Payday Loans

The payday loan industry is thriving in Canada; it keeps consumers coming back and causes them to fall into more debt. We explore ways to solve this problem, the role of government regulations and more.

Have you been in a situation where you resort to payday loans for quick cash? We provide everything you need to know about payday loans in a slideshow and steps you can take to eliminate these debts.

Owing money on a payday loan can be daunting, but this is especially true if you can’t repay your payday loan on time. These short-term, high-cost loans seem like a quick solution to money needs... Read more »

A payday loan may be tempting, especially when you are in need of an emergency expense but beware! They do more harm then good and can put you into serious debt. Doug Hoyes explains the pros and cons of using payday loans for emergencies.

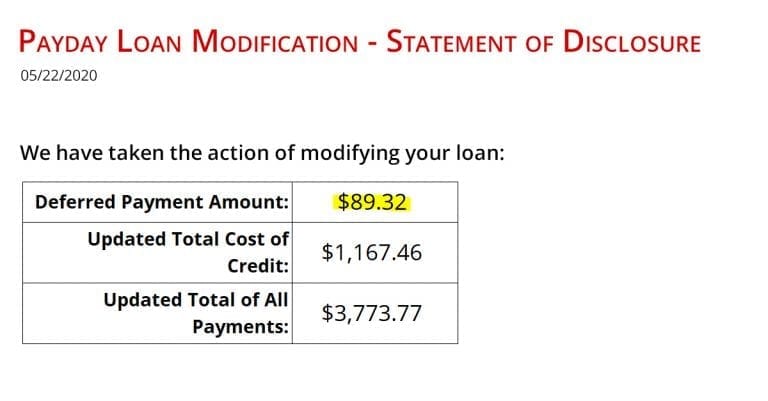

Payday lenders will try anything to collect. Loan modification agreements do not alter the ability of your bankruptcy or proposal to wipe out these debts. Learn about these traps from Ted Michalos.

Have you fallen into the payday loan trap, and are now struggling to pay them back? Find out why credit counselling may not be the best solution to deal with payday loans and what a better option is.

Taking on another payday loan to pay back existing payday loans is not the answer. Learn how a bankruptcy or consumer proposal can eliminate payday loan debt and get the help you need to break the cycle.

Have you ever run low on cash before your next payday? What solution did you use? If your answer is a payday loan, find out why they aren’t the best choice and 8 alternatives you could use instead.

Cash Store Financial Services Inc. filed for bankruptcy protection in 2014 and are were delisted from the Toronto Stock Exchange. Find out what happened and what our expert insights are.