There are benefits to reducing your debt sooner than the term you signed up for when you took out your loan. We are still living in very uncertain times. I’ve always advocated for paying down debt as fast as you can. The less debt you have, the less risk you face when life changes your financial situation for the worse.

The ability to make extra repayments on a loan depends on the type of debt you carry and your loan agreement. While some term loans may come with penalties for early payment, others allow for extra payments, so you escape debt early. And of course, revolving credit like credit cards and lines of credit can be paid down as fast as you are able.

Table of Contents

Benefits of making extra loan payments

There are two monetary benefits to making extra loan payments: saving on interest and shortening the loan term, which means you get out of debt sooner.

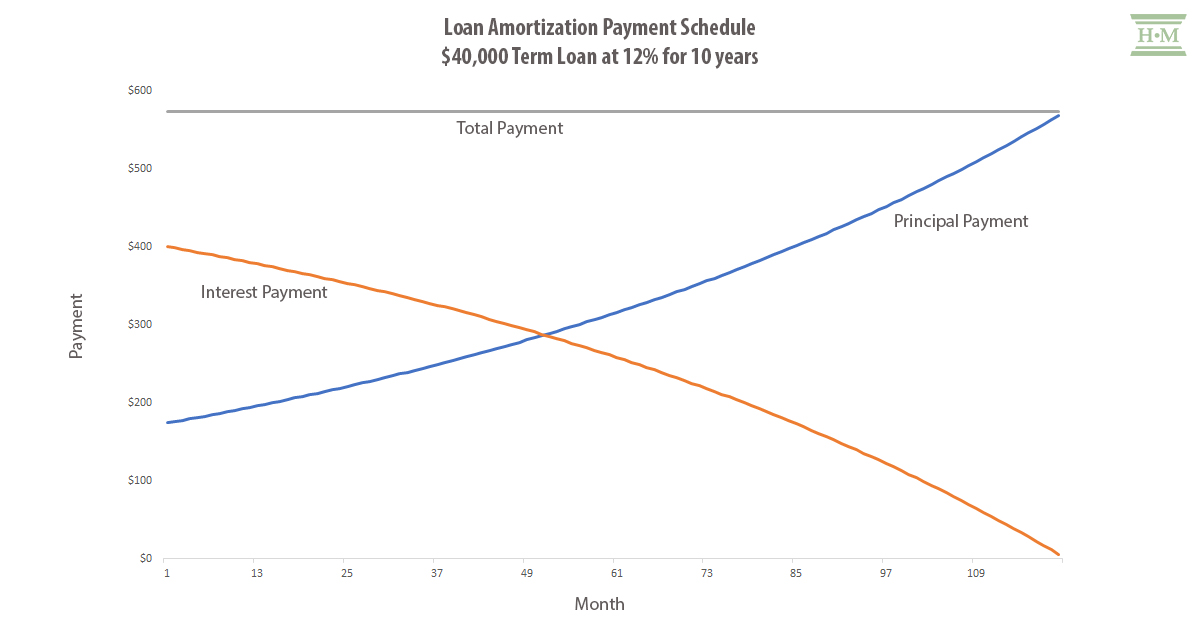

To understand how extra payments work, let’s look at how loan amortization works.

Each month, part of your payment goes towards interest, and the remainder goes towards the principal. When your loan is new, more of your monthly payments pay interest, and less goes towards the principal. Over time, the amount going towards principal increases and the amount allocated to interest decreases.

Loans with a fixed monthly payment, like your mortgage, car loan or student loan, work like this. This image shows how your payment amount is allocated between interest and principal over the life of a loan.

