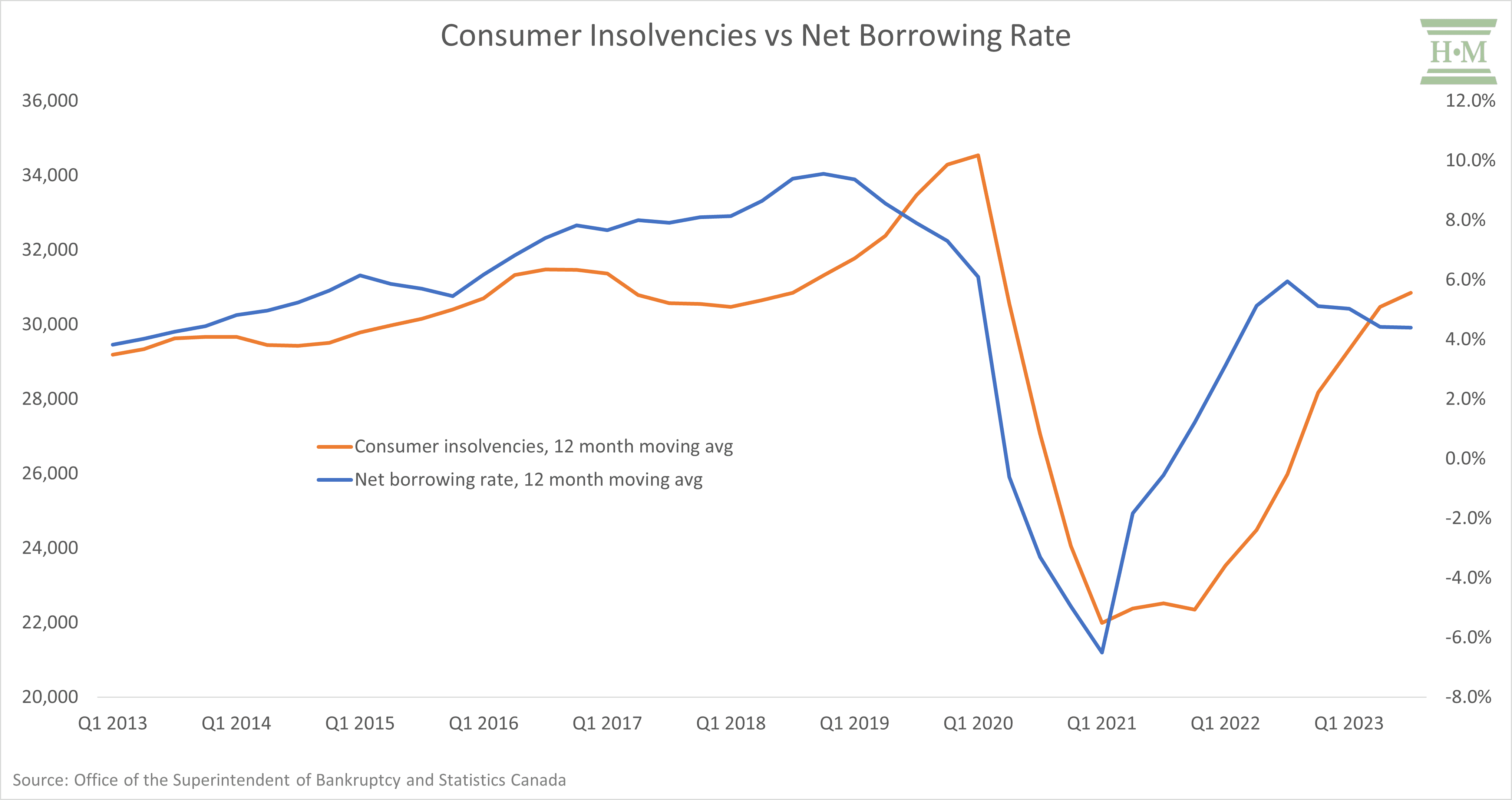

The past year has seen a steady erosion in financial stability for Canadian debtors. The result is that consumer insolvencies are rising rapidly.

In my year-end post, I will outline what is behind the average Canadian debtor’s re-accumulation of consumer credit and how that will impact consumer insolvency levels in the coming year.

Table of Contents

Consumer Insolvencies Rising Rapidly

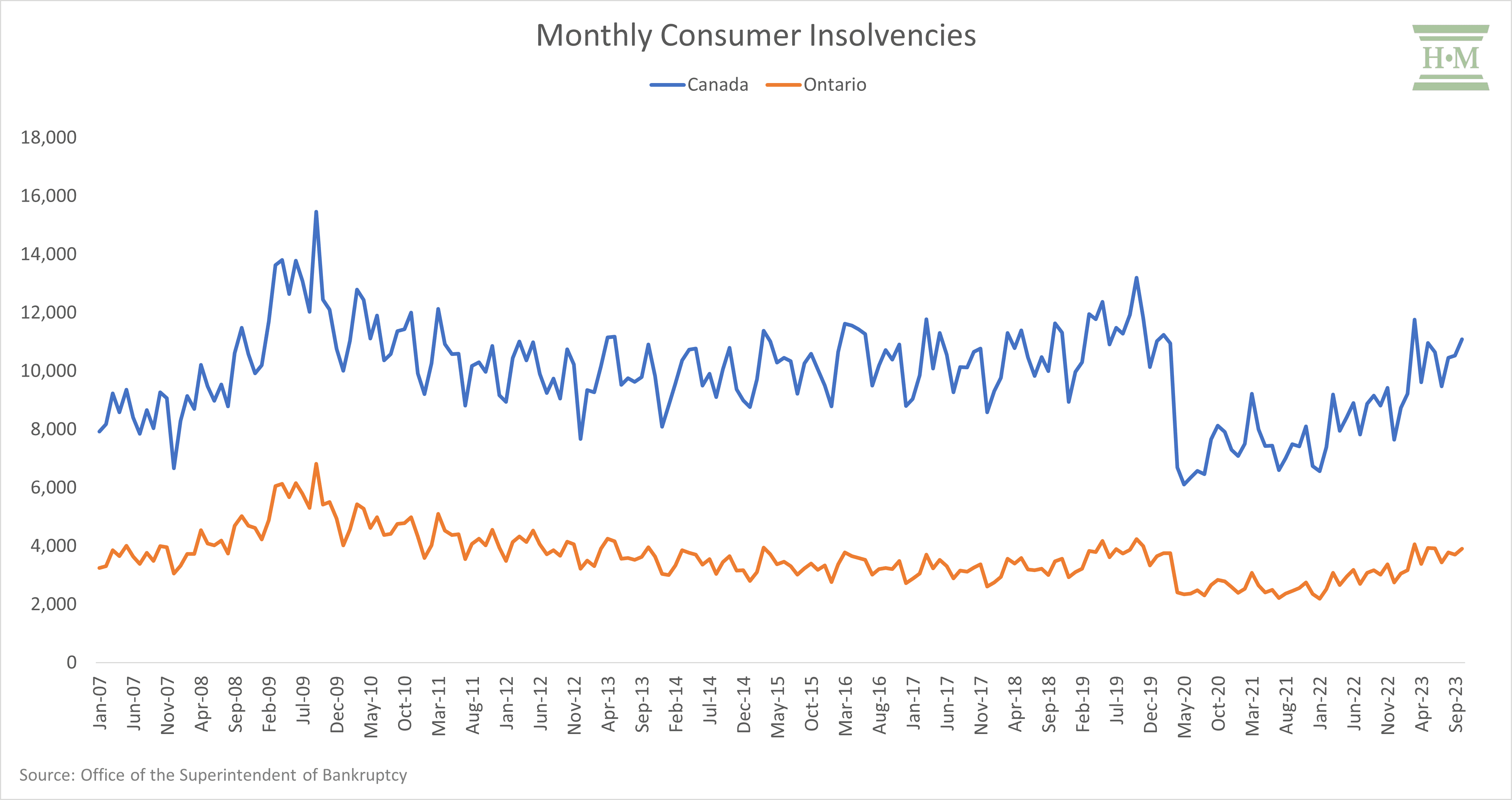

Total consumer insolvencies in Ontario increased by 27.2% in the first ten months of 2023, while Canadian insolvencies increased by 23.3%. Ontario insolvencies are now just 3% below 2019 volumes, while Canadian filings remain 11% below pre-pandemic levels.

The pace of growth has slowed in recent months as we move further away from the pandemic bottom of mid-2020, yet growth remains well into the double digits. October volumes were up 29.5% in Ontario and 25.8% Canada-wide.

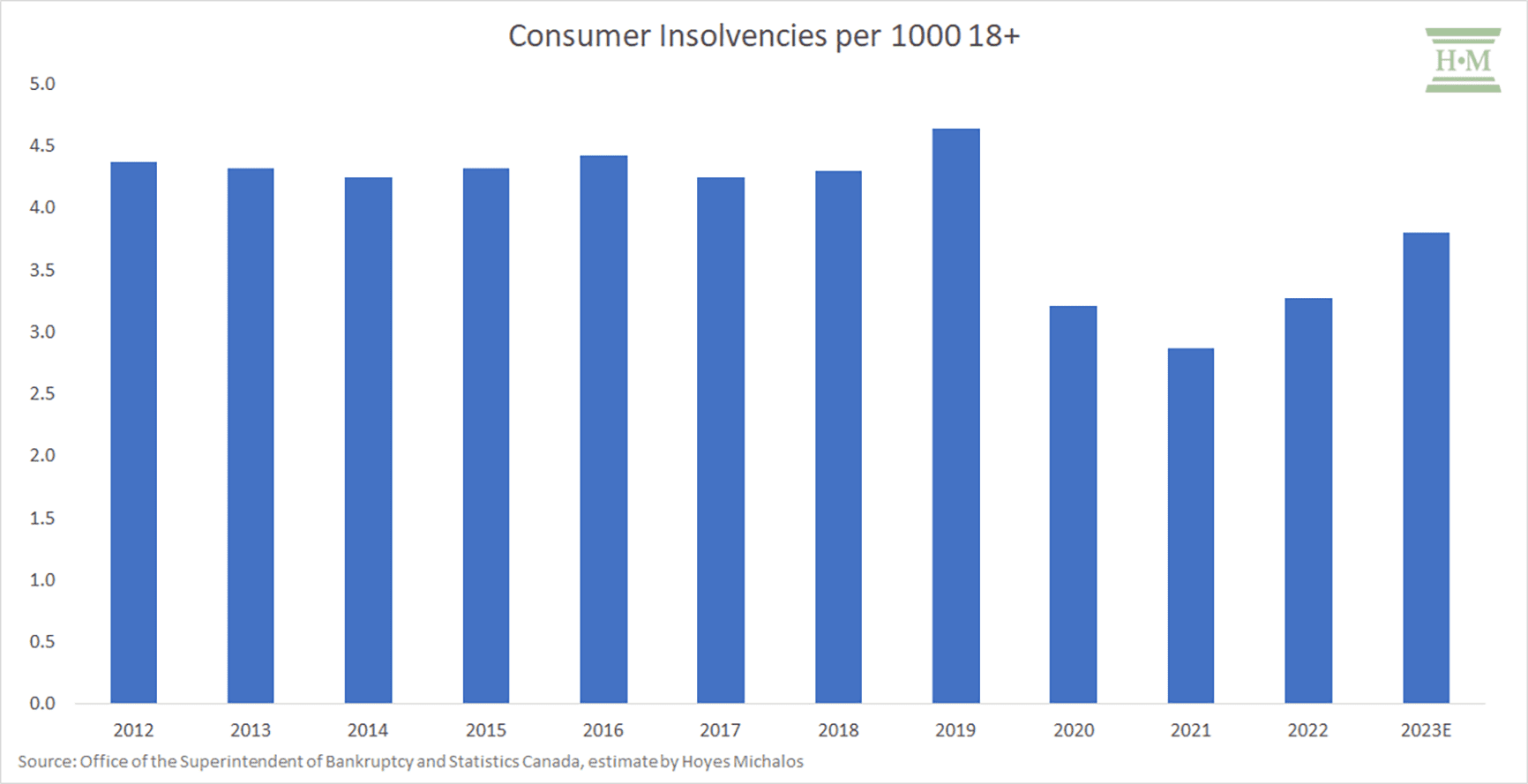

Consumer insolvencies per capita remain below pre-pandemic levels but are increasing as more Canadians struggle with debt repayment. We estimate that 2023 will see a consumer insolvency rate of 3.8 per 1000 adults, up from 2.9 in 2021 and 3.3 in 2022.

