The Bank of Canada Lowers Key Interest Rate to 2.75% Amid Trade Uncertainty

The Bank of Canada’s March 2025 announcement reduced its target for the overnight rate to 2.75%. This is a further decrease of 0.25% following a similar cut in January 2025. The Bank Rate is now 3.00%, and the deposit rate is 2.70%.

This move signals a shift in the Bank’s assessment of the Canadian economy. While early 2025 showed promising growth and inflation near the 2% target, The Bank anticipates tensions with escalating trade conflicts will dampen economic activity and consequentially increase inflationary pressures.

The Bank of Canada’s decision highlights a delicate balancing act. They are attempting to support economic growth in the face of trade headwinds while simultaneously managing the risk of rising inflation. The “more-than-usual uncertainty” emphasized by the Bank underscores the need for Canadians to be exceptionally proactive and cautious with their finances.

Key Impacts and Considerations for Canadians:

- Lower Borrowing Costs: This rate cut will further reduce interest expenses on variable-rate mortgages, lines of credit, and other loans. This could free up cash flow for households.

- Increased Affordability (Potentially): For those looking to enter the housing market or refinance, lower rates may improve affordability, but this must be balanced against other economic factors.

- Stimulus for Economic Activity: The rate cut is intended to stimulate spending and investment, counteracting the negative impacts of trade uncertainty.

- Inflationary Risks: The Bank acknowledges that tariffs and a weaker Canadian dollar could push inflation above the 2% target, despite the rate cut’s intention. This is a key area to watch.

- Increased Debt Risk: The lower rate may encourage taking on more debt, which will put stress on Canadians budget if rates change.

Actionable Steps:

- Review Your Budget and Debt Load: Understand how the rate cut impacts your current expenses. Even with lower interest payments, be mindful of your overall debt levels.

- Stress-Test Your Finances: Consider what would happen if interest rates were to rise again in the future. Can you still comfortably afford your debt repayments?

- Don’t Overextend: While lower rates make borrowing more attractive, avoid taking on new debt that you may struggle to repay if circumstances change.

- Consider locking in: if you have a variable rate consider if locking in a fixed rate is right for you.

- Seek Professional Advice: A Licensed Insolvency Trustee can provide a personalized assessment of your financial situation, help you develop a robust plan to manage debt and navigate economic uncertainty, and explore debt relief options if you’re already struggling. This is especially important in a volatile economic climate.

The current Bank Rate is at 3.00% and the deposit rate is at 2.70%

| Bank Rate Changes Since 2010 | Target Overnight Rate | Change |

| May 31st, 2010 | 0.50% | 0.25 |

| July 19, 2010 | 0.75% | 0.25 |

| September 7, 2010 | 1% | 0.25 |

| January 20, 2015 | 0.75% | -0.25 |

| July 14, 2015 | 0.50% | -0.25 |

| July 11, 2017 | 0.75% | 0.25 |

| September 5, 2017 | 1% | 0.25 |

| January 16, 2018 | 1.25% | 0.25 |

| July 10, 2018 | 1.50% | 0.25 |

| October 23, 2018 | 1.75% | 0.25 |

| March 3, 2020 | 1.25% | -0.50 |

| March 15, 2020 | 0.75% | -0.50 |

| March 26, 2020 | 0.25% | -0.50 |

| March 2, 2022 | 0.50% | 0.25 |

| April 13, 2022 | 1.00% | 0.50 |

| June 1, 2022 | 1.50% | 0.50 |

| July 13, 2022 | 2.50% | 1.00 |

| September 7, 2022 | 3.25% | 0.75 |

| October 26, 2022 | 3.75% | 0.50 |

| December 7, 2022 | 4.25% | 0.50 |

| January 25, 2023 | 4.50% | 0.25 |

| June 7, 2023 | 4.75% | 0.25 |

| July 12, 2023 | 5.00% | 0.25 |

| June 5, 2024 | 4.75% | -0.25 |

| September 4, 2024 | 4.25% | -0.25 |

| October 23, 2024 | 3¾% | -0.50 |

| December 11, 2024 | 3½% | -0.50 |

| January 29, 2025 | 3.00% | -0.25 |

| March 12, 2025 | 2.75% | -0.25 |

When the Bank of Canada lowers rates, banks and mortgage lenders usually follow with reduced borrowing costs. Here’s what a 25-basis point drop can do for a mortgage:

If you have a $400,000 mortgage, amortized over 25 years, at 2.59%, your monthly payment is $1,810. A reduction to 2.34% would bring your payment down to $1,760.

That’s a $50 decrease each month.

Though the decrease is smaller than the impact of an increase, over time, this savings adds up. A reduced monthly payment can free up cash flow, giving you some breathing room or more room for savings (so- don’t take on more debt!)

In the long run, lower interest rates can also reduce the total interest you pay over the life of your loan.

How much does a 25-basis point increase in interest rates cost?

Every time the Bank of Canada raises rates, banks and mortgage companies follow with increased mortgage rates. Here is the impact of a 25-point increase on a small mortgage.

If you have a $400,000 mortgage, amortized over 25 years, at 2.59%, your monthly mortgage payment would be $1,810 per month.

That same $400,000 mortgage at 2.84% would cost you $1,860 per month.

That’s an increase in your monthly mortgage payment of $50 a month.

Multiply this by the 5 rate increases some economists are predicting, and you are facing a possible increase in your mortgage payment of $250 a month.

With so many Canadians living paycheque to paycheque, this is going to be a shock. Yet, we shouldn’t be surprised.

In 2012, I was interviewed on CBC Radio’s The Current, on a segment about Doubting Personal Debt and we discussed, even way back then, that debt is a “ticking time bomb”. Back then I warned that low interest rates were making our debt artificially ‘affordable’. I made the comment that we could be in trouble if interest rates rise.

And on the same day in October 2018 as the Bank of Canada increased rates to the highest since December 2008, I was once again on CBC Radio’s The Current to talk about Canadian debt as part of a special they were calling Debt Nation.

When facing a rising rate environment, you need to consider what an increase in interest rates will do to your personal cash flow.

For many years the best decision a Canadian could make was to get a variable rate mortgage (not a fixed rate), because the rate was lower. That’s great, but a variable rate, obviously, is variable, so it can go down, but it can also go up.

Today you may be paying 3% on your variable rate mortgage, so on a $200,000 mortgage amortized over 25 years you are making a monthly payment of $946.40. What happens if your variable interest rate were to increase by 1%? Again, you may not think 1% is a big number, but a 4% interest rate on your $200,000 mortgage amortized over 25 years would cost you $1,052.04 per month. Can you afford to pay an extra $105.55 per month on your mortgage? Will your after-tax paycheque be increasing by $105 per month this year? If not, higher interest rates will squeeze your budget.

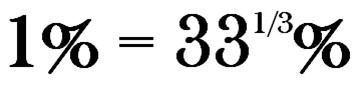

Here’s where most people miss the point: going from a 3% to a 4% interest rate is not an increase of 1% in your payments. If your rent goes from $300 to $400 per month, how much did your rent increase? Answer: one third, or over 33%.

That’s the point: if your interest rate increases by 1%, the actual interest cost of your mortgage in the example above increased by over 33%.

That’s a huge increase, and unless your pay will also be going up by 33%, higher interest rates will be a problem for your monthly cash flow.