Insolvency Industry Insights

Industry insights from Hoyes Michalos co-founders Doug Hoyes and Ted Michalos on bankruptcy, debt relief and consumer debt issues that affect Ontarians. Doug and Ted are strong advocates of a fair, equitable and transparent process for those dealing with overwhelming debt problems.

The payday loan industry is thriving in Canada; it keeps consumers coming back and causes them to fall into more debt. We explore ways to solve this problem, the role of government regulations and more.

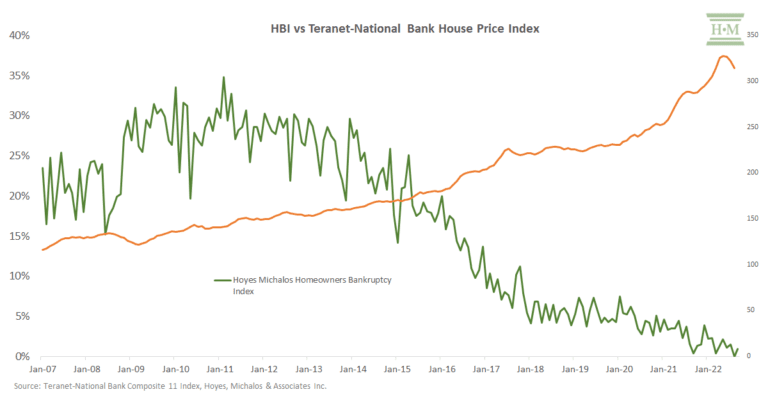

Hoyes, Michalos has been tracking and reporting on homeowner insolvencies since 2007. Our homeowner insolvency index peaked in 2011 at 29.1% and has fallen steadily, reaching a low of 1.6% in 2022 and rising to... Read more »

On March 10, Reddit exploded with reports of old City of Ottawa debts mysteriously appearing on credit reports. Based on reporting from CBC Ottawa, on January 12, 2024, the City of Ottawa signed a five... Read more »

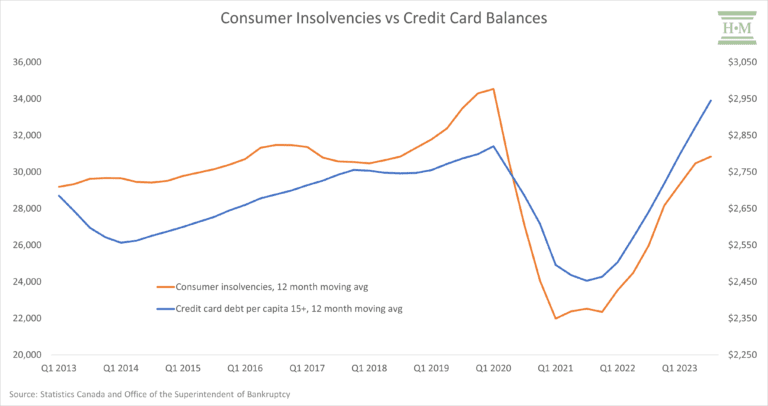

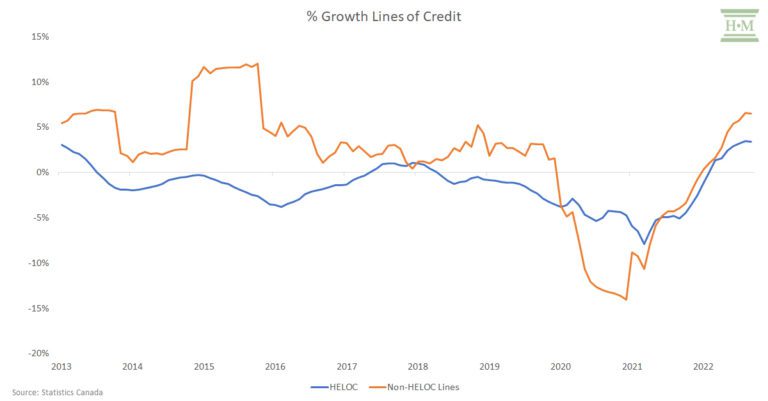

The past year has seen a steady erosion in financial stability for Canadian debtors. The result is that consumer insolvencies are rising rapidly. In my year-end post, I will outline what is behind the average Canadian debtor's re-accumulation of consumer credit and how that will impact consumer insolvency levels in the coming year.

Consumer insolvencies are on the rise again. In this year-end analysis, Doug Hoyes examines the affordability of consumer debt and changes in household credit patterns to explain why he thinks we'll keep seeing double-digit consumer insolvency growth increases into 2023.

Many homeowners have expressed that they are facing financial hardship as a result of record interest rate hikes. So why are homeowner bankruptcy rates so low? Doug Hoyes explains the cycle in this post and when he expects homeowner insolvencies to rise.

Doug Hoyes weighs in on whether or not a debt jubilee is a solution to high household debt, student debt and how a modern debt jubilee might work for both private loans and government loans.

Are you wondering what happens to your pension if the company you work for goes bankrupt? Doug Hoyes offers his professional insights on the corporate bankruptcy process with regards to pensions.

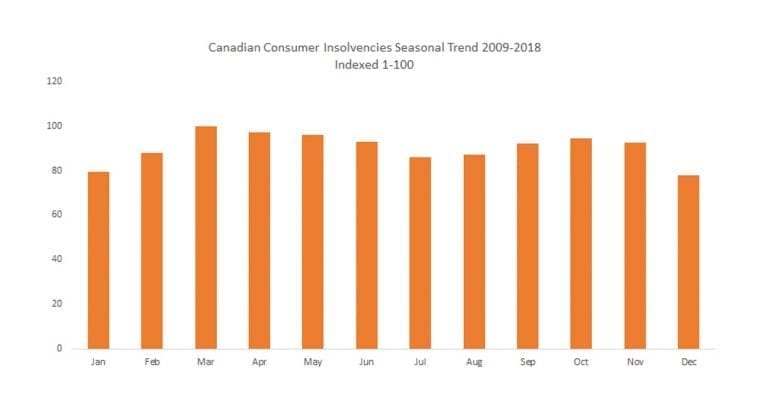

Insolvency Manager Scott Terrio does a deep dive into long term Canadian insolvency statistics to explain the economic and seasonal nature of insolvency filings in Canada.

Ted Michalos explores the asset profile of the average insolvency debtor from our annual bankruptcy study and explains why most insolvent debtors have very little assets at the time they file insolvency.

Are you having some sort of a moral dilemma because you want to file for insolvency to create a fresh financial start for yourself? Find out 5 reasons why bankruptcy is not morally wrong.

A bankruptcy score is a scoring system used by lenders to rank the potential of bankruptcy in your future. Doug Hoyes explains exactly what a bankruptcy score is and what it means for your credit.

RESPs are considered an asset in a bankruptcy and are not exempt from seizure in all provinces. Doug Hoyes explains why it's time to change the federal law around RESPs and bankruptcy.

Cash Store Financial Services Inc. filed for bankruptcy protection in 2014 and are were delisted from the Toronto Stock Exchange. Find out what happened and what our expert insights are.