Money in 24 hours. Simple online application. Low payments. 36 month payment terms. That all sounds great when you need a quick unsecured loan to help consolidate some unsecured bills or pay for an emergency expense or repair. There are plenty of lending companies who will grant loans to individuals with poor credit. But are these bad credit, high-interest financing loans worth it no matter how desperate you are for the cash?

To their investors they must be. Duo Bank of Canada recently completed the purchase of Fairstone Financial Holdings Inc., a large subprime lender. Despite the fact that they offer unsecured loans starting at 26.0%, and in our experience as you will see below often at rates much higher than that, subprime lenders feel “There is a very large under-served market in the Canadian population, and the focus for Duo Bank and Fairstone in combination is really to provide access to quality financial products to that under-served market in Canada, that typically isn’t a good fit for the large banks.”

While, for the individual borrower, often millennials, these loans may temporarily delay an oncoming insolvency proceeding, in the end it is likely to increase Canadian insolvencies in the future.

Understanding Bad Credit Loans

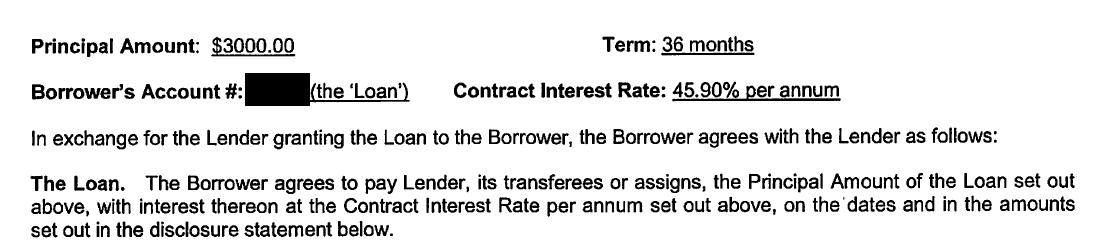

To help you understand what terms and costs you agree to, we look at one such example from Loan Away, a large online lender. We’ve redacted the borrower’s name for privacy.

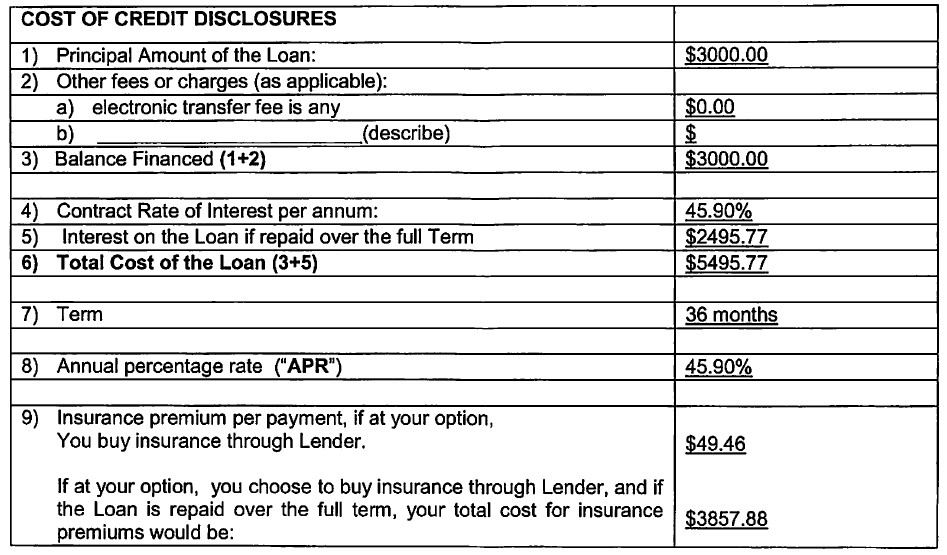

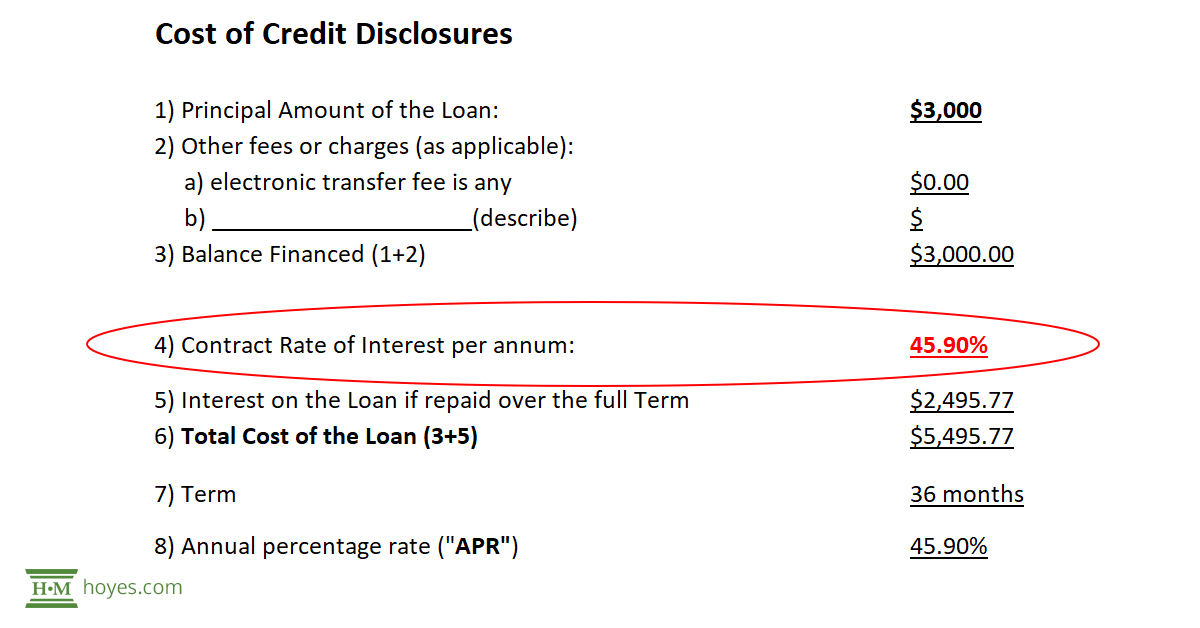

As per the Loan Away agreement, this client borrowed $3,000 for 36 months. The contracted interest rate was 45.90%. Usury laws in Ontario prohibit loans above 60%. Since this is not a payday loan, these laws apply. So while ridiculously expenses, this interest rate is perfectly legal.

