Home » Bankruptcy Alternatives

Alternatives to Bankruptcy in Canada

Discover alternatives to bankruptcy that can help Canadians manage their debt effectively. Learn about debt consolidation loans, debt management plans, and informal debt settlements. Understand and compare the benefits and potential drawbacks of each option. Explore how credit counselling services can assist you in developing a personalized debt repayment strategy. Get information on debt consolidation programs offered by non-profit organizations and financial institutions. Learn about the differences between these alternatives and formal insolvency proceedings like bankruptcy and consumer proposals. This section provides comprehensive information to help you explore all available options before deciding on a debt relief solution that best fits your financial situation.

Looking for alternatives to bankruptcy? Schedule a free consultation with Hoyes Michalos. Our Licensed Insolvency Trustees will help you explore all your options and find the best solution for your financial needs.

What can you do if you are unable to make your some debt payments yet you have significant home equity? We explain home equity debt consolidation, home equity loans and when a consumer proposal is a better option.

Not sure if bankruptcy is the right choice for you? In this blog, discover what debt relief alternative will suit your financial situation, as we explore 5 options from personal budgeting to insolvency.

Considering filing for another bankruptcy? It’s not uncommon, but there are some things you should know before you do. Explore the implications of filing subsequent bankruptcies and what your alternative is.

Are you wondering if you should use credit counselling or a consumer proposal to get out of debt? We explain both solutions, provide a pros and cons list and fully compare both strategies.

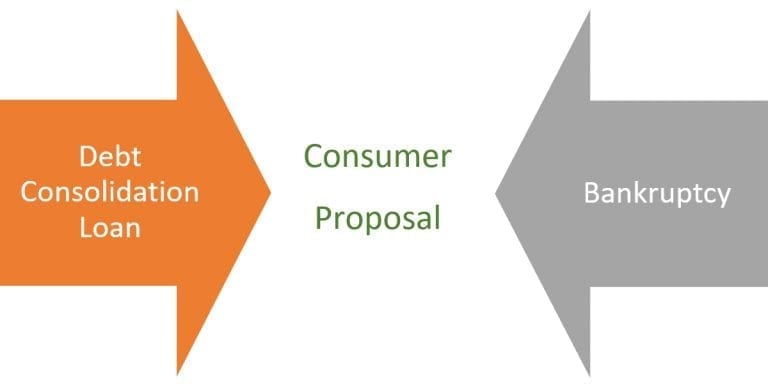

A consumer proposal is an alternative to bankruptcy and there are huge differences in how both insolvencies options work. Doug Hoyes explains why a consumer proposal is not bankruptcy.

Trying to decide between a debt settlement plan and a consumer proposal? We explore a contract from a debt settlement firm, and why a consumer proposal is more often the better choice for you.

Learn about personal bankruptcy, consumer proposals and business bankruptcy in Canada. Compare options and costs to find the right debt solution for you.

If you're carrying multiple high-interest debts like credit cards and loans, this detailed guide will help you understand whether you should consolidate debt or do a debt settlement to achieve debt relief.

Most people worry that bankruptcy is their only option for eliminating debt. Luckily, that's not the case. We review 5 alternatives to bankruptcy for dealing with overwhelming debt.

Find out if a bankruptcy or debt settlement is the right choice if you are struggling with problem debt. We take a deep dive into the pros and cons of both options and provide next steps to debt help.

Bankruptcy and credit counselling are two commonly compared options to deal with debt problems. Understand the benefits and downsides of each alternative and which would best suit your financial situation.

Are you in a difficult financial situation and looking at options on how to deal with your debts? Here is your guide to two common approaches: debt management plans and consolidation loans.

It's possible to stave off bankruptcy or choose better debt relief alternatives. Doug Hoyes explains how you can deal with debt on your own, and what other alternatives you have if you have too much debt.

Are you considering credit counselling to help you manage large amounts of unpaid debt? Doug Hoyes explains affordability, alternatives and additional consequences of this type of program.

Have you fallen into the payday loan trap, and are now struggling to pay them back? Find out why credit counselling may not be the best solution to deal with payday loans and what a better option is.

Doug Hoyes reviews the business side of credit counselling, how agencies are funded by big banks and why it may not always be the best solution to get out of debt.

Not-for-profit credit counselling agencies still have to get paid, and they earn kickback fees mostly from banks. Learn 5 reasons why these agencies are now just debt collectors and why it matters to you.

Senior citizens are experiencing more financial hardships now than ever and they are a rising percentage of Canadians filing insolvency. Our experts talk about options for seniors facing insolvency.

Credit counsellors use a program called a debt management plan which are not always successful. We explore a case study from one of our clients in this situation and offer some alternative solutions.

What do you need to consider before choosing between debt consolidation or bankruptcy? We’ll explain both debt relief options, so you can make an informed decision on which one will work best for you.