Today we are going to take an in-depth look at credit counselling and debt management plans as one of your options when dealing with debt.

To help you decide if credit counselling can help you get out of debt we look at:

- Who can benefit from credit counselling;

- What credit counselling costs;

- How credit counselling will affect your credit;

- What credit counsellors do and who they work for;

- What qualifications your credit counsellor should have;

- When to consider other debt reduction options.

I have always been a supporter of local, full service, not-for-profit credit counselling that requires qualified individual counsellors to meet with people face-to-face, help them deal with the underlying causes of their financial difficulties and teach useful money management skills. Unfortunately, credit counselling services across Canada have changed. Local organizations have been on the decline, being overtaken by large, national, call centre credit counselling agencies.

I’ll begin by saying I am a Licensed Insolvency Trustee. Full disclosure that means we compete with credit counsellors. However, I’d like to present this view of credit counselling, both the good and bad, in the hopes that you make an informed decision about what debt reduction program is best for you.

This is a long post, with plenty of information, so grab a coffee or scroll through the headings to find what’s useful to you.

Table of Contents

Who can benefit from credit counselling?

What is credit counselling all about? Credit counselling is generally thought of as the process of teaching people better money and debt management skills, getting help with personal budgeting and dealing with consumer credit problems. Today, the term ‘credit counselling’ is often used as a softer, less scary label for the service they really do – a debt management plan.

A debt management plan is simply a debt repayment plan arranged through a credit counsellor. It is just one possible debt solution for those struggling with consumer debt. In a debt management plan, you can consolidate your unsecured debt, including credit cards, lines of credit, unsecured loans and past due utility bills into one monthly payment to the credit counselling company.

There are advantages to repaying debts through credit counselling:

- Your credit counsellor is dealing with your creditors and working out a repayment plan for you

- You consolidate several payments into one monthly payment

- You can refer collection calls to your credit counsellor

- You may qualify for an interest freeze or reduction in the interest rate charged

Yet credit counselling, or more specifically, debt management plans, are not as painless as they are made out to be.

There are two specific implications of using a credit counsellor that should be considered:

- To qualify for a debt management plan, you must be able to afford to repay your debts in full plus fees, usually an additional 10% to 15% on top of your monthly debt payments.

- Credit counselling will affect your credit. There is a widespread view that credit counselling is a way to deal with your debts without any negative impact on your credit score. This is not true. If you file a debt management plan, it will be reported on your credit report like any other debt remediation program.

So, the question should not be will credit counselling help me get out of debt, but rather, how does credit counselling compare to the cost and impact of other debt relief options? In other words, is credit counselling the best way out of debt for me and is a credit counsellor the right person to explain all the alternatives?

Let’s explore some of those questions.

How much does credit counselling cost?

Credit counselling works when you can afford to make a payment each month that will satisfy all your debts over a maximum period of 5 years. On top of this you will be required to pay a monthly fee of 10% to 15% of your payment and often a sign-up fee, typically $50.

You can calculate the cost of a debt management plan easily on your own:

Monthly payments = Total debts / 48-60 months * 1.10 (for fees)

For example,

If you owe $18,000 in credit card debts and outstanding bills, you will need to pay $300 every month for 60 months to your creditors assuming they agree to freeze the interest on your accounts. In addition, you will need to pay $30 a month for credit counselling fees, making your total monthly payment $330 to erase $18,000 in debts over five years through a debt management plan. This means you will repay your full debt balance plus $1,800 in credit counselling fees in this example.

The truth is that a consumer proposal is often a better, and cheaper, alternative to credit counselling, because with a consumer proposal you can offer your creditors less than you owe and there is no extra fee on top – trustee fees come out of any monies paid to creditors. While every situation is unique, based on your income and assets, a settlement of 35 cents on the dollar through a formal proposal is typical. Credit counselling requires you to repay everything.