Consumer insolvencies per capita remain below pre-pandemic levels but are increasing as more Canadians struggle with debt repayment. We estimate that 2023 will see a consumer insolvency rate of 3.8 per 1000 adults, up from 2.9 in 2021 and 3.3 in 2022.

Credit Card Debt – Canary in the Coal Mine

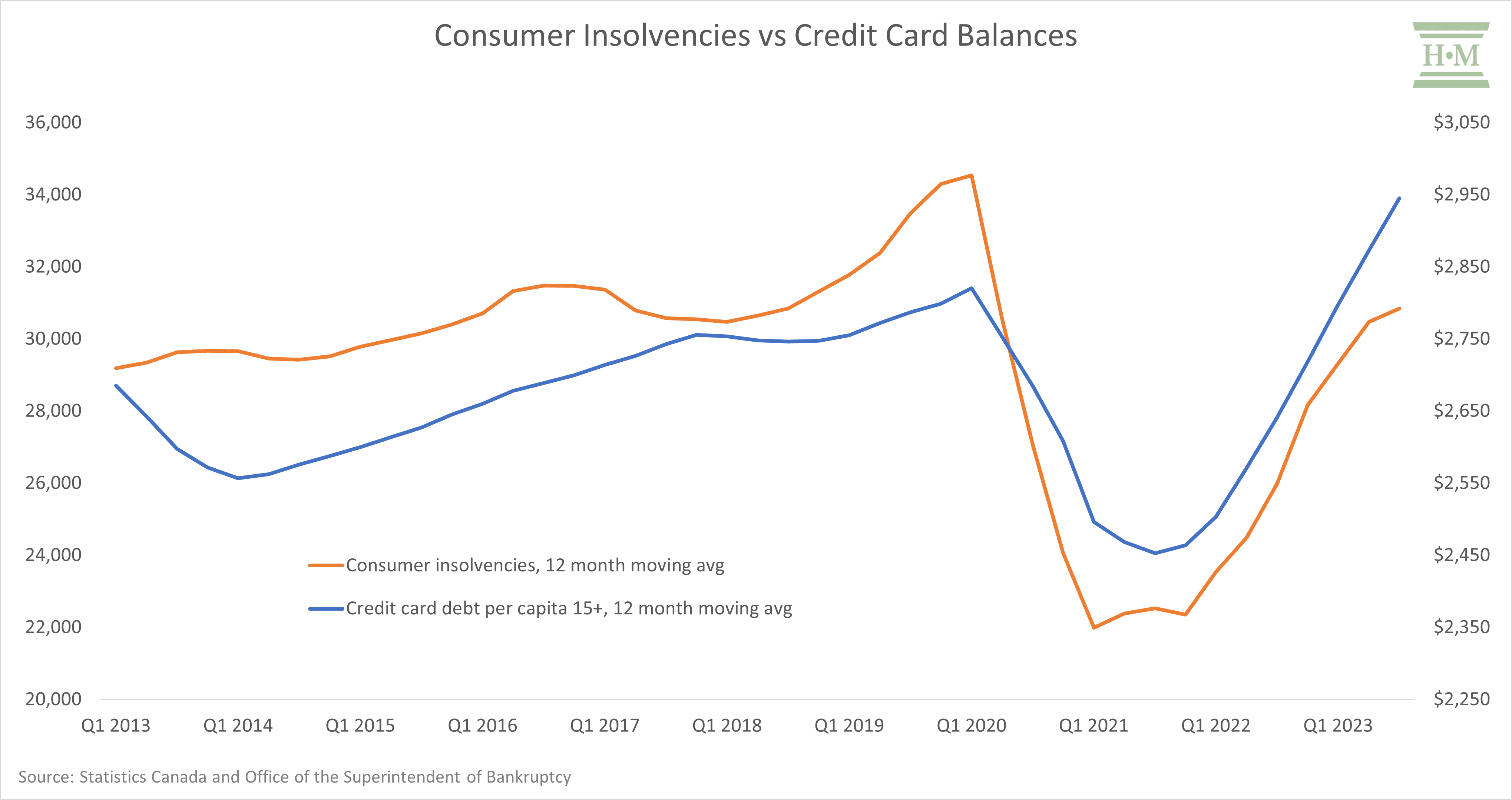

The issue? While some debt indicators look better, Canadians continue borrowing problem debt.

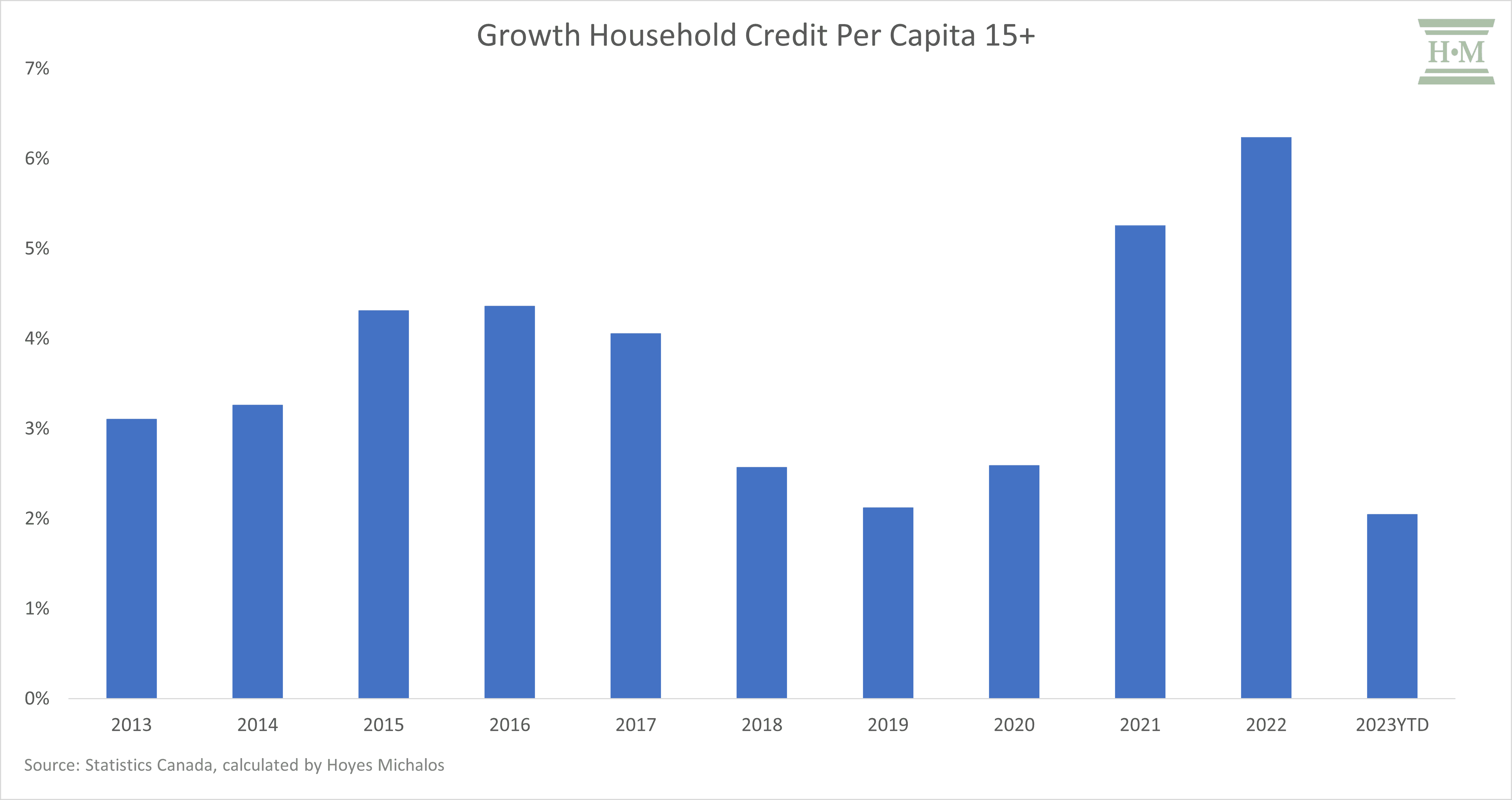

Per capita balances are up an average of 2.1% in the first three quarters of 2023, the lowest annualized growth in recent history and slower than in 2019 amid the pandemic.

