Credit counselling is a program to repay your debts in full. Many people choose credit counselling because they think the program is less harmful to their credit. The problem is, in a significant number of situations, credit counselling can leave you worse off financially. Here is an actual client story we encountered to show the true cost of credit counselling.

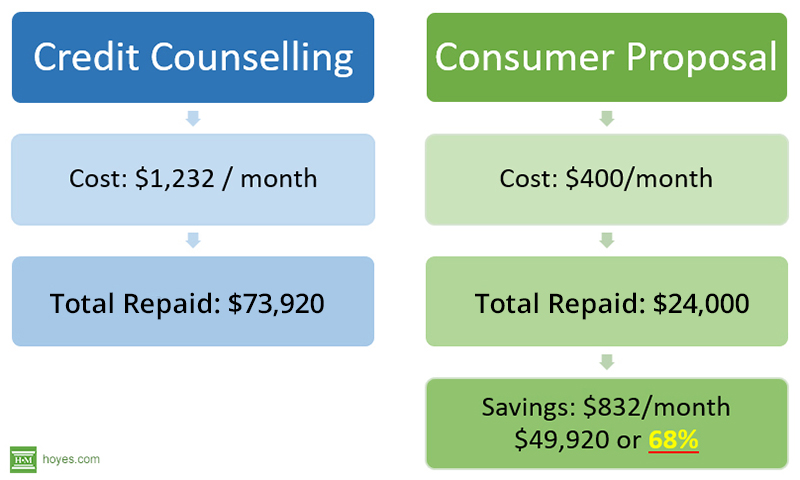

Sondra (not her real name) owed a total of $66,500 in unsecured debts including two traditional bank loans and a Visa line of credit. Sondra contacted a large national Canada credit counselling agency for debt help. The credit counselling agency proposed a debt consolidation program that would require Sondra to make monthly payments totaling $1,232 for five years.

Table of Contents

How was the cost calculated?

The credit counsellor took $66,500 in total debts and divided that by 60 months amounting to $1,108 a month to support debt repayment.

Credit counselling agreements require an additional “Monthly contribution of 10% of all funds deposited in trust”.

In Sondra’s case this added an extra monthly payment of $123.20, bringing the total program payment to $1,232.

Interestingly that is a circular calculation. While the fee payment is 10% of all payments, in effect, Sondra paid 11% of her debts as additional fees ($123/ $1,108).

Is this affordable?

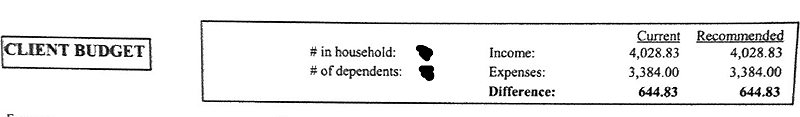

Is Sondra’s case, it was not. The documents provided by the credit counselling company that Sondra signed showed her budget at the time had a cash flow available for debt repayment of $645 a month.

Sondra’s debt consolidation program payments represented 171% of her available budget as recommended by the credit counsellor.

Within two months of signing up for the program, Sondra was unable to keep up with her payments. The credit counselling company rewrote her program to deal with the missing payment, proposing to increase her monthly cost to $1,253 a month.

How does a consumer proposal compare?

While Sondra’s case is extreme, not everyone in a Debt Consolidation Program or Debt Management Program owes $60,000 in unsecured credit, it highlights the flaw in trying to eliminate large levels of debt through credit counselling. Credit counselling agencies purport to provide budgeting help, yet in this case, the counsellor recommended a program that was clearly unaffordable.

Eventually, Sondra contacted our office to discuss a consumer proposal. Including accumulated interest, Sondra now owed $63,000 in debts.

Based on her income, we recommended a proposal to creditors which would see her repay $24,000 of her debts, at a monthly cost of $400 per month. This amount was well within her budget, and her creditors voted to accept this proposal.

Saving money by filing a consumer proposal instead

The result was that Sondra was saving $832 a month for 60 months by choosing a consumer proposal rather than continuing with her credit counselling program. Sondra saved $49,920 over five years.

Additional consequences of credit counselling

Potential ongoing interest costs

I understand many people are afraid to talk with a Licensed Insolvency Trustee and view credit counselling as a softer, less damaging program. However, this is not always the case. Let’s look at some of the contract terms that Sondra signed.

“I understand that this agreement does not guarantee the suspension or cancellation of interest or service charges for accounts listed in the program.”

“I have been given written confirmation of the estimated length of the DCP. Estimated months to payout: 60 months + interest.”

Participation in credit counselling programs is voluntary, and not all creditors will agree to waive interest. While traditional banks and lenders often do, many financing companies will not wholly waive interest costs. This means that after the program, the debtor may continue to owe money to their creditors.

Credit impact of credit counselling

Credit counselling agencies like to say that the effects of a debt consolidation program (or debt management plan) are less harmful than either a consumer proposal or bankruptcy. I’d disagree with this statement.

The credit counselling contract we reviewed contained two clauses regarding the credit impact of entering a debt management program:

“Entering into a debt repayment program may lower your credit rating or credit score.”

“We agree not to accept or apply for additional credit while on this Debt Consolidation Program.”

In fairness, a consumer proposal has similar implications. Like a debt consolidation program, a consumer proposal is reported on your credit report. If you file a consumer proposal, you must say that you are in a proposal if you apply for credit above $1,000. We always recommend that our clients avoid taking on new credit while in a proposal since the objective is to get out of debt.

Credit counselling agencies like to say that a debt consolidation program is removed from your credit report sooner than a proposal. This is because of reporting differences between TransUnion and Equifax. While TransUnion removes the note for credit counselling after two years, Equifax leaves the note on your credit report for three years for both a consumer proposal and credit counselling. Effectively, there is little immediate credit score difference between a consumer proposal and credit counselling.

Repairing credit sooner with a consumer proposal

It is the long-term impact where the true difference lies.

In our case study, if Sondra could afford to repay $600 per month (still half the cost of credit counselling) she could complete her proposal in 40 months or just over three years. That would mean her recovery could begin much sooner. The note on her report would be removed roughly six years after signing her proposal, one year faster than it would be removed in a debt consolidation program or debt management plan by TransUnion and two years sooner for Equifax.

Most importantly, by paying back 70% less over time through a consumer proposal, Sondra will be much further ahead financially. She’ll have more savings in the bank and will not need to rely on credit to survive.

Is credit counselling right for you?

I’ll repeat what I’ve said before; I’m not against all credit counselling programs. For the right person, it’s a great way to work out a repayment plan with the help of a credit counsellor. Credit counselling can be the right solution if:

- You owe a small amount to a few creditors;

- You only need help with one or two debts, and the remaining are manageable;

- You are not insolvent, perhaps because you have more equity in your home than debts;

- You can afford the total monthly cost of the program through to completion.

In all other cases, it is in your best interest to talk directly to a Licensed Insolvency Trustee to see if a consumer proposal would cost you less than credit counselling.