Comparison of the monthly cost of credit counselling to proposals:

| Unsecured Debts | Credit Counselling¹ | Consumer Proposal² |

| $20,000 | $366/month | $117/month |

| $25,000 | $458/month | $146/month |

| $30,000 | $550/month | $175/month |

- Repaid over 60 months including 10% to 15% fee

- Settled at 35 cents on the dollar, fees included.

You can use our debt options calculator to compare your payments across several debt reduction programs including debt consolidation, credit counselling, and a consumer proposal for your debt levels.

How much debt do I need for credit counselling to work?

So, when should you consider credit counselling?

There is no debt limit to a debt management plan however in general credit counselling works best for individuals with unsecured debt balances of less than $10,000 or, if you have enough income, up to $20,000. If for example you have a few overdue bills, have a small old debt in collections, a manageable credit card balance but need help organizing payments, credit counselling can be a good idea.

While you can do a debt management plan for higher debt amounts, this is unusual and not recommended because:

- Higher debt balances can make your monthly payments unaffordable.

- Debts like student debt and tax debts, which are often larger, cannot be included in a debt management plan.

- Payday loan companies don’t always participate and may not waive interest costs. Dealing with multiple payday loan debts is much better done through a consumer proposal or, if you can’t afford that, bankruptcy.

How will credit counselling affect my credit report & credit score?

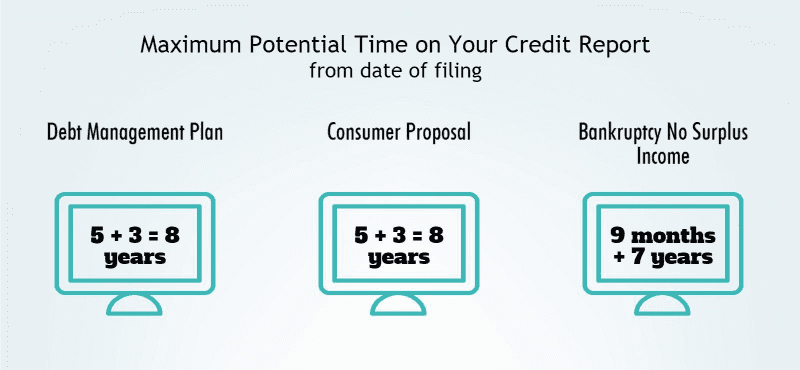

As mentioned earlier, many people are surprised to learn that credit counselling has the same impact on their credit as a consumer proposal.

A debt management plan will be listed as an R7 on your credit report. A notice will appear at the bottom of your report that you are in a scheduled repayment plan and, depending on the credit bureau, it will remain there for 2-3 years after completion of the program. Each debt included in your plan will have a notification that it is included as part of a scheduled repayment plan. The debts themselves will fall off your report 6-7 years after the last activity date.

This is the same reporting as a consumer proposal.

Since both credit counselling and a consumer proposal have the same results in terms of your credit and credit score, it only makes sense to compare the pros and cons of credit counselling vs a consumer proposal.

How does credit counselling work?

The credit counselling process begins with a financial assessment, where your counsellor will look at your income, your expenses and your debts but the primary objective to qualify for a debt management plan is to see if you can afford to repay your debts in full.

If you decide to work with a credit counsellor to repay your debts, you will be required to sign an agreement outlining your monthly payments with the credit counselling agency and typically pay a sign-up fee, usually around $50.

It is essential to know that your credit counsellor has not yet talked with your creditors. Once you sign the paperwork to do a DMP, your counsellor will begin to contact the creditors you decide to include in the plan. You might include your credit card company, your cell phone provider, utility company, bank, or credit union. It usually takes two to three weeks, depending on the creditors, to obtain agreement to participate. Others may take longer, depending on the size of the organization and workload; however, typically a month to have the creditors say yes or no is normal.