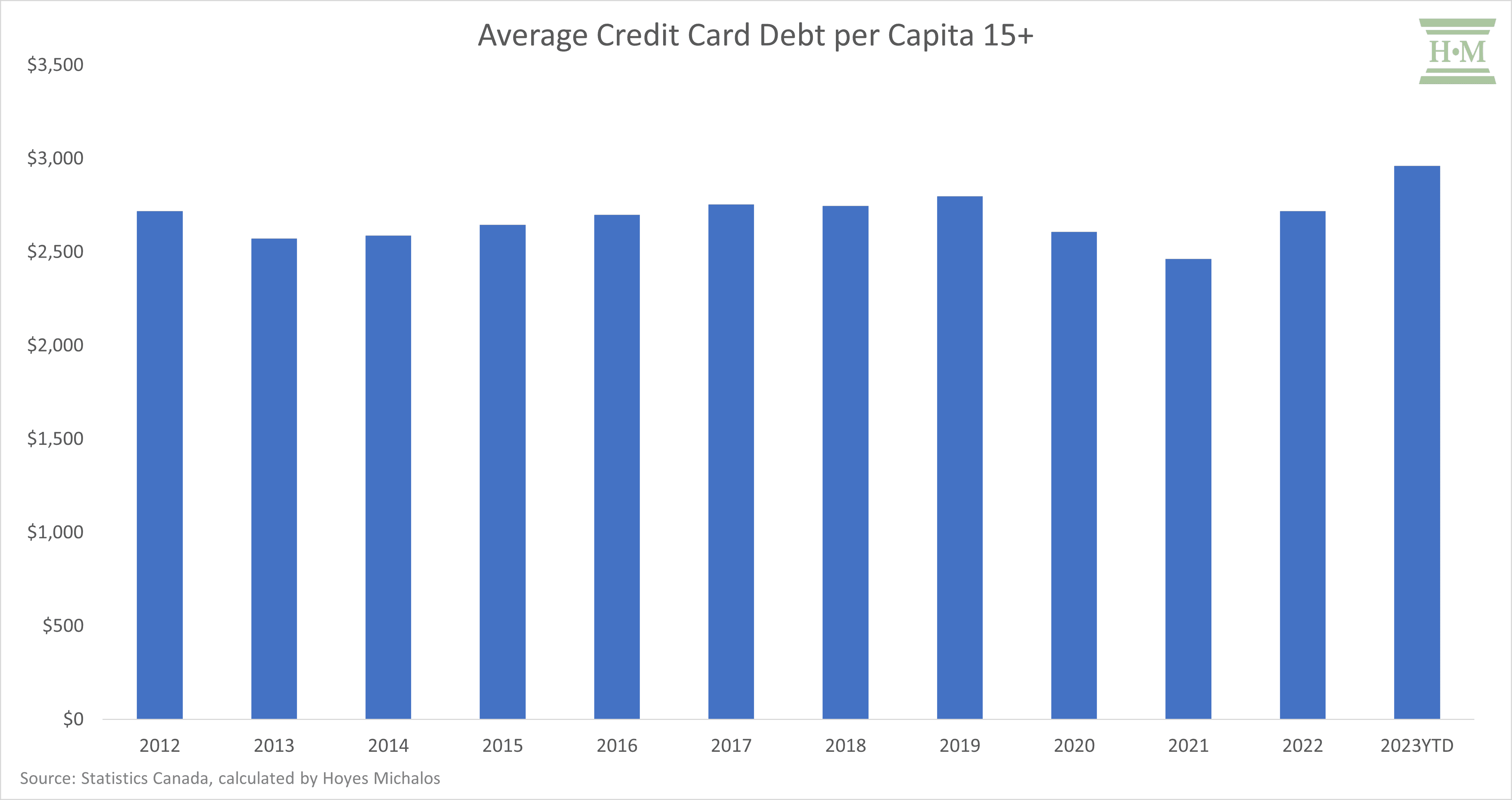

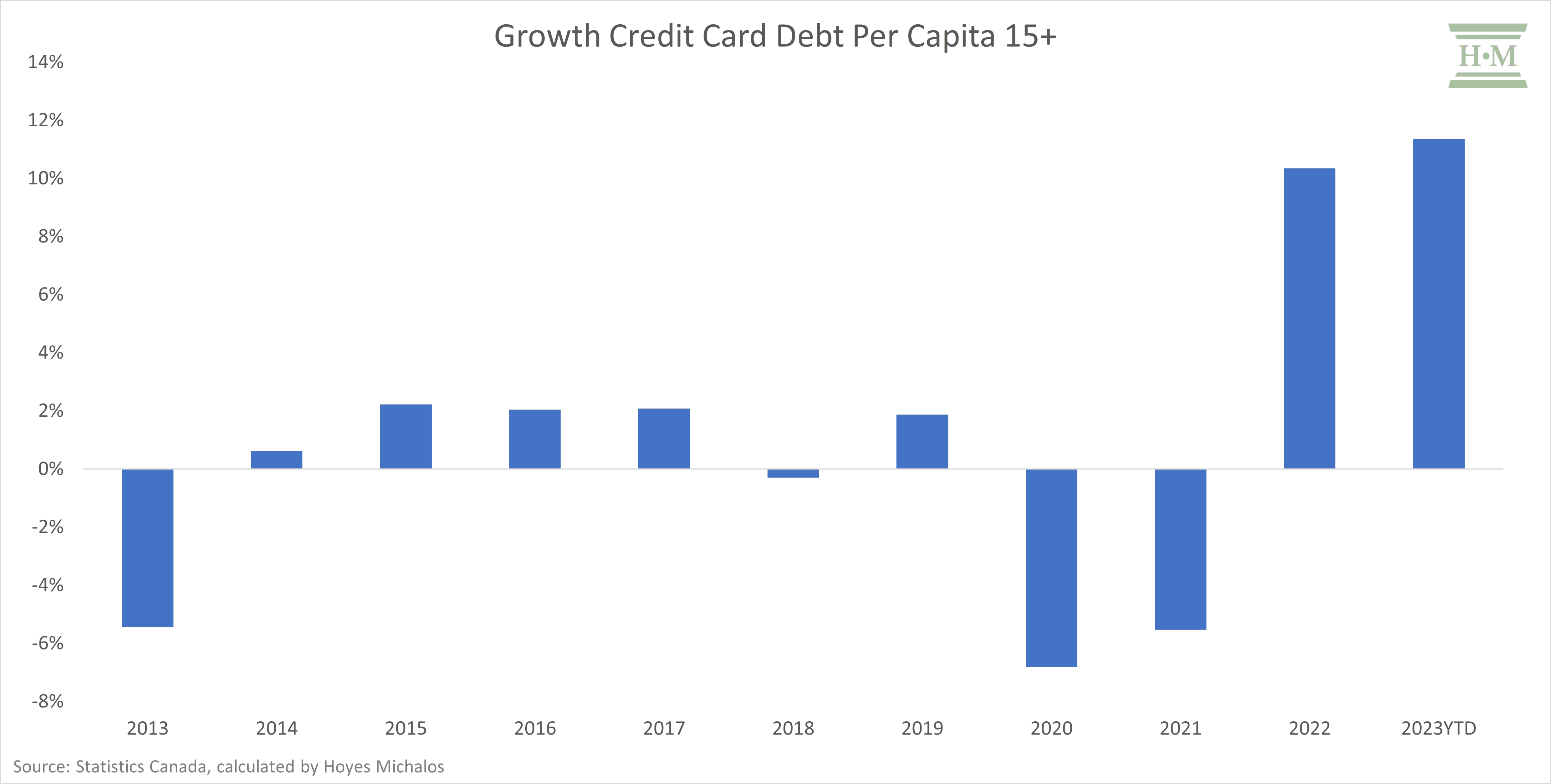

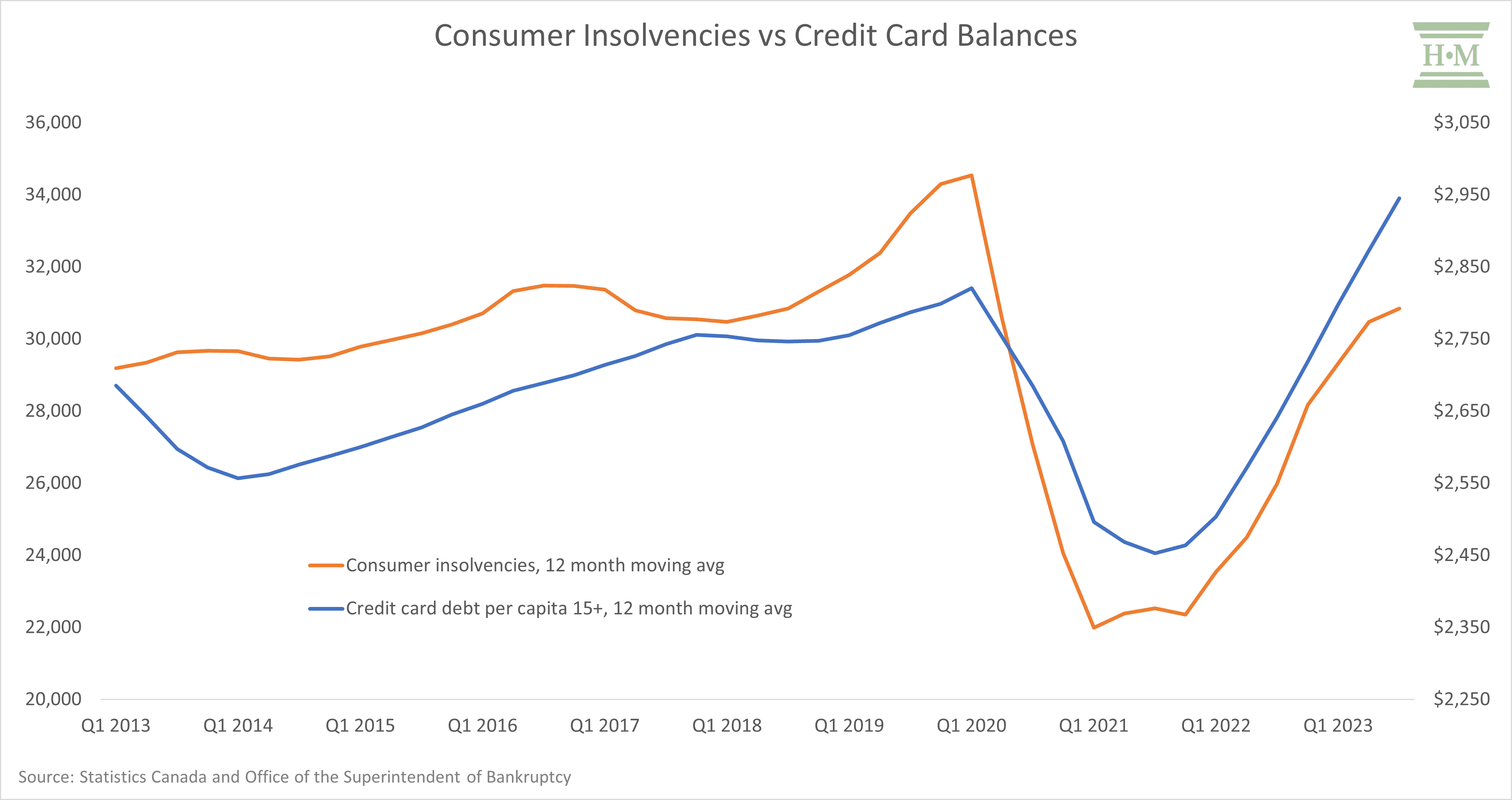

Credit card debt balances in aggregate and per capita are rising and have surpassed pre-pandemic norms.

