I have received a significant number of calls from existing clients asking for my opinion on a variety of credit repair loan companies that offer loans to “automatically build up your savings” and/or to “improve your credit score”. The number one concern posed by those asking about these types of credit repair or savings loans is “are they worth it?”

What Are These Companies Offering?

One commonality between each of these companies is that the service they are offering is not always easy to understand. Are they a lender, a credit repair agency or a savings company? The truth is the only way to tell is to do a complete and thorough review and ask a lot of questions. We’ve done some of that for you and here are some of our findings.

Savings Loans

Certain companies, like Refresh Financial, offer to provide you with a loan of up to $5,500 so you can begin building your savings. They tell you that you can use this money for an emergency fund or even a vacation. As an upside they tell you that as you progress with your loan you can save money on interest rates, qualifying for better rates on larger loans like car loans or even a mortgage.

What they really do:

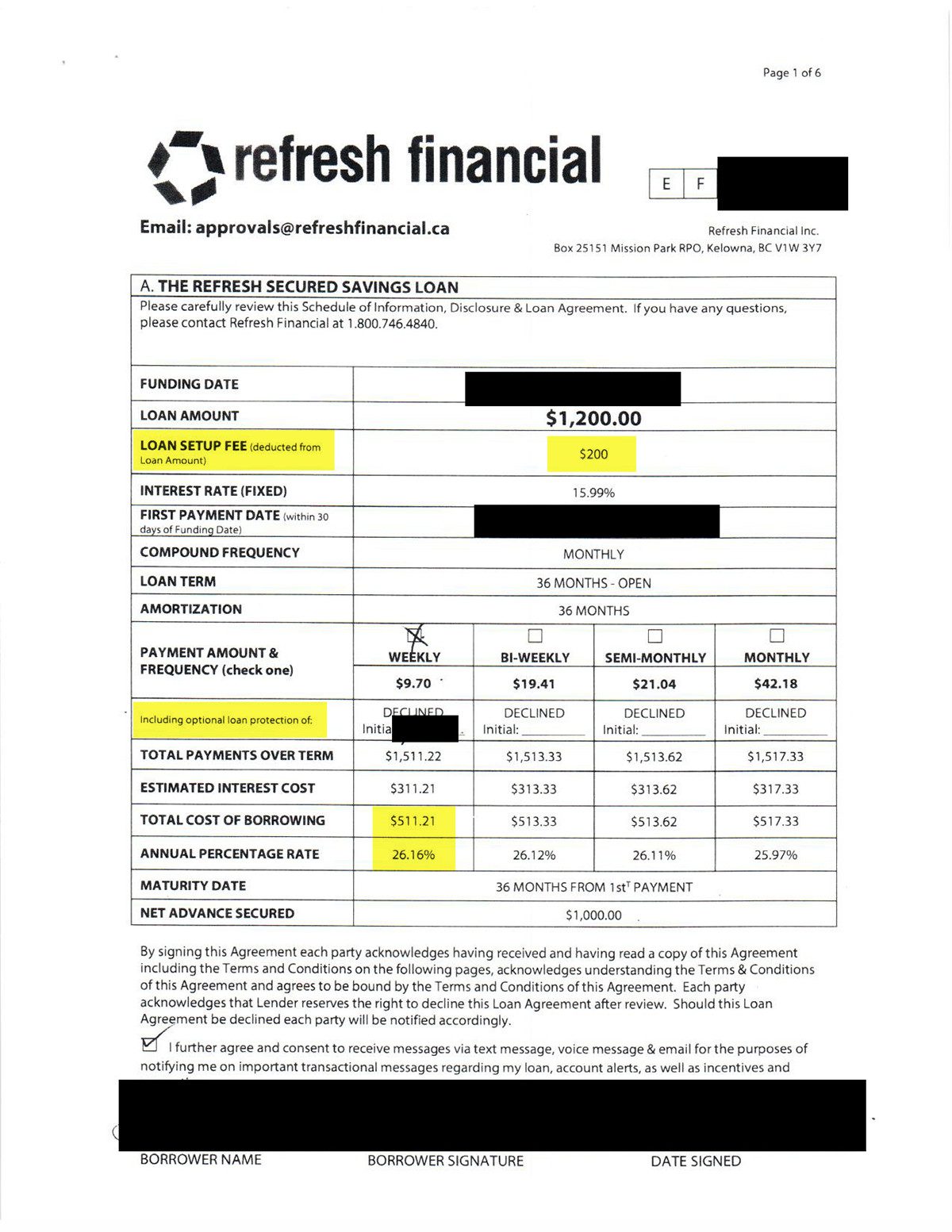

Based on information provided by a client, here’s an example of how these programs work: Our client asked to borrow $1,200. Based on the contract offered (a redacted copy appears below), he will make weekly payments of $9.70 over three years to repay the full $1,200, plus interest, at a quoted rate of 15.99%. However, there is also a loan setup fee of $200. This means that the borrower will pay $511 in interest and fees on a three year loan of $1200, or an equivalent interest of just over 26%.

But what about the savings? Here is how that works: Refresh Financial will put $1,000 (not the full loan amount because they took the $200 setup fee up-front) into a Guaranteed Investment Certificate (GIC). However, this GIC secures the original loan so the borrower does not have access to this money right away. They gain access over time as they make payments. The amount builds slowly, as initially a higher portion of the $9.70 payment goes towards interest. Effectively, the client does not have $1,000 in savings until the end of three years, and those savings cost $1,511 in payments.