Usually you make your first monthly payment before the credit counsellor has an agreement with your creditors. Each month the credit counselling agency takes your payment amount and distributes this money among the participating creditors. If at the beginning some creditors don’t sign up, your credit counsellor may have the money paid to a single small creditor to get that small debt out of the way or encourage the creditor to agree to sign on. They may also choose to pay off an interest-bearing account first. While the underlying principal of DMPs is that all participating creditors receive a pro-rata share of the monies collected, what is to prohibit a credit counselling agency from paying off creditors in a different order and issuing an earlier payout to a bank or creditor that provides a more substantial fair share donation back to the counselling agency?

This distribution process differs significantly from the legal, government regulated consumer proposal process. In a proposal, you do not make payments until your proposal terms, the ones you want to offer, have been written down and filed with the government. No monies are paid out to one creditor ahead of another. By law, all creditors receive a pro-rata share of your proposal payments.

Can credit counselling help you get out of debt?

One of the disadvantages of credit counselling is that participation is entirely voluntary and is uncertain. Your creditors may or may not agree to accept a revised repayment plan, and they don’t always agree to freeze or lower your interest. You do not necessarily make a deal that works for you. Each individual creditor is in the driver’s seat.

The non-binding aspect of a DMP can mean that not all debts are paid off at the completion of the program. Some creditors may not participate, which means you will still have to keep up with these payments plus any interest charges. If too many opt-out, this can impact your financial ability to complete the program.

Again, this differs dramatically with a legally binding proposal filed with a trustee. All unsecured creditors are bound to the same proposal terms offered by you once accepted by the majority of creditors and interest is frozen on all accounts. Creditors are stayed from taking any legal action against you while you are in a consumer proposal. No such protection exists in a debt management plan.

In addition, a DMP does not deal with tax debt; CRA will not settle tax debts in a DMP, but because a consumer proposal is governed by federal law, they are required to consider all consumer proposals. If you have significant tax debt, a DMP is not an option.

An outsider’s view

In a conversation with Richard Dunwoody, a consultant with 30 years’ experience working with creditors in the financial service industry, including their policies and practices dealing with credit counsellors, he points out this flaw in the debt management plan process and why this puts consumers at risk.

Transcript:

Richard Dunwoody: So, Doug I just want to clarify one of your points you made in explaining a debt management program and I think this is a critical point, is that not all debts are paid off at the completion of debt management program. So, a debt management program will span typically a 48 month period, not all creditors will reduce interest or just wipe out the interest on the payments. That leaves consumers at the end of the 48 month debt management program with some residual debts still owing to the consumers. And we saw this back in December in a Toronto Star article where an unfortunate lady had gone through 48 months, paid off most of her debts, but still owed $5,600 at the end of that program.

The Toronto Star reported on one such case where an individual, working with Credit Canada, made payments of $657 a month for 48 months yet her largest, and high cost debt, with CitiFinancial was not included. Working with a credit counsellor meant that CitiFinancial was not obligated to participate.

“While in credit counselling, Borden says she agreed to pay $675 a month toward meeting all her obligations. It meant working two jobs, seven days a week, plus overtime, for nearly four years. By 2012, she had wiped most of her record clean. All except for her debt with CitiFinancial.”

Working with a credit counsellor didn’t reset this person’s financial situation. She was left with a large, expensive debt at the end, was making higher monthly payments during the program than she would have needed to in a consumer proposal, and still has to deal with the financial and credit impact of her CitiFinancial account.

Richard recommends that you know exactly what your deal is going in. Ask questions along the way.

- What are my creditors agreeing to?

- Which creditors opted out of the program?

- Which creditors agreed to reduce my interest rate and by how much?

- At the end of the program, what if anything will I still owe to my creditors?

- What happens if I don’t complete my payments?

Phone in debt advice

Traditionally credit counselling was done through a face-to-face meeting with your local non-profit credit counsellor who would meet with you, look at your financial situation and work through your budget to determine how you can save money and, if needed, find a way to repay your debts. Having this second set of eyes on your personal finances can be a good idea.

Unfortunately, today much of credit counselling, and enrollment in debt management plans, is done over the phone.