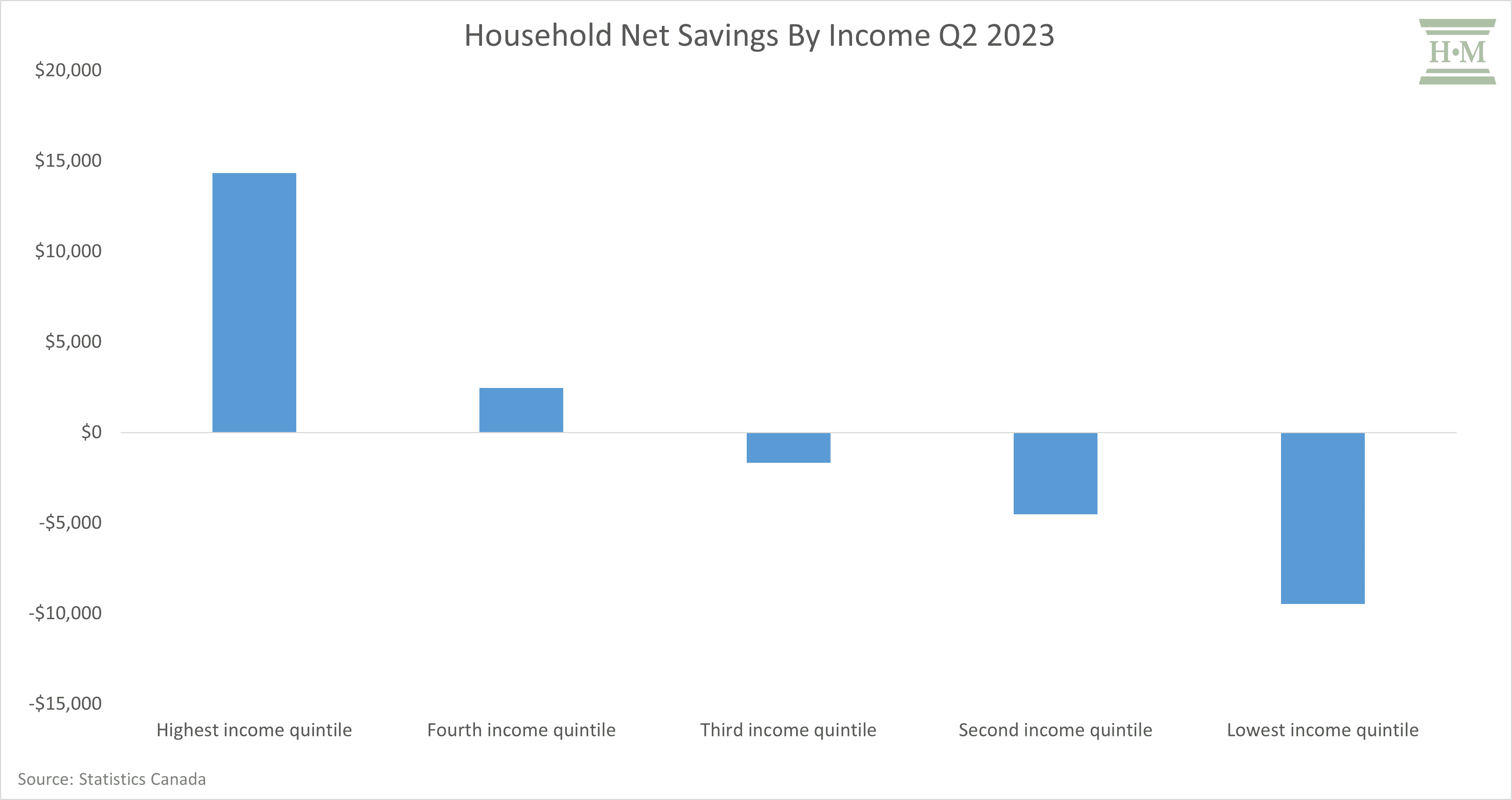

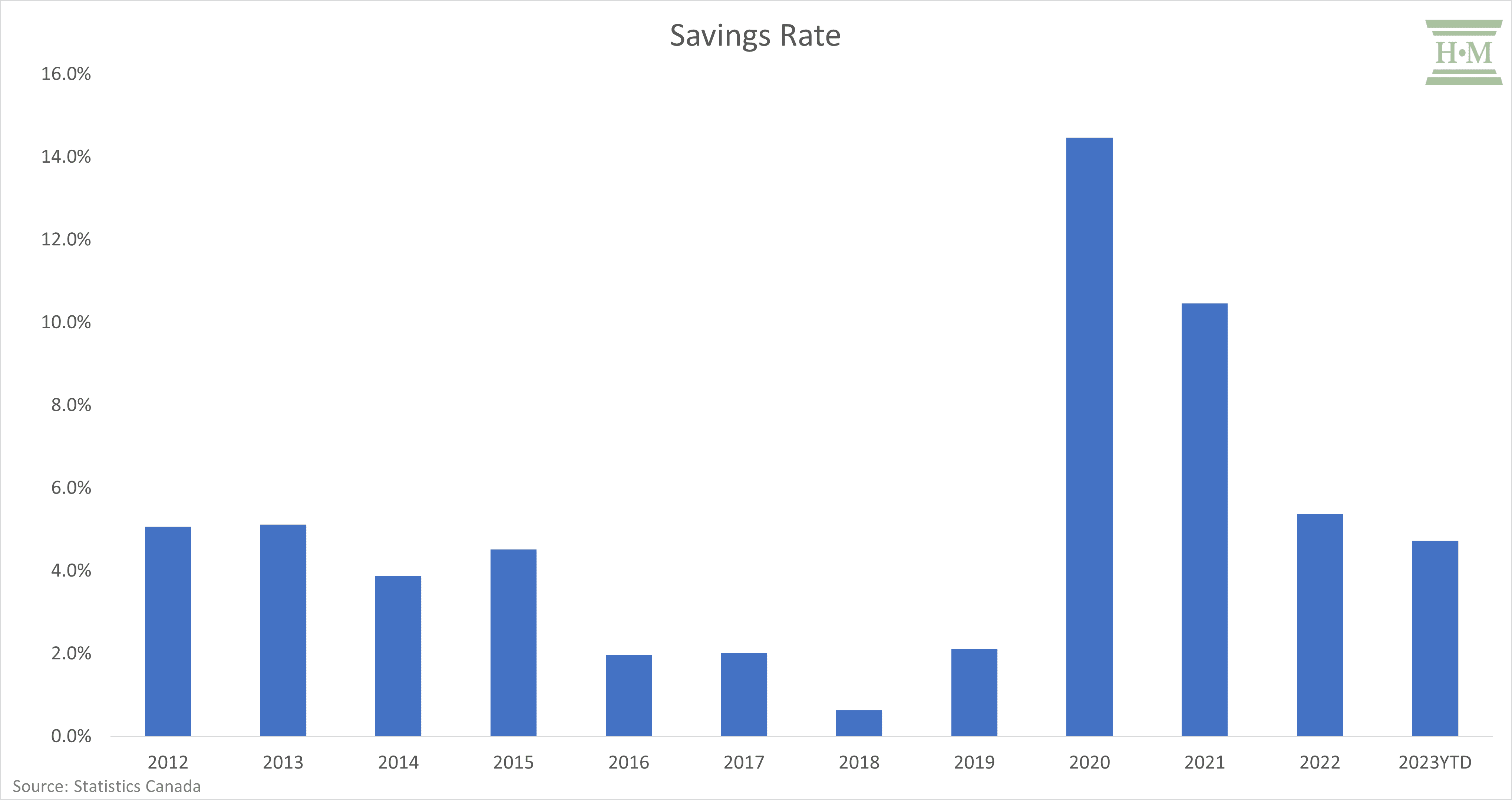

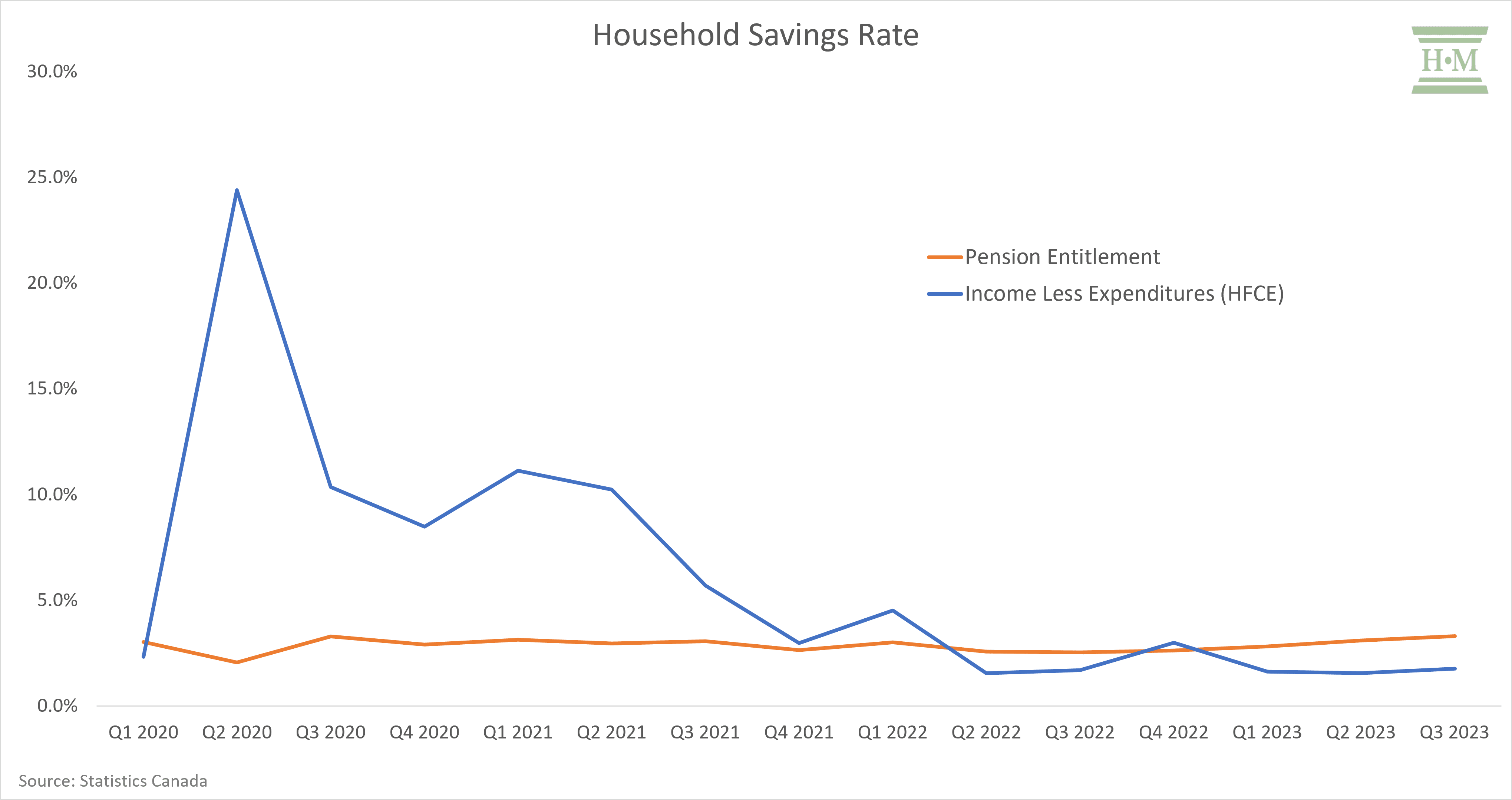

While the average savings rate in Canada has risen slightly over the past two quarters, it has declined considerably from pandemic highs, and the average for 2023 is below 2022.

Also, with an average annual household income of $38,500, most insolvent debtors are among the income groups experiencing more significant drops in savings.