We know these numbers from a sample loan sent by a client:

In terms of saving money, the client would be much better off placing $9.70 a week, through automatic payroll deductions, into some form of savings account like a TFSA. If he had, after three years he would have $1,513, plus a little bit of interest, not $1,000.

So if saving money is your objective, you are better off doing so on your own.

But what if you are trying to improve your credit score? These loans are generally reported on your credit report as a term loan, and the loan provider’s position is that a term loan of this type will help you rebuild your credit. While we cannot definitively say how a $1,200 term loan will impact your credit report, the real interest cost is higher than that on a credit card. In the case of a credit card, however, you can use the card for purchases and if you pay the balance in full each month, you can rebuild your credit at a much lower cost ($84 a year).

There are other companies and programs that offer loans that will be reported on your credit report, including some offering credit score improvement programs (some offer you a tablet computer) for a substantial fee or cost.

Ultimately only you can decide if getting a credit repair loan, or getting an unsecured or secured credit card, is right for you. I do, however, have some thoughts on how to rebuild or repair your credit.

How Should You Repair Your Credit?

In general, we advise clients to consider a secured credit card, a small unsecured credit card or a small loan as a way to begin the process of rebuilding credit after filing a bankruptcy or consumer proposal. Used wisely, these forms of new credit after bankruptcy will allow you to rebuild your credit history by keeping your monthly usage well below the actual limit and allow you to show the lender that you can repay your debts each month. I believe the same approach is appropriate for anyone with bad credit today who would like to improve their credit rating (provided they have already dealt with their debts).

It is true that from there you will need to show that you can manage larger terms loans such as a small car loan. However, we cannot confirm that borrowing money and paying substantial interest and fees under these forms of credit repair programs will repair your credit score any faster than a less expensive credit card or other alternative.

I recommend you only borrow money if you need to. As the old saying goes, you can’t solve a debt problem with more debt.

Here’s my advice:

First, start with a goal. If you don’t expect to have a need to borrow in the future, don’t waste money on trying to rebuild your credit. If your goal is to finance a car, or even a house, that’s the goal you should work toward.

So, for example, if you want to finance a car, find out what it takes to finance a car at a reasonable interest rate. The car dealer may tell you that you need a $2,000 security deposit and two “trade lines” on your credit report. Now you have a goal. You need to save $2,000 (probably through a savings account or TFSA where you set aside some money every payday) and establish two “trade lines”.

What’s a trade line? It’s anything that shows up on your credit report and could include a credit card or loan. Ask your bank or credit union if they will give you a small loan (perhaps for an RRSP). If they won’t, two small credit cards may be the answer.

Second, crunch the numbers. As shown in the previous example, paying $1,500 to end up with $1,000 in savings may not be your best option. While an unsecured credit card looks more expensive because the interest rate is 29.9% compared to 15% (in our above example), when you compare fees ($200 versus $84) and the fact that you can pay zero in interest if you pay off your credit card balance each month, the unsecured credit card is now clearly much cheaper. Only after looking at all the numbers can you determine how much is a reasonable amount to pay to establish a “trade line”.

It’s up to you, and that’s the most important piece of advice: only you can decide which goal is most important for you, and only you can decide how much you are willing to pay in fees and interest charges to accomplish that goal.

If you are looking a credit repair companies because you have too much other debt to qualify for a loan at a good rate, consider the option of eliminating your old debt first. Eliminating debt is often the first, real step to rebuilding credit. Contact us today for a free consultation. We’ll give you options to be debt free.

How many times can anyone file for bankruptcy or do a consumer proposal. I filed bankruptcy way back in 2002 I think and with me not working and not getting a heck of a lot of money am having a hard time paying my bills.

Hi Tammy. You can file a bankruptcy a second time, but the bankruptcy will last longer and probably cost more the second time. If you are not working you will need to consider whether or not bankruptcy is your best option, so I suggest you contact us and one of our trustees can review your situation and help you review your options.

Stay away from refresh financial, they are a scam with their ‘reverse loans’. If you want true credit repair then get a secured credit card through HomeTrust or CapitalOne. Refresh Financial has a 33% shareholder which is EasyFinancial and they have over 60 BBB complaints because EF are sneaking the Refresh Financial plan into loans. I know, because it happened to me. Refresh took $50 out of my account bi-weekly until it went to the BBB and I closed my account. What they do, if give you a REVERSE loan which means you pay them for a number of years of which you pay interest and fees and then they give you a portion of the money back while they report to the credit bureau after so much time. It may sound ok, but you are paying a premium interest rate and admin fees for money that will be returned later. You DO NOT actually get a loan with them. Check out the BBB and read the complaints then make a choice.

I wanted to add too that after 3 months Refresh Financial had not reported anything further to the credit bureau and although I got out of the agreement through the BBB, I never saw a refund or received the contract.

refresh financial is a scam! and they target the most vulnerable group of society under the disguise of help!

they also sell your information to other lending companies such as easy home to harass you with phone calls around Christmas and offer you dirty loans at a whopping 46% interest!

Refresh financial is it really a scam. Pls contact me or tell me if there is a way to get out of it. I just signed up with them but didn’t start payments untill January. Pls help

Hi Denise. If you are unhappy with their service, I would suggest you contact them directly and ask how they are helping you, and if you are not satisfied ask them for a refund.