One large credit counselling agency, Consolidated Credit, even outlines the online & phone counselling process on their website: https://www.consolidatedcredit.ca/about-us/who-we-are/expect-1st-session/ including this screen shot of their commentary.

Their credit counselling process is geared towards a phone consult, or even impersonal online form as you can see from the material below quoted from their website:

“Essentially, the credit counsellor will request all of the same information you would enter into the Free Debt Analysis form online – they just walk you through the process. In general, if you use the phone option, the full debt analysis will take about 30 minutes on average, so the counsellor can get a complete picture of your financial outlook. If you choose the online method, you complete this part on your own time and then a counsellor contacts you to follow up and finish your evaluation.”

“At the end of your credit counselling session – whether you started directly with a credit counsellor over the phone or submitted your information online for a counsellor to review – you will have a clear idea of which debt solution is the right choice for your unique financial needs. If that solution is a debt management program through the credit counselling agency, the credit counsellor will also be able to tell you exactly how much you will pay each month on your reduced debt payment and how long it should take to complete the program.”

While there is no harm in enquiring and asking questions over the phone, I do not believe it is possible to do a comprehensive debt assessment in a phone conversation.

The increased use of videoconferencing services is making its way into the credit counselling process. The Office of the Superintendent of Bankruptcy now allows debt assessments virtually by video. However, there is one big difference: the OSB requires, by law, a debtor to be assessed by a Licensed Insolvency Trustee, not by a salesperson or even a credit counsellor.

What exactly is the success rate of a debt management plan?

To review this, we’ll go back to our conversation with Richard Dunwoody. Credit counselling agencies themselves have reported that the completion rate for debt management plans is around 43%. That means that less than half of all individuals who start a DMP are able to complete their payments.

Transcript:

Doug Hoyes: Okay. So, now back to what you were saying which was the second point, success rate. So, what is the overall success rate on a debt management plan?

Richard Dunwoody: Well, in order to explain the success rate when I’m going to reference is a comment or a statement made in a research paper of a graduate law student here in Toronto. And it comes from a comment that he received from the director of one of the credit counselling organizations where they provided the success rate of the files closed in that 42.7% had successfully completed a program. That’s astonishing, only 42.7%.

Doug Hoyes: So, about 43%, so you’re talking about people who start the program only 43% complete it three, four years later whatever that is. And you find that astonishing because it’s such a low number.

Richard Dunwoody: Well, you have greater than a 50% chance of being unsuccessful in the program.

If you fail to complete a debt management plan, creditors can cancel any interest reduction component leaving you with a larger debt to repay.

What’s in a name? Debt consolidation, credit counselling, or debt management plan?

So, we learned that credit counselling agencies can help you get out of debt through a debt management plan. We also learned that a debt management plan is a way to pay off 100% of your debts over time.

Let’s add to the confusion of ‘terms’. Credit Canada has a page on their website that talks about a Debt Consolidation Program or DCP. By their definition this is a “process of combining two or more debts into one. The result is a single debt payment and lower total interest costs.”

In other words, this is a debt management plan. Credit counsellors have once again ‘softened’ the name of their program to appeal to those experiencing debt problems and reduce any negative connotation with the program. My concern, however, is that this further confuses consumers. If this is a consolidation program, does that mean it’s safer? Does that mean it will not impact my credit report? The answer to both those question is no – it’s the exact same program as a debt management plan, just with a better marketing name.

But what about financial counselling services?

Proper credit counselling addresses the underlying issues that lead to financial difficulty. This requires multiple meetings to go through your budget, help you review your expenses, and correct the behaviours that got you into debt in the first place.

While some agencies still provide this service, most people contract with a credit counselling agency to perform a debt management plan. There is no legal or legislative requirement for credit counselling to provide face-to-face, ongoing financial education and advice. Phone-in debt management plans rarely provide this type of personal support.