Affordability Crisis and Cash Flow Crunch

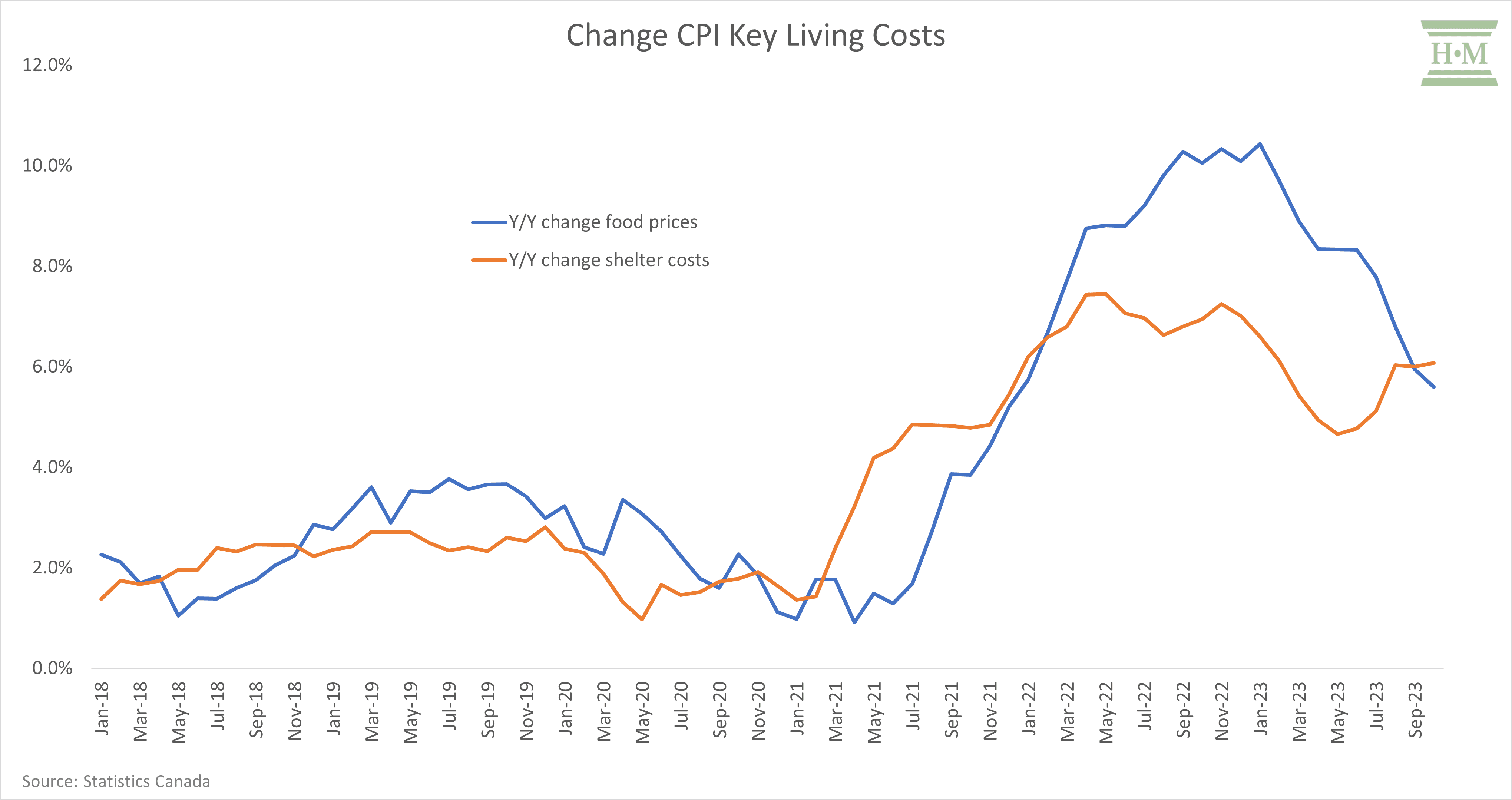

Although the pace of inflation is slowing, the impact on household finances remains high.

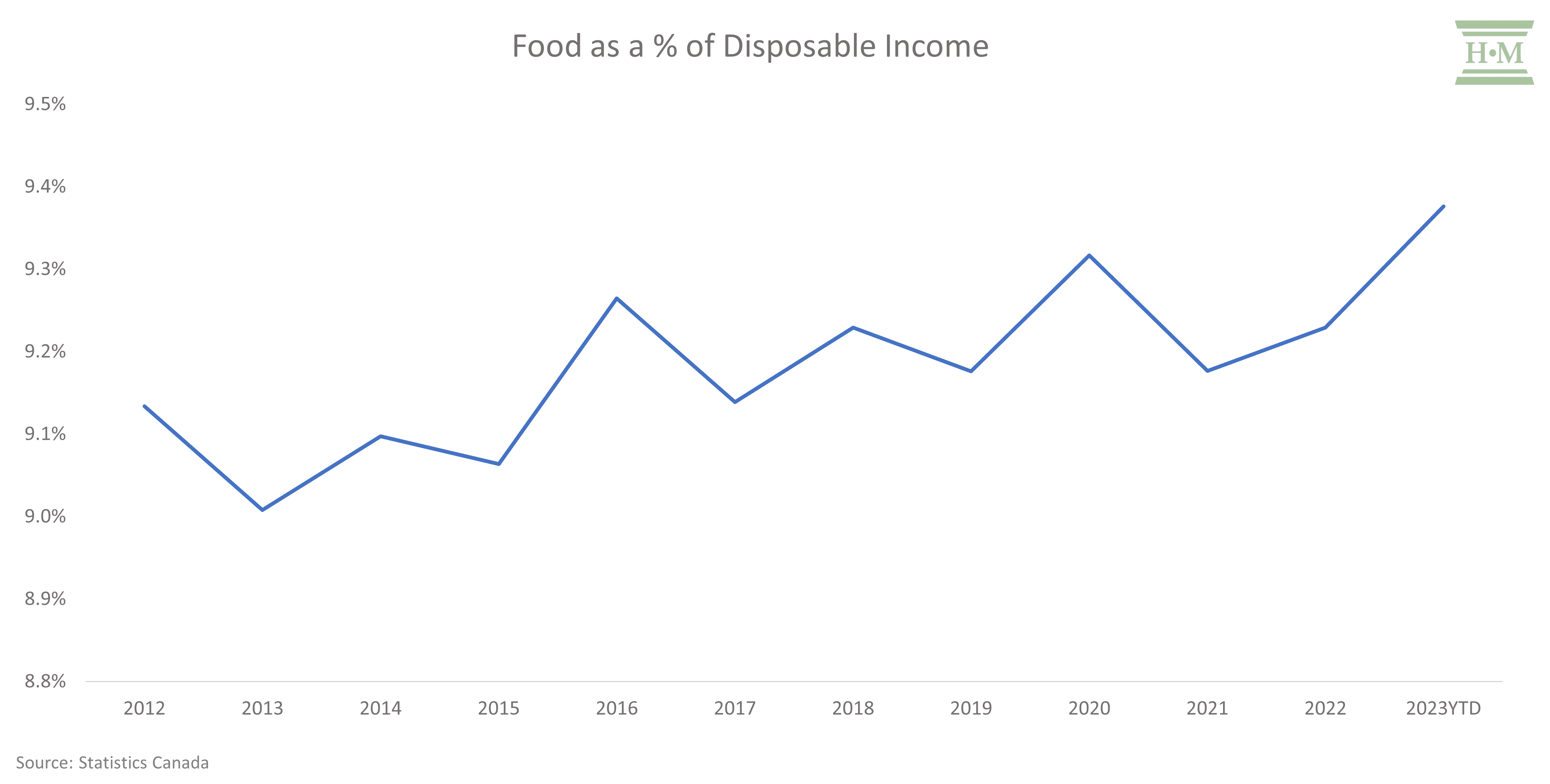

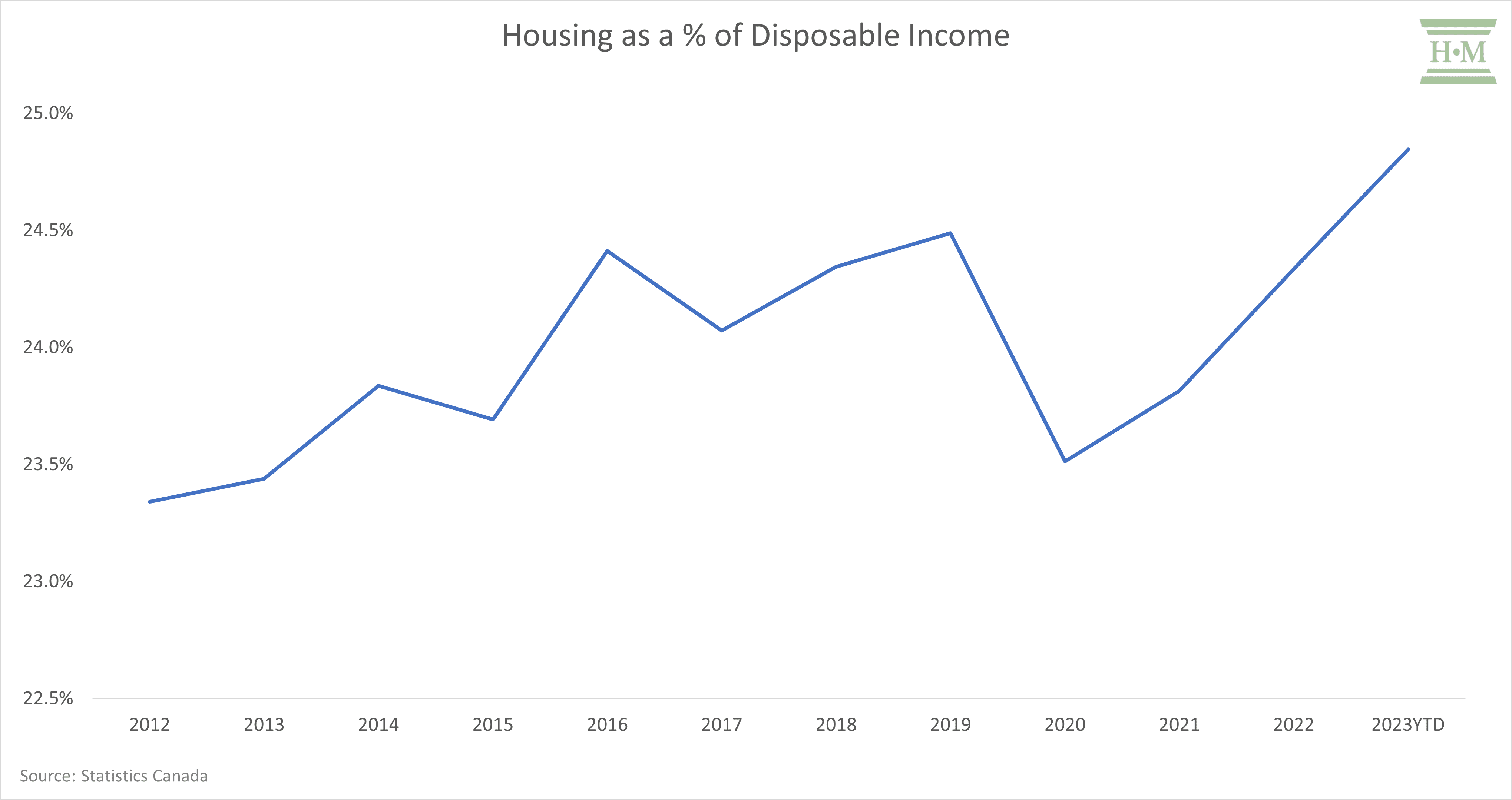

Canadian consumers spent an increasing share of their disposable income in 2023 on essential living costs. Food inflation, rising rents and higher mortgage payments are straining household budgets.

Looking at this another way, Canadians are borrowing more to fund essential living costs. As we can see, when Canadians are net borrowers, consumer insolvencies tend to rise.