You save money on interest

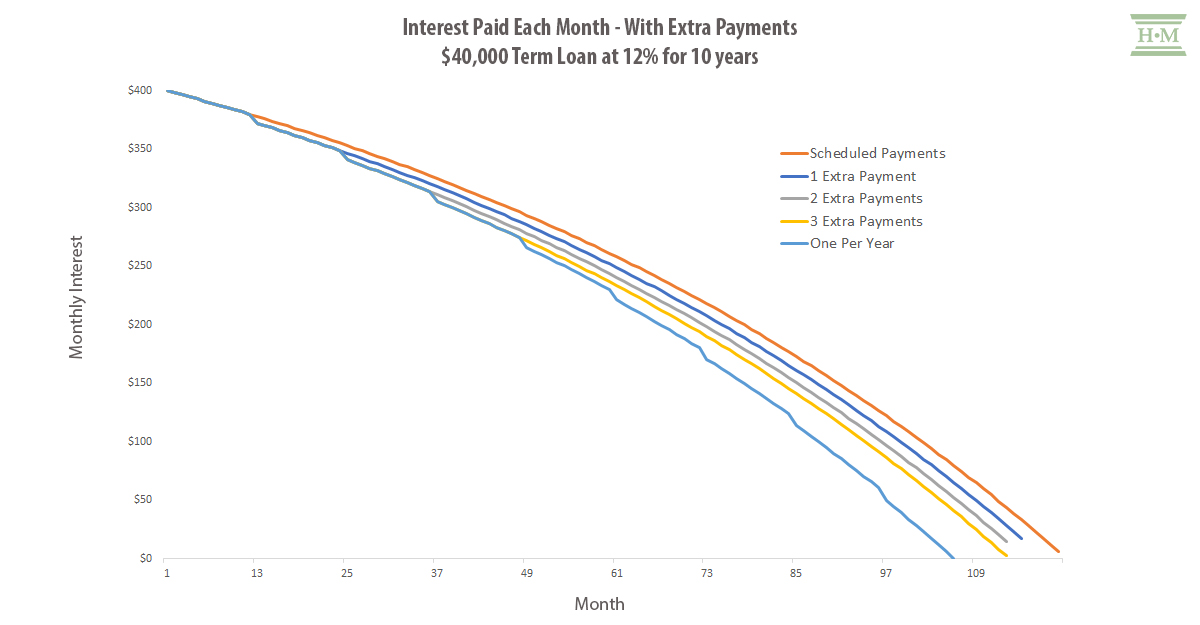

Making an additional payment on a loan today reduces all future interest costs on that loan. That’s because 100% of your extra payment reduces the remaining loan balance right away.

On-going interest is calculated based on the principal outstanding on your loan. While interest rates are usually quoted annually, your lender might charge you interest compounded monthly, daily or semi-annually. However, for simplicity’s sake, let’s assume your loan interest is compounded monthly. This is the way most term loans work.

To calculate the interest you will be charged next month, divide your interest rate by 12 (the number of months in the year) and multiply by the loan amount owing at the beginning of the month. The lower your principal at the beginning of the month, the lower your interest cost will be.

When you put extra money towards your loan principal, the amount of interest you pay is lower every following month until the end of the loan term. The earlier you make additional payments, the bigger the savings. That’s the power of using compounding interest in your favour when you have debt – interest savings grow over time.

You get out of debt sooner

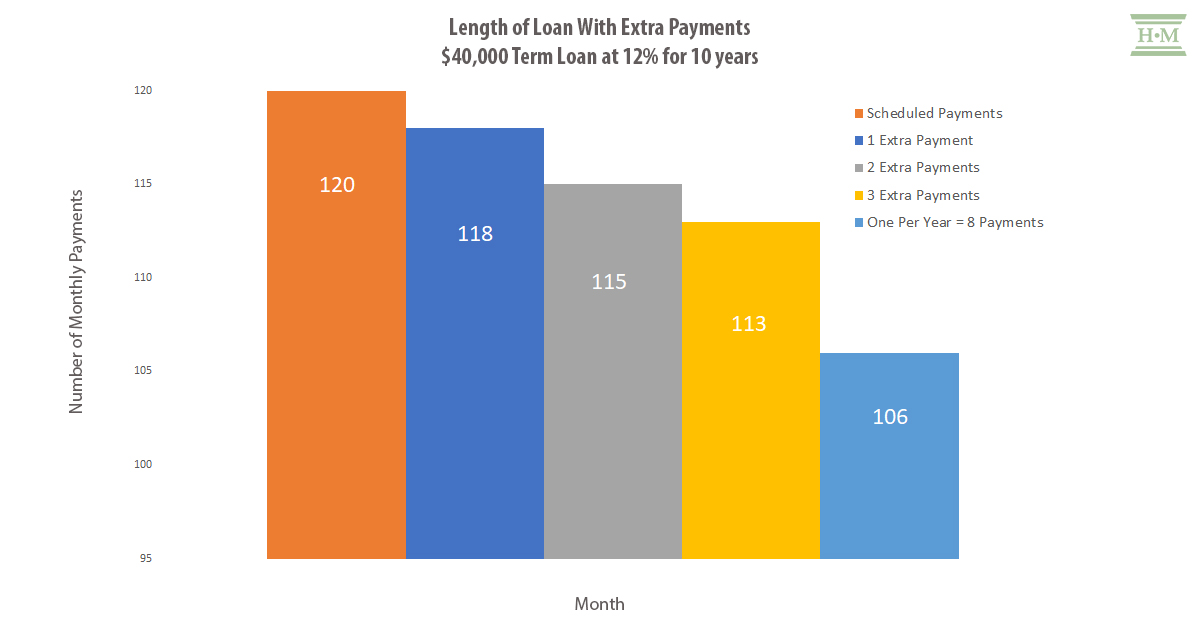

Making extra payments on the loan not only saves you interest, it also shortens your overall loan term, so you pay off your debt early.