Contrast this with working with a Licensed Insolvency Trustee. If you file a consumer proposal or bankruptcy, you are required to attend two mandatory credit counselling sessions. During these sessions, we spend time with you to review your budget for ways to reduce expenses and balance your finances. We review your credit report with you and walk you through ways to correct errors on your report and rebuild your credit score. At Hoyes Michalos, if you want a third session, we are happy to provide that for you for free. We firmly believe that financial credit counselling is an essential part of the recovery process and should not be skipped in favour of simply repaying your creditors this once.

Which brings me to who should you talk to about your debts?

Choosing a credit counsellor

In Canada, there are generally three options for working with a credit counsellor.

- Not-for-profit credit counselling agencies

- For-profit credit counselling companies

- Licensed Insolvency Trustees also provide credit counselling services.

Accreditation

If you do decide to work with a credit counsellor, it is vital to ensure that they are accredited and qualified to provide the services you are looking for and need.

Unfortunately, there are no consistent initials that go after a credit counsellors name, no formal CC designation, making it difficult to access the credentials of your credit counsellor. Unlike with Licensed Insolvency Trustees, who are government regulated and licensed, accreditation of credit counsellors in Canada is self-regulated. However, self-regulation isn’t always enough.

Let’s look at the three largest, national, credit counselling agencies in Canada.

On Credit Canada’s website you can see a list of 13 credit counsellors (as of May 2019) who work for the agency. Each lists their accreditation as follows:

- Accredited Financial Counsellor Canada (AFCC)

- Bankruptcy and Insolvency Act (BIA) certified

One of the other major credit counselling agencies in Canada, The Credit Counselling Society (or No More Debts), does not list their credit counsellors. They do state that “All of our Credit Counsellors are professionally trained. They are also required to become certified through the Accredited Financial Counsellor Canada Program [SIC AFCC] which is administered by the Association for Financial Counselling and Planning Education.” Interestingly enough the link provided refers to a financial counseling and coaching training program operated out of the United States.

Another large agency in Canada offering debt management programs is Consolidated Credit. Their website does not provide a list of credit counsellors or information about individual staff accreditation, although the agency is also a member of CACCS and OACCS.

Let’s look at these credentials.

The first, their counsellor certificate, is provided through something called the Accredited Financial Counsellor Designation program. Financial Fitness provides this certification program. Financial Fitness is a brand name, launched in recent years, for the Ontario Association of Credit Counselling Services. OACSS is associated with the Canadian Association for Credit Counselling Services, launched in recent years as well. Confused? You should be. These are all ‘regulatory’ bodies, yet they are interlinked, self-created associations or collaborative groups set up for, and by, the credit counselling agencies themselves. The result is a circular reference of certification, logos and accreditation.

As to the second credential listed, “Bankruptcy and Insolvency Act Certified” it appears they are referring to the BIA Insolvency Act Insolvency Counsellor’s Qualification Course run by the Canadian Association of Insolvency and Restructuring Professionals (CAIRP).

As of 2019, the government mandated that bankruptcy counselling be managed and completed by credit counsellors registered with the Office of the Superintendent of Bankruptcy under individual Licensed Insolvency Trustees. You can read the new counselling direct 1R4 here. Unregistered, outside agencies are no longer able to provide BIA counselling. We looked up each credit counsellor on Credit Canada’s website as of May 2019, and none were registered as BIA Insolvency Counsellors with the government.

My bigger objection is with the way they refer to this designation as Bankruptcy and Insolvency Act (BIA) certified. To be clear, there is no such BIA designation. Credit counsellors and credit counselling agencies are not trained, licensed or experienced in providing insolvency advice. Only Licensed Insolvency Trustees have the extensive training to assess and perform bankruptcy and consumer proposals. The BIA counselling certificate was initially designed to allow local, full-service credit counselling agencies to provide the budgeting, credit repair and financial literacy education material required in mandatory credit counselling. It is not training in the legal aspects of bankruptcy and proposals and should not be presented or perceived that way.