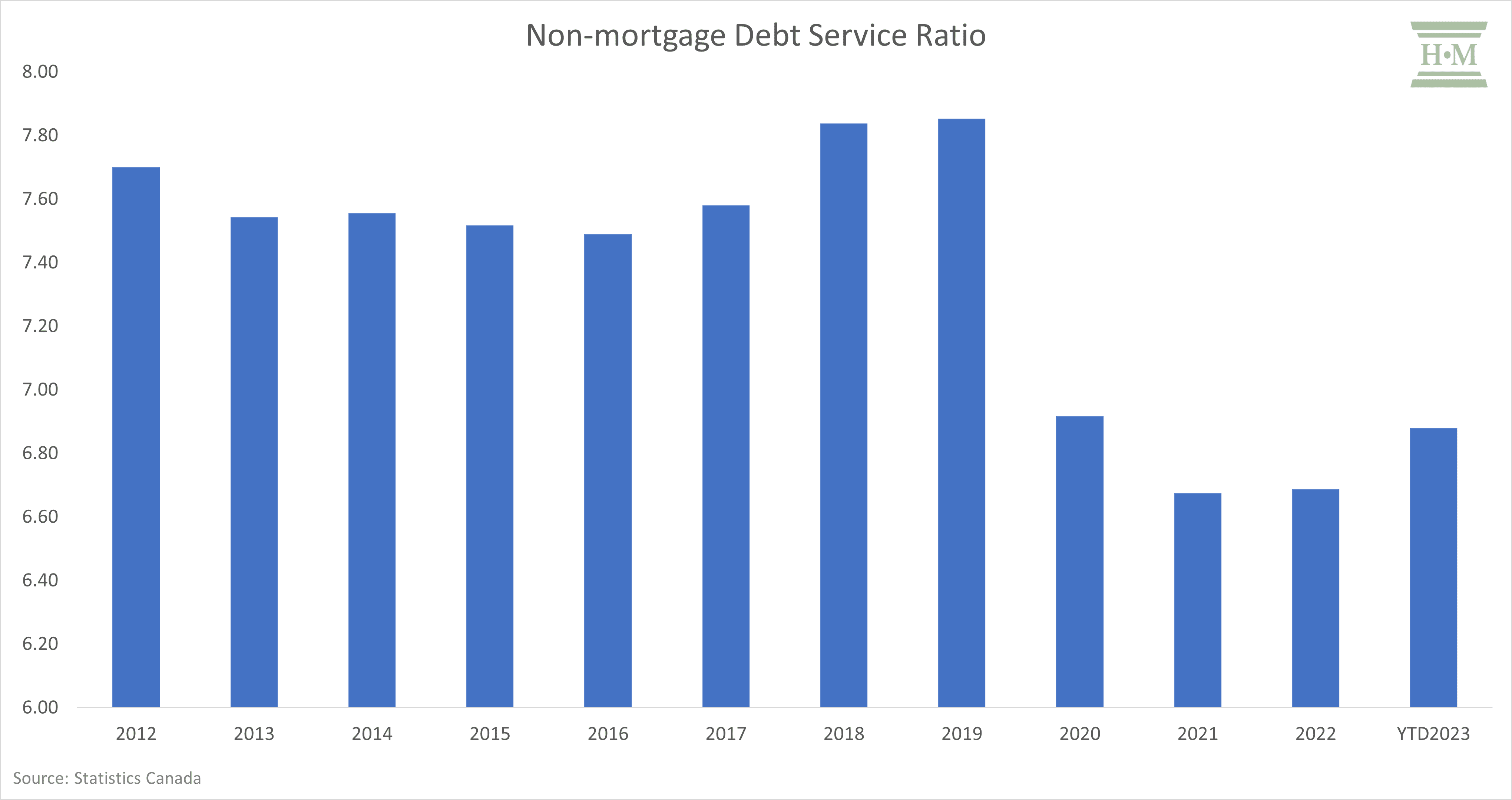

The non-mortgage debt service ratio increased to an average of 6.88% in the first three quarters of 2023, up from 6.69% in 2022, and has been trending upward due largely to rising credit card balances and higher rates on lines of credit.

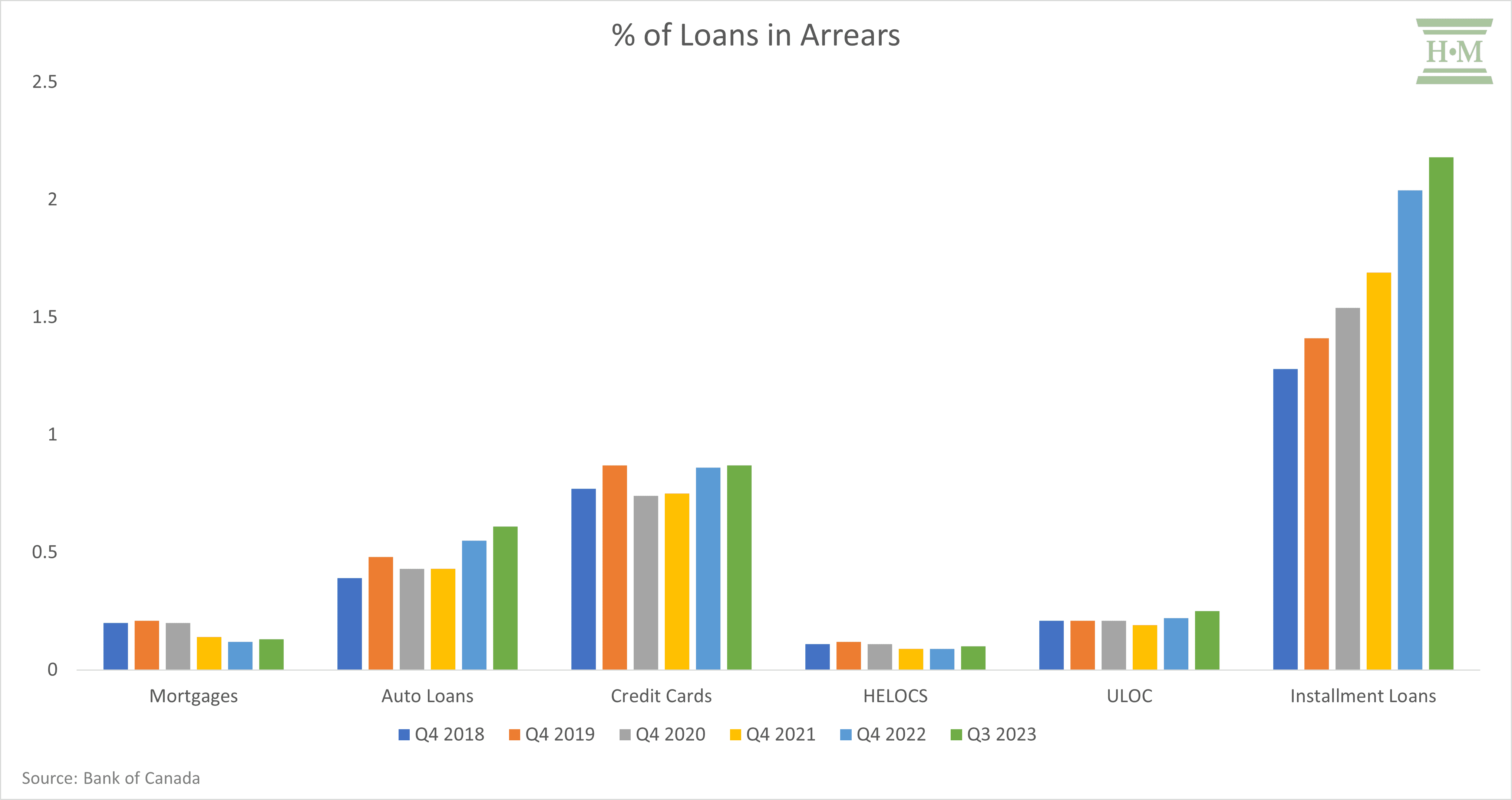

However, the significant rise in past-due installment loans is more interesting (and worrisome). Delinquencies for installment loans in the third quarter of 2023 were 2.4 times the previous low of 0.92% in Q4 2017. Like credit card debt, insolvent debtors are heavy users of high-interest installment loans. As our 2022 insolvency study pointed out, over half of insolvent debtors (53.1%) carry at least one high-interest rapid loan. A rise in delinquency among sub-prime loans will also push insolvency rates up in the coming year.

And What About Homeowners?

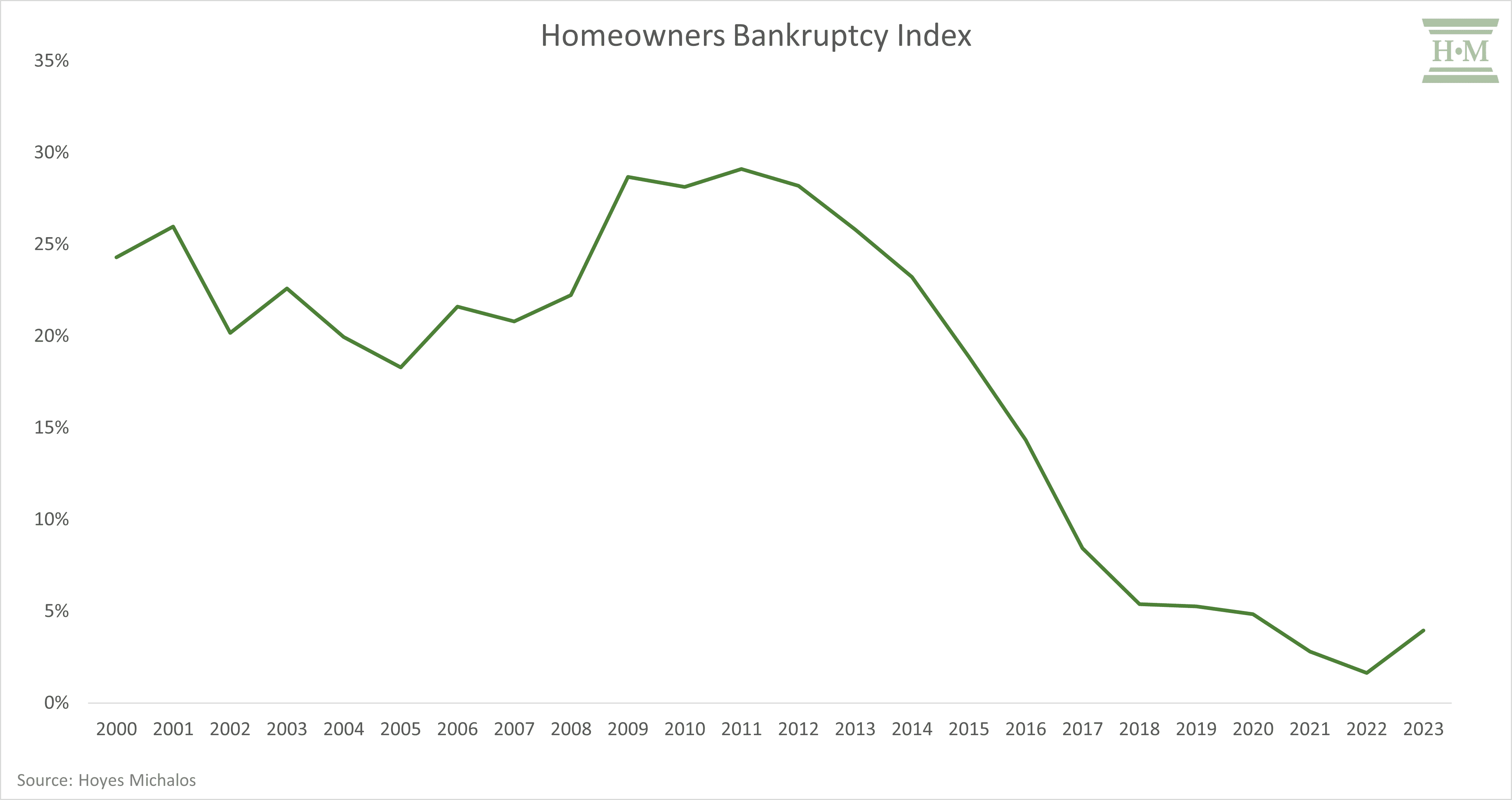

Our homeowner bankruptcy index has risen from historical lows, albeit very slowly. Our annual index is 4.0% (year to date, November 2023), up from 1.6% in 2022.

