Effective Money Management and Budgeting Strategies

Master the essentials of effective money management to achieve financial stability and prevent debt problems. Learn how to create and stick to a realistic budget tailored to your income and lifestyle. Discover strategies for building an emergency fund, setting financial goals, and prioritizing savings. Understand the importance of tracking expenses and identifying areas for potential cost-cutting. This section provides practical advice and tools to help you take control of your finances and build a secure financial future.

Gail Vaz-Oxlade’s Money Master Class: Hoyes Michalos is proud to be the official host of Gail’s money master class. Get all the links and downloads you need to start your journey to get out of debt.

No one wants to be a fraud victim. It causes tremendous stress and we have also seen it lead to serious debt problems in some cases. In this post, learn how fraudsters use tricks and deceptions to steal your hard-earned money so you stay protected.

Ever wanted a budgeting plan where you get to spend guilt-free? Look no further than zero-based budgeting, where every dollar is accounted for so you can rest knowing your money is well-managed.

A budget can be the key to long-term financial success. We show you the steps to creating a realistic first budget which includes your future money goals.

It’s common for people to have a tough time implementing and sticking to a budget. In this blog, we share some of the most prevalent budget “fails” and helpful tips to help you achieve your budget goals.

The key to creating a sustainable budget is balance and flexibility. In this blog, learn about what defines a need and a want, and how to use the 50-30-20 rule to create a budget that will work for you.

Many Canadians rely on credit cards for emergency funds. Is this a good idea? Doug Hoyes explores whether credit cards are OK to use in an emergency and whether to pay off credit card debt or create a rainy day fund.

Some businesses that do your taxes offer ‘cash back’ incentives for using their services, but what does this mean for the consumer? We explain how instant tax refunds really work and the associated costs.

Are you juggling training for a second career and trying to keep up with your debt payments? Learn about how Second Career Ontario can help with the cost of retraining so you avoid more debt.

Our experts offer their advice on the pros and cons of joint bank accounts and credit cards, and what happens to these accounts when one person finds themselves facing insolvency.

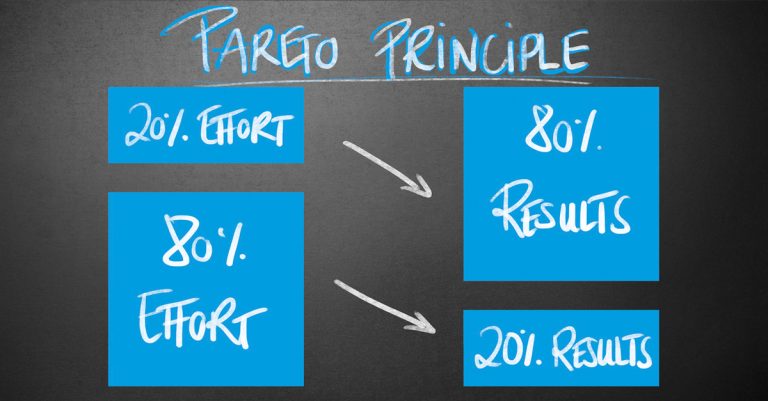

Do you feel like you’ve never been taught how to budget properly, or just don’t have the time or motivation to? Doug Hoyes explains his “cheat way” to financial success with money management.

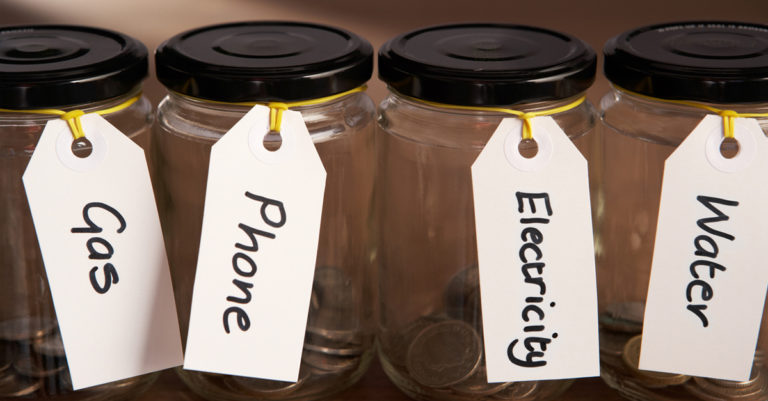

A large and unexpected cost can throw a wrench into your budget or cause you to turn to high cost debt. Explore how even a small emergency fund can help your finances.

Are you trying to find a trustworthy financial planner in Ontario? Find out how to find a credible planner, the income you need to work with them, and if you should use investments to pay down debt.

Have you recently completed a consumer proposal or bankruptcy, and are trying to rent a new place? We provide resources for stable and affordable units and what to do if you have a bad credit score.

Are you raising children in a single income household? We explore a case report from one of our clients in this situation and provide you with 5 steps to create a successful budget for your family.

Have you received a call from a CRA agent demanding your credit card information? Learn our top 10 tips you can use to identify fraudulent calls and what you can do if you are scared.

Do you find it difficult to stick with budgets you create? Well, most people do, so what are your options? Find out what our secret to budgeting is and our top tips on how to stay on top of bills.

Budgeting can be stressful, and few individuals have the discipline to stick to one. In this blog, find out why our approach to budgeting is simply to pay bills as often as you get paid.