Collection Calls

Understand your options for dealing with credit card debt in collections including how the process works, dealing with collection agencies, and exploring debt relief options like settlement, consumer proposals, and bankruptcy.

Collection agencies in Canada can garnish your wages, but only after taking specific legal steps. Learn how often agencies actually pursue garnishment, what they must do before taking your wages, and what options you have to protect your paycheque.

If you ignore a few old debts for long enough will they disappear? Doug Hoyes explains what an old debt is, how they are dealt with and which are excluded from the limitation period.

Are you being bombarded with calls from collection agents and are eager for advice on how to navigate these conversations? Here are our top 10 tips for you when dealing with collection calls.

Learn the risks of ignoring debt collectors, your rights, and effective ways to handle collection calls in Canada. Explore debt relief options to stop collections and regain financial stability.

If your unpaid debts have been turned over to a collection agency we explain what you need to know about how long collection agencies can pursue debt in Canada, both legally and with those annoying phone calls.

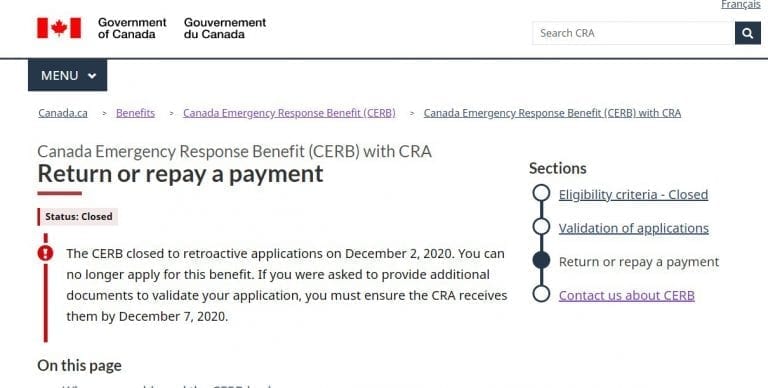

What are your options if CRA says you were ineligible and must repay CERB, CRB or other pandemic related benefits? Can you file a bankruptcy or proposal if you can't afford to pay back CERB? Doug Hoyes explains.

Paying a collection agency can leave a bad mark on your credit report longer. We explore three reasons why you should not pay a collection agency and what alternatives you may have to deal with unpaid debts.

There are provincial regulations that collection agencies must abide by. This blog outlines these rules, ranging from how often and when an agency can call, what they can say and when they can threaten legal action.

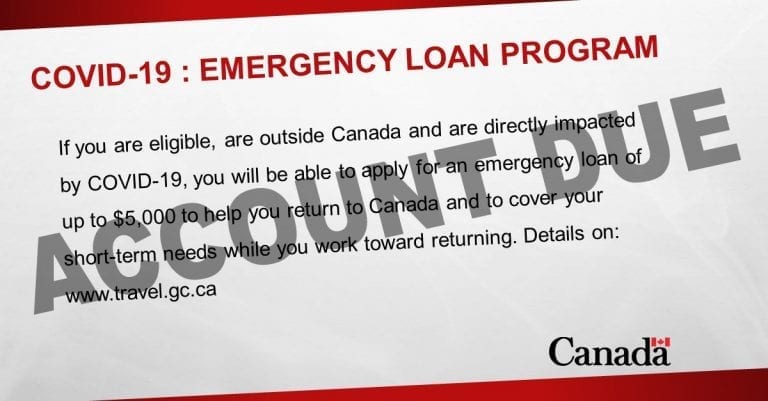

The Emergency Loan for Canadians Abroad program has issued repayment requests to recipients to pay in full within 180 days. Here, we explore what to do if the allotted time passes and you have unpaid debts.

Threatening an involuntary bankruptcy can be a very intimidating tactic that collection agents use against debtors. Want to know if this actually applies to you? Doug Hoyes explains.

Has a debt collection agent called, and left you confused about what your rights were in the situation? This guide explains Ontario’s debt collection laws and how to deal with these agencies.

Are you feeling pressure because you have unpaid debts to the CRA? In this guide we’ll explain various CRA collection methods and how insolvency works to stop the CRA and clear your tax debts.

Are you worried a collection agency will act on their threat and sue you? Doug Hoyes explores how debt collectors obtain files, when they can take you to court and what to do if you have a judgement against you.

We explain privacy laws and your rights when it comes to collection agents, how you can protect your personal information and what to do if it’s disclosed wrongly.

Have you received a call from a collection agent, and you’re stumped on how they were able to find you? Learn about various ways collections companies acquire your data and what you can do about it.

Bankruptcy provides protection from collection calls, however not all creditors get the message. Find out the three things to say if a collection agent calls you and when to turn to your trustee for help.

Are you receiving intimidating calls from collection agents? How do you respond to them? Find out 8 dirty tricks collections agents use in conversation, and how you can handle and stop these calls.