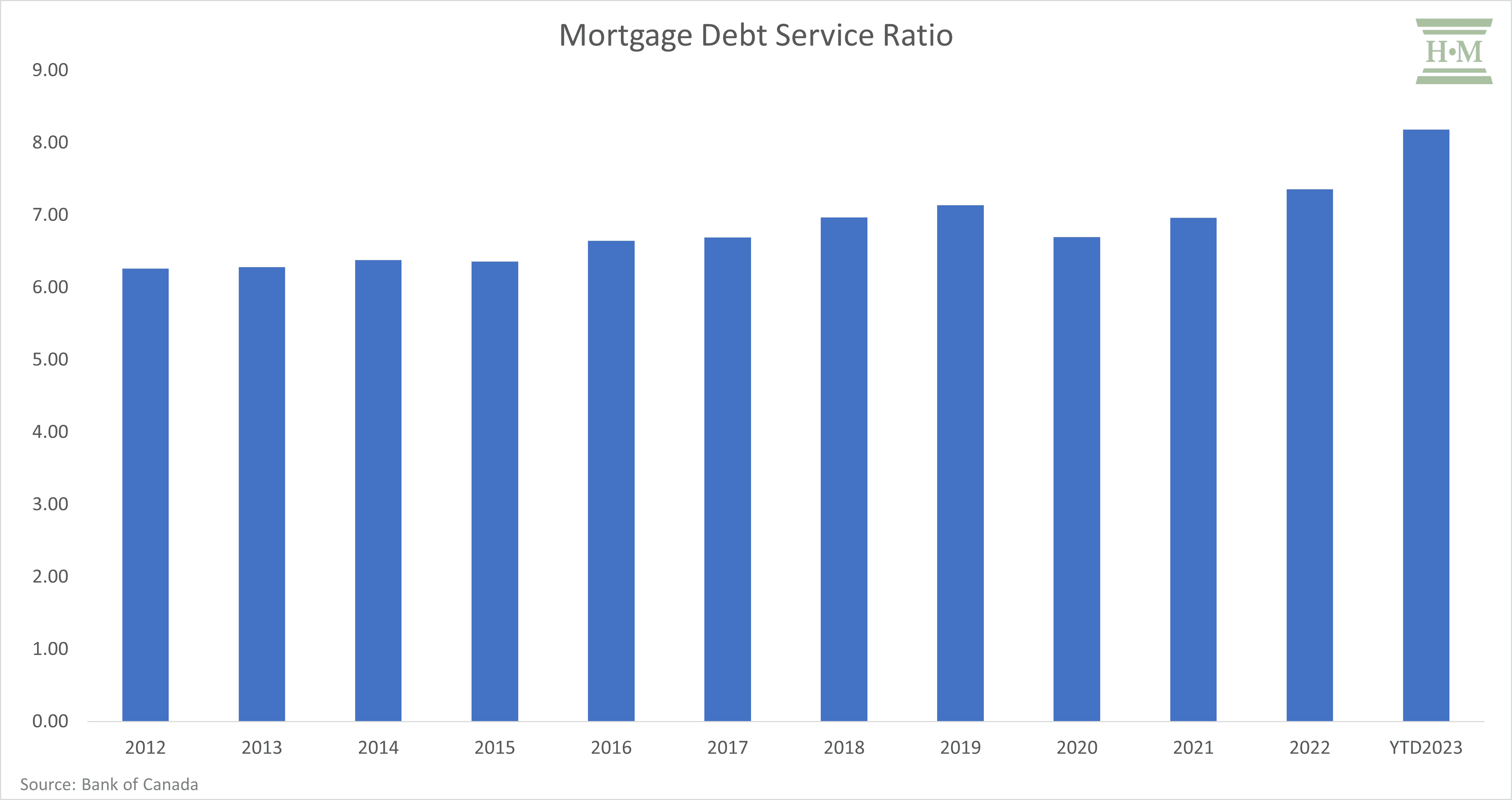

Interest rate increases have already begun to impact many homeowners. Even if the Bank of Canada lowers rates, higher rates will continue to be passed through to residential mortgage payments as a wave of mortgage renewals is forthcoming.

We have already seen an increase in the mortgage debt service ratio to an average of 8.18% in the first three quarters of 2023, up from a low of 6.71% in 2020.

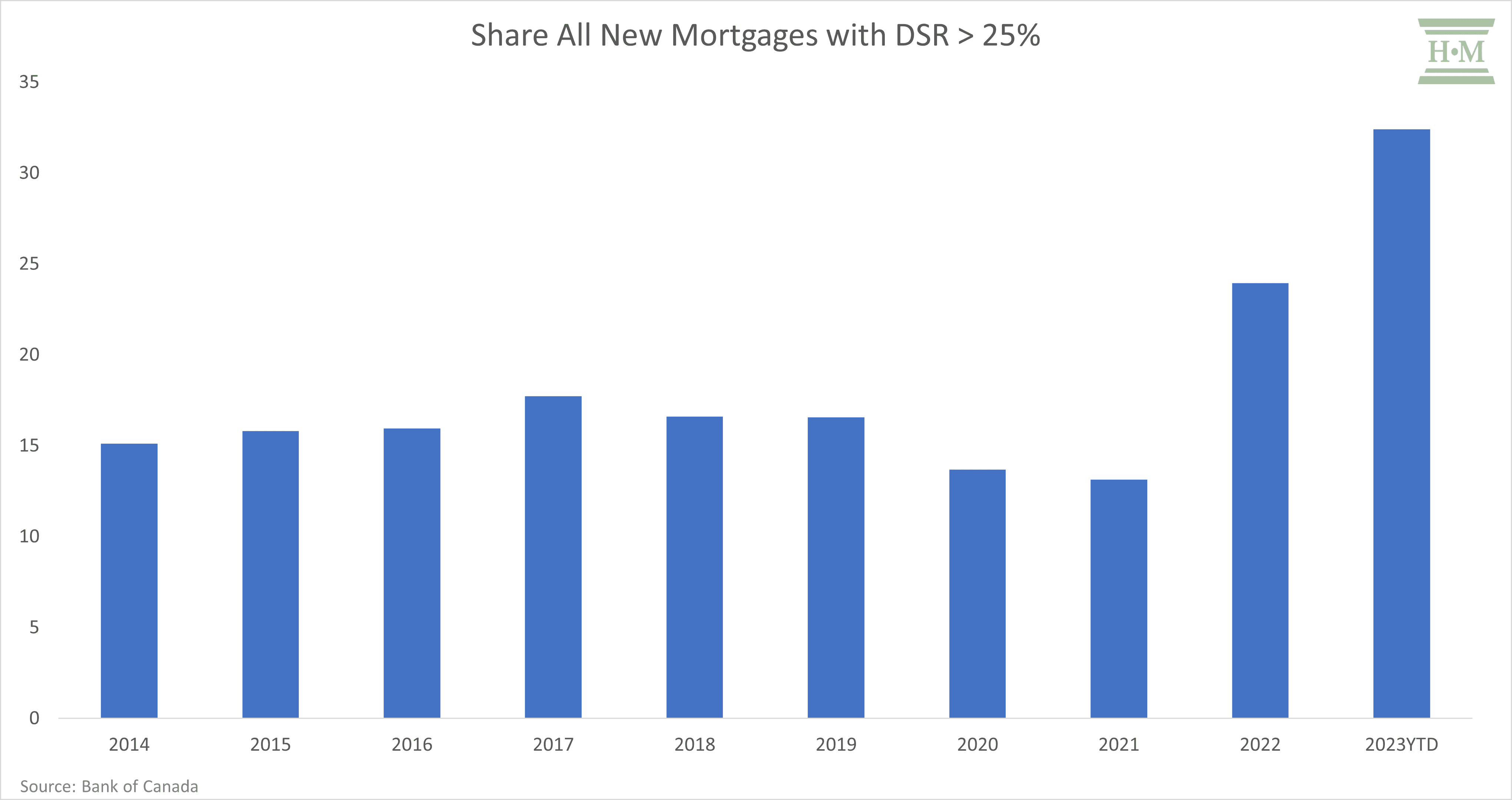

The share of vulnerable homeowners is increasing. The Bank of Canada reports that almost one third (32.4%) of new mortgages in the first three quarters of 2023 carry a debt service ratio greater than 25%. Households with this level of mortgage payment stress are much more likely to fall behind on debt payments once other credit options run out.

A homeowner may choose to file a consumer proposal if:

- Their total unsecured debt exceeds their home equity or

- They cannot refinance and may try a 100% consumer proposal repayment plan to reduce their ongoing interest charges.

In either case, they can choose to keep their home if restructuring their unsecured debt through a consumer proposal will fix their finances sufficiently to allow them to keep up with their mortgage payments.

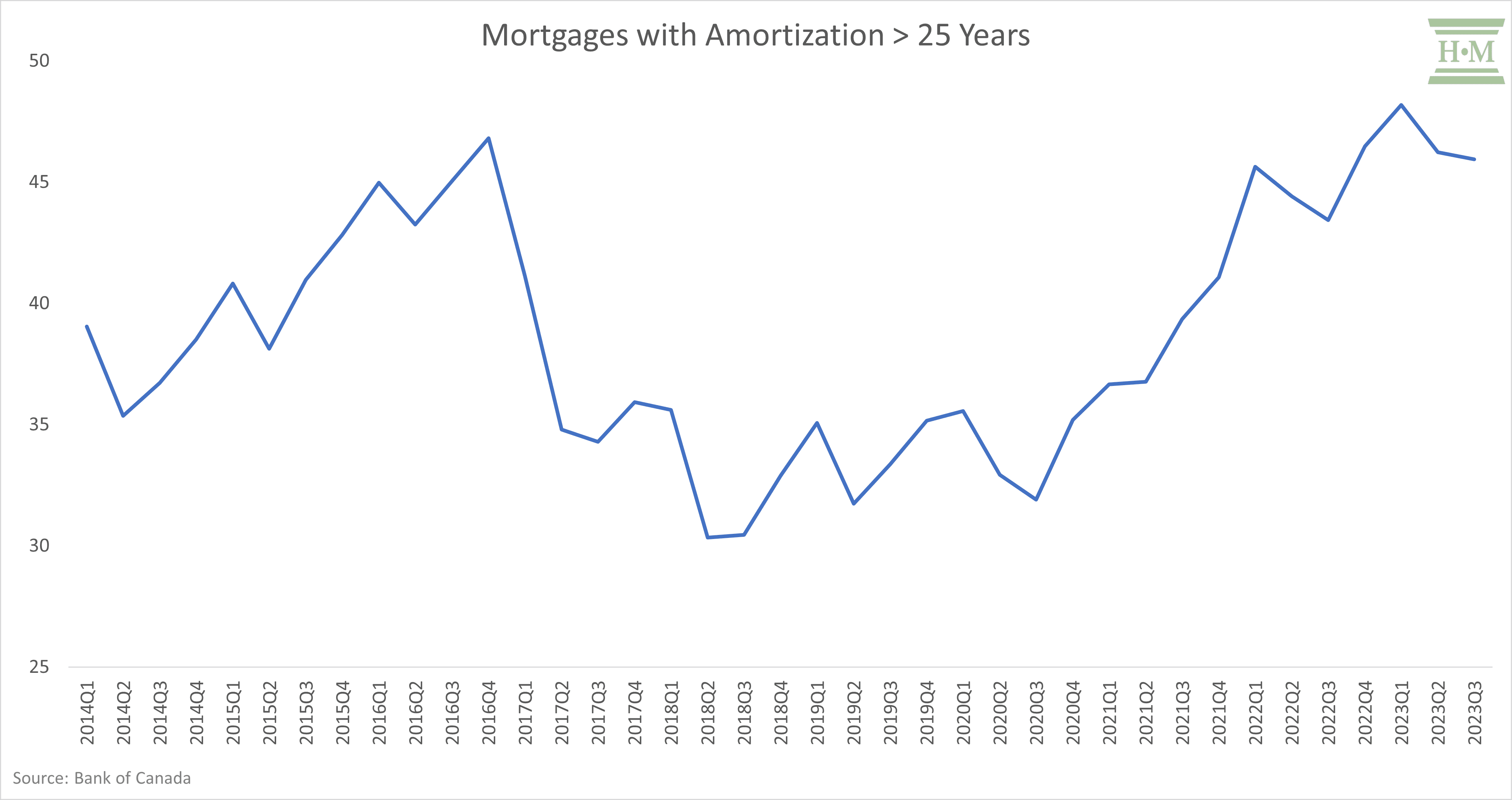

However, a concerning trend for homeowner insolvencies is the recent rise in negative amortization risk. The share of new mortgages with an amortization period longer than 25 years has risen and is now at levels not seen since 2016.