Richard Dunwoody also raised concern about the lack of regulatory oversight in terms of credentials. He believes that it is crucial to have a nation program of accreditation for credit counsellors, not provided through self-regulation, supported at the Federal or Provincial level.

Transcript:

Doug Hoyes: Well, let’s pick on some of those things then. So, qualifications, I am a Chartered Accountant, I’m a licensed bankruptcy trustee, it took me many years to get my qualifications. I had to take many years’ worth of programs, many exams. I assume credit counselling is the same, extensive background like tell me what accreditation they have to go through?

Richard Dunwoody: Well, that would be the natural assumption of a consumer approaching an organization is that these folks have accreditation and they’re self-regulated bodies often talk about the accreditation programs that their members have to go through. But research has shown and has been clearly evident that if we take the top two credit not-for-profit credit counselling organizations in Canada, one of them had zero employees that were certified, had any qualifications. And the second one only had 67% of their counsellors had any certification.

So, there isn’t that regulatory oversight. It’s a self-regulatory body that’s governing them. They don’t have to have any background credentials. They can walk in, sit down at the desk, answer the phone and start telling consumers how to manage their finances. And that’s what’s concerning.

Doug Hoyes: So, obviously some of them are accredited. It’s not like they have – some of them have no experience. And again, the people who I’ve had on this show and I mentioned their names earlier, Heather and Sue, they’ve both been in this business for many years. They’ve obviously taken courses; they have various forms of accreditation. But what you’re saying is, the person you’re talking to on the phone may or may not have any kind of formal accreditation. So, are you saying then that the first question you should ask is, what’s your background, what’s your accreditation? Is that a valuable question to ask?

Richard Dunwoody: I think that’s a critical question to ask. And to ask if their accreditation comes from their self-regulatory body or does it come elsewhere?

Doug Hoyes: And in Canada, is there an elsewhere?

Richard Dunwoody: In Canada there isn’t an elsewhere, but some of the counsellors will say well I took a math course or I took a budget course in high school and they feel that’s their accreditation.

Doug Hoyes: So, what you’re arguing for is what? A national accreditation program, a provincial program, what would you like to see?

Richard Dunwoody: Well, I think it’s important to have a national program, ok, that is not provided through a self-regulatory regime, but is either supported at the Federal or Provincial level. The Financial Consumer Agency of Canada (FCAC), has a number of programs that they offer. Those programs should be endorsed in more of a certified process.

So, as you can see, ‘credit counsellors’ is an undefined term. Agencies can pick and choose accreditation programs or operate their own as they see fit and the individual you speak to on the phone may, or may not, be fully trained and certified. Self-regulation without third-party oversight brings into question the value of these certifications.

Why do creditors promote and fund credit counselling agencies?

In addition to the 10% to 15% fee you pay to your credit counsellor, credit counselling agencies receive additional funding through something called a ‘fair share donation”. This contribution can run anywhere from nothing, which is common for certain collection agencies, to a maximum of 22% with the major banks.

The major banks and credit card companies like credit counselling. Banks and lenders would prefer someone try a debt management plan because they can recover more of their money. Even if a debt management plan fails part way through, and the person ultimately files a consumer proposal or bankruptcy, the creditor is happy because they have continued to receive monthly payments for a longer period of time. This is why credit counselling agencies like Consolidated Credit, Credit Canada, and The Credit Counselling Society are largely just debt collectors for the big banks.

Does this mean you should not work with a credit counsellor?

No. There are many programs that can help Canadians get out of debt, including credit counselling. Each have their place. It is important to choose the program that works best for you whether that is debt consolidation, a debt management plan, consumer proposal or bankruptcy. However, choosing the right option means understanding:

- The qualifications of the person you are working with and their ability to answer your specific questions or give advice on a particular program;

- That you will meet face-to-face with that professional and ensure you will have enough, personalized, ongoing support to succeed both during and after the program;

- The likelihood that you can afford the payments and will be successful in completing whichever plan you put in place;

- That you are informed enough, by a licensed, accredited expert, to assess all your options before making a final decision.