weight of 11 different payday loans. You may wonder how this happens? It’s simple, really and not uncommon. Like many others, Mary took out her first payday loan to have money to survive until the next payday. Unfortunately, that meant she was short again the following pay, which meant visiting a second payday lender to pay off the first and borrowing more to pay the rent. Carrying more than one payday loan is easy when you consider the number of online payday loan lenders like MOGO, Credit700.ca, and BC-Loans.com. These companies don’t report to your credit bureau so there is no registry to show you already have many loans outstanding. The cycle continued until Mary owed 11 different lenders almost $16,000.

She thought credit counselling would help her repay all this debt by consolidating it into one new simple payment, spreading the monthly payments over 60 months. She hoped this would break the cycle and allow her to get back on track financially. She signed up for a debt management plan.

The credit counselling agency Mary worked with built a repayment plan as follows:

Payment Schedule

| Duration | Monthly Payment |

| Months 1-5 | $916.00 per month |

| Months 6-10 | $693.00 per month |

| Months 11-12 | $521.00 per month |

| Months 13-18 | $465.00 per month |

| Months 19-36 | $318.00 per month |

| Months 37-41 | $242.00 per month |

| Months 42-60 | $145.00 per month |

Unfortunately, the debt management program created by her credit counsellor was unaffordable. A review of her finances reveals why credit counselling was a bad option for Mary to deal with all this payday loan debt.

- The monthly payments were front end loaded making for high initial payments, more than she could afford.

- In aggregate, credit counselling would still have required Mary to make payments totaling $15,897.71, including interest and counselling fees of $6,578.

- The debt management plan excluded all of Mary’s other debts, so she still had to keep up with all those payments as well.

When Mary came to see us for payday loan help, we did a full debt assessment, reviewing all her debts to determine what she could afford to repay. A full assessment showed that she had $71,000 in unsecured debts, including:

| Payday Loans | $19,000 |

| Bank Loans | $39,700 |

| Credit Cards | $5,000 |

| Tax Debts | $3,900 |

| Other Financing Loans | $2,500 |

Based on Mary’s situation, it was impossible for her to keep up with all these payments. Based on her monthly income and debts, Mary could offer her creditors a settlement proposal in the range of $420 per month for 60 months. This would be all the payments Mary would be required to pay against all her debts. In total she would repay $25,200, including all fees and costs to eliminate $71,000 in debts. You may notice that the monthly proposal payments would be significantly lower than those required in the first 18 months of her debt management plan, which only dealt with her payday loan debt.

If you have significant debts, including multiple payday loans, a consumer proposal vs debt management plan is almost always the cheaper alternative. This is because a proposal allows you to make a deal for less than the full amount owing, while a debt management plan requires you to repay 100% of the debt plus fees.

In the end, based on her unique situation, Mary filed for bankruptcy. Her precarious income made keeping up with proposal payments difficult. Again, this was an option available to Mary because she talked with a Licensed Insolvency Trustee. Through a discussion of her situation, it was clear that bankruptcy was a better option than the debt management plan.

If you, like Mary, have complex debts, including payday loans, we encourage you to contact a Licensed Insolvency Trustee to review all your options to find the best plan for you financially.