In a market with falling housing prices, long or negatively amortized mortgages will increase the risk that an indebted homeowner will choose to walk away from their home if they cannot make their mortgage payments. Any shortfall in the mortgage can be eliminated through a consumer proposal.

Combine high home ownership costs, low home equity and rising revolving credit, and you have a recipe for increasing homeowner insolvencies.

Conclusion and Future Outlook

So, we have rising credit card debt, increasingly squeezed household budgets and a rising risk for homeowners.

Economic factors like rising credit card debt and interest rate changes generally have a 12 to 18-month lagged effect on consumer insolvencies. Even ignoring a potential uptick in homeowner insolvencies, I suspect we will maintain the current growth trajectory of consumer insolvencies for at least 2024 and into 2025.

If you want to hear specific predictions on how much higher insolvencies will rise in 2024, tune in to the podcast with myself and my co-founder, Ted Michalos, airing on December 30, 2023.

Top 2023 Debt Statistics

- Insolvencies – rising – up 27.2% YTD Ontario, up 23.3% Canada

- Consumer insolvencies per capita (Canada) – rising – 3.8 per 1000 adults estimated 2023

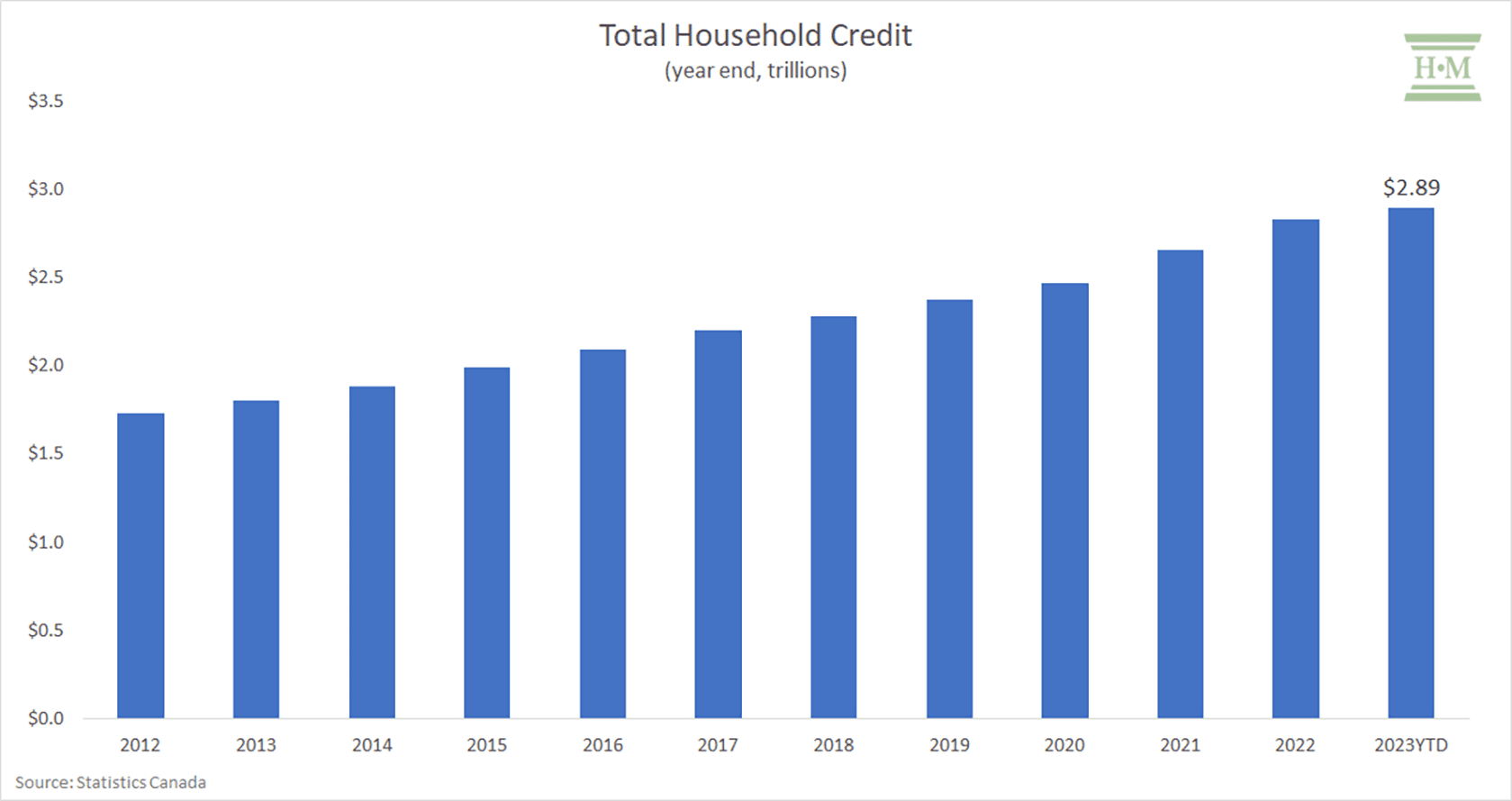

- Household credit – slow growth – $2.89 trillion September 2023

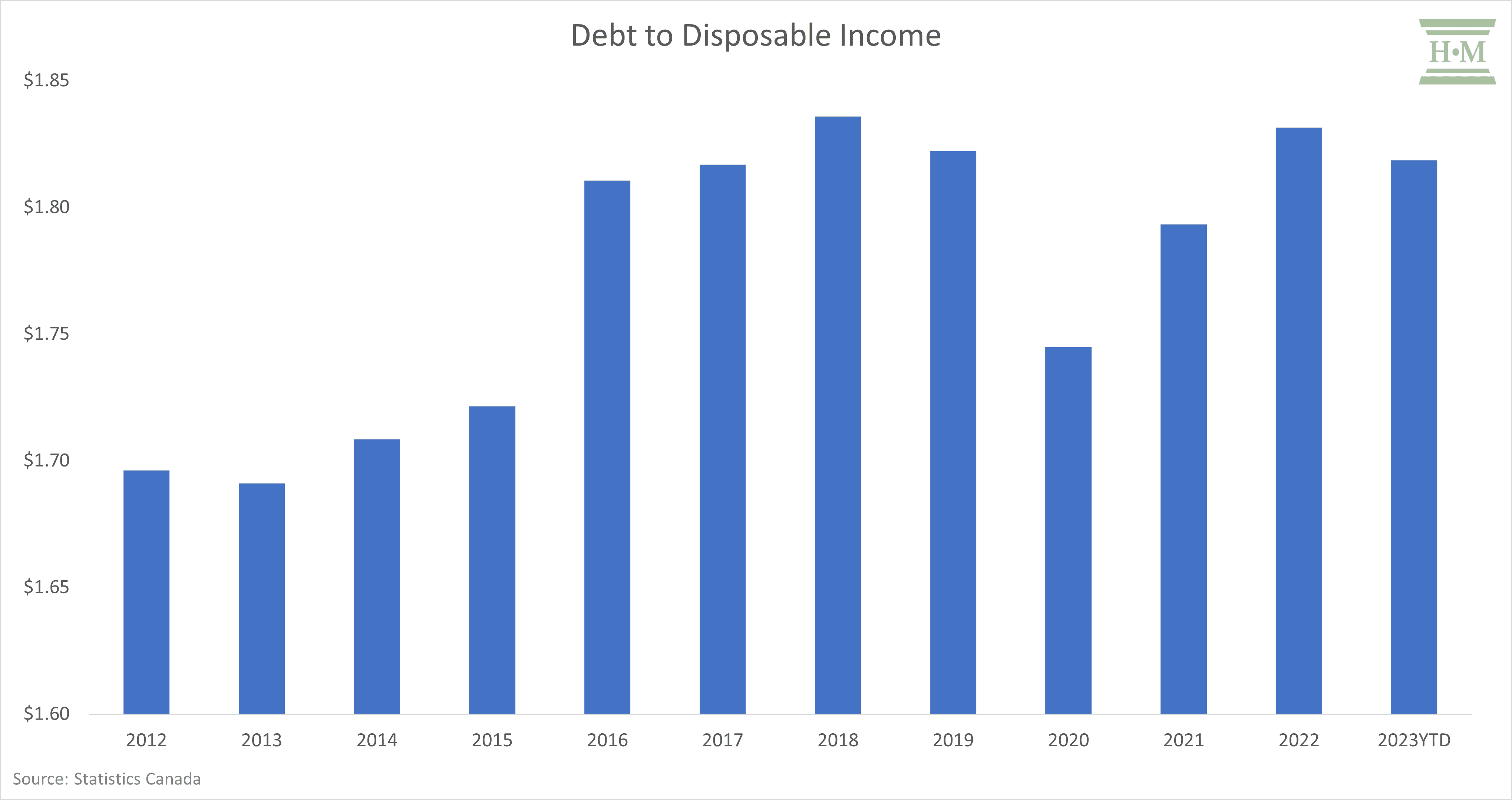

- Debt to disposable income – improving – $1.82 Q3 2023

- Credit card per capita – rising – up 11.4% YTD

- HFCE as % disposable income – rising – 98.4% YTD

- Food spending as % household disposable income – rising – 9.4% YTD

- Housing costs as % household disposable income – rising – 24.8% YTD

- Total debt service ratio – record high – 15.22% Q3 2023

- Credit card delinquencies – rising slightly – 0.87% Q3 2023

- Homeowners Bankruptcy Index – rising slowly – 4.0% YTD

- Mortgage debt service ratio > 25% – rising – 32.4% YTD

- New mortgage amortizations greater 25 years – rising – 45.95% Q3 2023

External Sources:

- https://ised-isde.canada.ca/site/office-superintendent-bankruptcy/en/statistics-and-research

- https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3610063901

- https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1710000901

- https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3610011201

- https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3610058701

- https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3610010701

- https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3810023801

- https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3610066201

- https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3610066401

- https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1110006501

- https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1010013901

- https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1810000401

- https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1410028701

- https://www.bankofcanada.ca/rates/indicators/indicators-of-financial-vulnerabilities/