Even better, the impact of one extra payment is more than one month shorter on your loan. Since your future monthly interest costs will be lower, more of each future loan payment will pay down your loan. That’s why some lenders call their prepayment program accelerating your loan payments.

In our $40,000 term loan example, one single extra payment made in year one chops two months off your loan term.

If you make one extra payment a year, it takes just eight payments to pay off your loan 14 months sooner. Make one additional payment every year, and it takes 106 payments to be debt free, rather than the original 120. That’s extra money in your pocket, not your lender’s.

Watch out for prepayment penalties

Even if you have the money to make an additional payment on your mortgage or loan, you may not be able to. Lenders make money by charging you interest. They don’t like you to pay off your debt faster. A prepayment penalty is a condition in your loan agreement that says if you pay off the loan in full before the maturity date, there is a penalty to compensate the lender for lost interest.

Prepayment rights are in the fine print of your loan contract. For example, you may be allowed to make two extra payments a year on your mortgage or make a lump sum or balloon payment once a year. Amounts beyond that can trigger a penalty. Read your contract carefully and weigh the costs of this penalty against future interest savings.

Pay off high-interest debt first

If you have multiple loans, always focus on reducing high-cost debt first. Some experts advocate for the debt snowball method where you knock off small debts first, but I recommend you pay off high-interest debt first. You want to accelerate the downward slope of the interest line as fast as you can; high interest rates compound your savings faster than low rates.

Personal loans vs credit cards

We talked about concepts like prepayment privileges and penalties in your loan contract. This is true for a personal loan like your mortgage or bank loan, but not revolving credit like credit cards or lines of credit. These types of loans only require that you make minimum payments, but you can pay off any amount, up to the full balance, at any time.

You should always pay down credit card debt as fast as you can. You want to get to a stage where you can afford to pay your balances in full every month and avoid interest altogether. Not only do you save interest, but keeping your balances below 30% of your limit is better for your credit score.

Benefits of paying off a loan early

So we’ve run through the math, but what about other reasons to pay off debt early?

- You save money you can use towards other purchases, such as a house or car.

- You’ll be in a stronger financial position with reduced financial risk to an unexpected life event like a lost job, illness or divorce.

- Less interest means more cash flow in your pocket every month, reducing the risk of missed payments or juggling one debt to pay another.

- You’ll have more control over your finances and more flexibility to make better financial decisions in the future.

- If you have a lot of debt, reducing balances lowers your debt-to-income ratio and your utilization rate, which can improve your credit score.

If nothing else, wouldn’t you just like to pay off your debt as quickly as you can? Paying off your debt gives you peace of mind. You won’t be worried about making your next payment and won’t be worried about a financial emergency. Having less debt reduces your stress significantly.

How to make extra payments fit your budget

The disadvantage or obstacle to paying off debt earlier is you have to come up with the funds to make larger payments every month. Doing that can seem daunting.

However, you can pay down debt faster if you have a plan. Here are some tips to help you create a debt reduction strategy that works.

- Round up your payment amount. Let’s say your monthly payments are $130. Round them up to $150 or even $200. This way, you’re putting extra money toward the loan while working within an affordable range.

- Make micro-payments. As I said earlier, every dollar you put against your debt reduces the principal balance and therefore reduces future interest. Consider making small weekly payments rather than waiting until your bill arrives if you carry a balance on your credit cards.

- Ramp your payments up slowly. Increase a dollar with every payment. If you paid $100 this month, pay $101 the next month. You are much less likely to notice this incremental hit to your budget.

- Pay weekly or biweekly instead of monthly. The earlier you make a payment, the less interest you pay.

- Make one larger extra payment a year. There is a balance to be made between having an emergency fund or paying off credit. If you are worried about unexpected expenses, save up money in a cushion account. Once a year, take some of that money and apply it towards debt repayment.

As I said, a lot of people deferred loan payments in recent months to avoid late or missed payments. Deferring loan repayment means you still have to pay both the principal and interest later. Deferrals helped you avoid late and missed payments. But now it’s time to catch up. And if you don’t think you can, it may be time to consider debt relief services.