Lenders are required to disclose the cost of credit, which was done by Loan Away. Over three years, the borrower agreed to pay $2,495.77 in interest on a $3,000 loan.

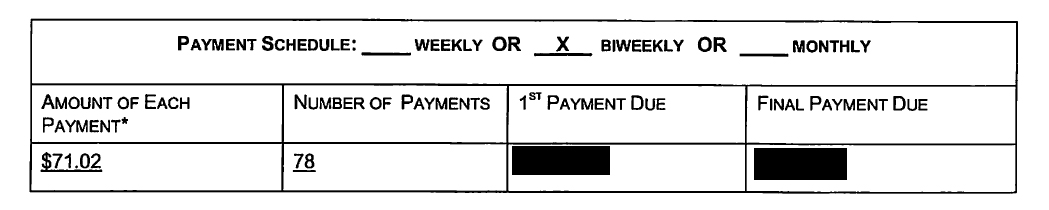

So why do people take out these loans? The answer is an attractive repayment schedule. Lenders will arrange payments around your paycheque. Weekly or biweekly payments can appear quite low – and affordable.

In this case, the borrower contracted to pay $71.02 bi-weekly. The sad truth is that a $71 payment every pay looks very attractive compared to the ongoing stress of collection calls, being threatened with a wage garnishment, or worrying about eviction for rent arrears.

And if it stopped there, for many people, this would be expensive but not catastrophic. But the costs don’t stop there.

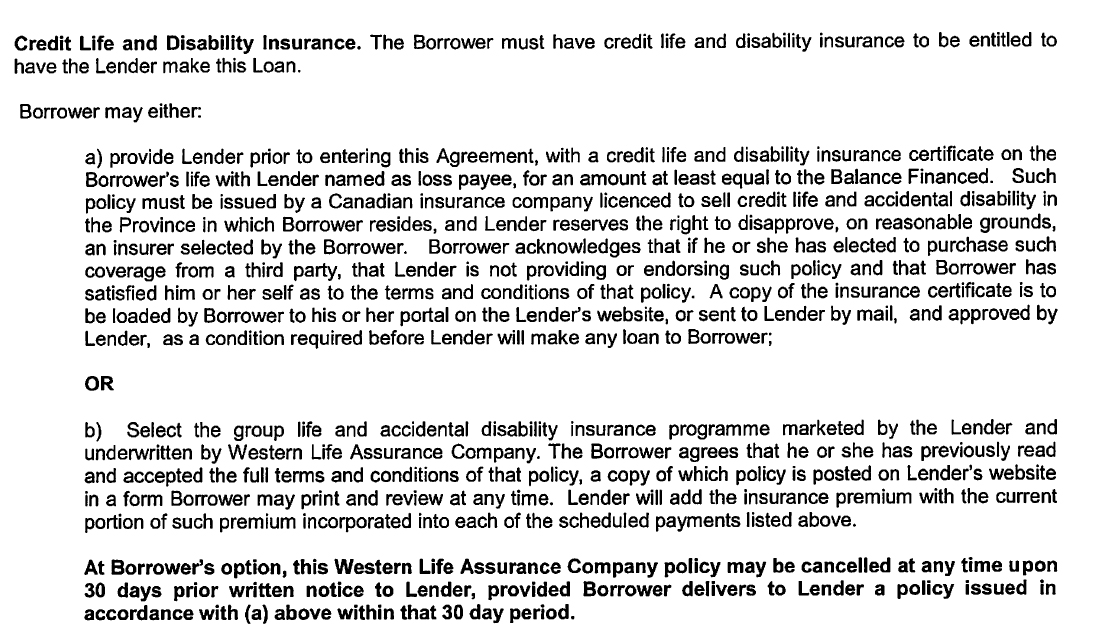

Most of these financing companies encourage or require that the borrower carry some form of insurance on the loan such as loan protection insurance or life or disability insurance in the name of the lender. This can add thousands in additional fees, sometimes surpassing the actual interest charged.

In the case of EasyLoan the borrower this insurance was required either through their own plan, or via the lender.

In most cases, the lending company knows the borrower does not have this insurance on their own, which means purchasing such insurance through the lender.

In our actual example, the additional insurance premium cost the borrower an additional $53.42 biweekly including HST or $4,266.76 over three years on a $3,000 loan.

When you do the math, this $3,000 financing loan cost $6,763 in interest and fees over three years, more than double the amount borrowed.

We have seen a significant rise in the use of high-cost financing loans among heavily indebted borrowers. While we’ve used the example Loan Away, they are certainly not the only company offering installment loans at rates of of 36% or more.

For many, financing loans are just bad debt piled on top of other debt. If you already have debt, talk with a Licensed Insolvency Trustee about your options. These types of loans, whether to consolidate overdue bills or make an emergency purchase, only serve to postpone and usually worsen debt problems.