Before you decide on a debt relief solution in Ontario, make sure you understand the implications of each. While every option has its own benefits in terms of interest savings and cost, each one also carries different risks.

There are some important questions you should ask when considering debt solutions. For example, are you dealing with a licensed debt professional? What legal protection will you be receiving, if any? What about the impact each debt relief option will have on your credit report?

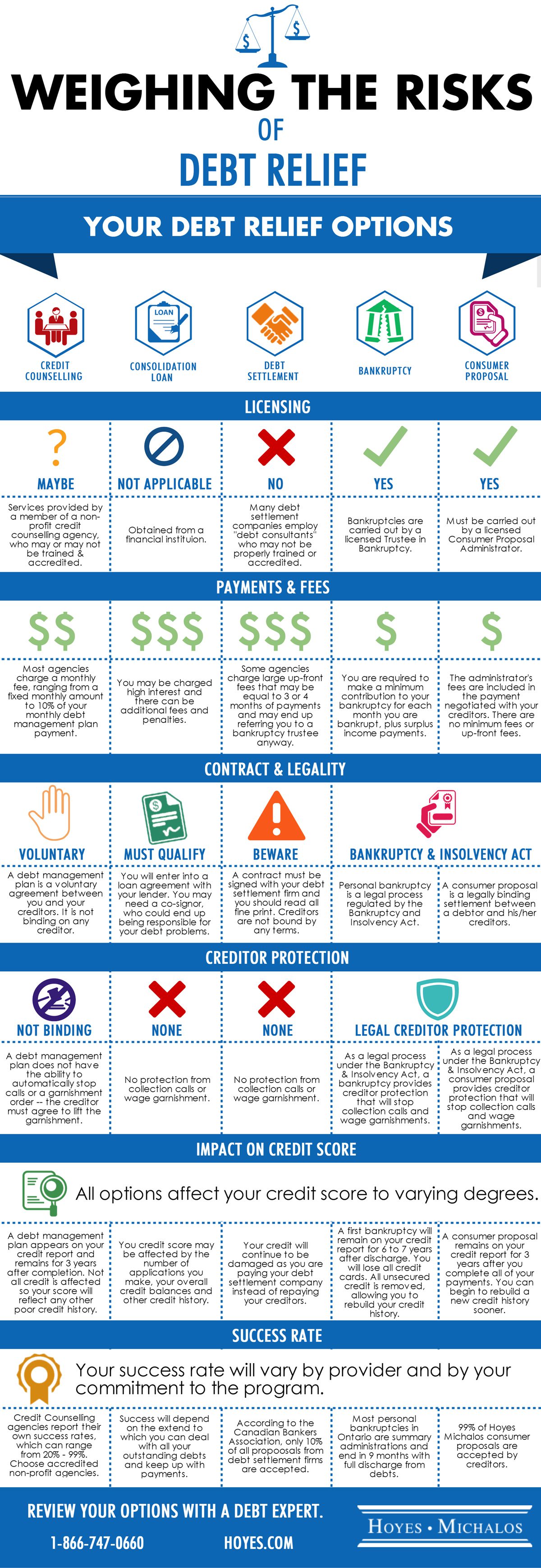

A summary of this information is also available in a handy infographic at the end of this post.

Table of Contents

Is Your Debt Professional Licensed?

No matter what option you choose to eliminate debt, you should always ask about the qualifications and credentials of the debt expert with whom you are working. Also, they should be members of an accredited association which requires them to be trained and in good standing.

- If you’re working with a credit counselling agency, it should be licensed with a reputable provincial or national association.

- Individual credit counsellors may or may not be certified or trained to discuss all debt relief options. Unfortunately, this applies to both for-profit and not-for-profit credit counselling agencies. The agency should be accredited and so should the individual who is helping you.

- Bankers and lenders offering debt consolidation loans are not certified, but you should still ensure you are dealing with a reputable lending institution. Though beware of the many low credit debt consolidation companies that offer what appear to be easy debt consolidation options. These can end up costing you much more in the long run.

- Many debt settlement companies will employ debt consultants who are not properly trained or accredited. In fact, debt settlement firms themselves are not licensed. Anyone offering debt settlement services in Ontario must be a registered pursuant to the Collection and Debt Settlement Services Act. But, lawyers, not-for-profit credit counsellors, and licensed insolvency trustees are exempt from this requirement.

- Licensed insolvency trustees are the only debt relief professionals that are licensed by the federal government. In addition, they are the only debt relief experts able to file a bankruptcy or consumer proposal.

How Expensive is Debt Relief?

It is not possible to just walk away from your debts. Each debt relief option requires that you make some form of payments. What those payments will be, and what they cover differ for each debt solution.

- Most expensive: Debt settlement through a debt consultant and debt consolidation tends to be the most expensive debt relief option. Why? Because debt settlement companies often charge large fees with a low success rate. What’s more, debt consolidation interest rates vary and extra fees may apply.

- Mid-range cost: A debt management plan, through a credit counsellor, requires that you repay 100% of your debt. Also, most credit counselling agencies charge a monthly fee, ranging from a fixed monthly amount to 10% of your monthly debt management plan payment.

- Least expensive: A bankruptcy or consumer proposal usually provides the cheapest option in terms of total payments. One of the biggest benefits of a consumer proposal is that it is often results in the lowest possible monthly payment. Debt relief payments include Trustee fees (no extra fees apply). All fees are federally regulated.

Is the Debt Relief Program Legally Binding?

Not all debt relief options have authority to be legally binding.

- A debt management plan (DMP) is a voluntary agreement. It is also not binding on any creditor. Failing to complete a DMP often results in the cancellation of any interest relief. A debt management plan cannot eliminate tax debts. What’s more, payday lenders won’t participate in any voluntary debt relief programs either.

- To qualify for a debt consolidation loan, you may have to provide security through a second mortgage, for example, or you may need a co-signer. Failing to make payments can put your assets and your co-signer at risk if you consolidate with a new loan this way.

- Beware of signing any contract with a debt consultant. Read the fine print carefully. Many require you to pay large up-front fees and creditors are not bound by any terms. You may pay significant fees without achieving any debt relief.

- A bankruptcy or consumer proposal, which can only be filed with a Licensed Insolvency Trustee is a legal process under the Bankruptcy & Insolvency Act. It is legally binding on your unsecured creditors.

What Legal Protection Do You Have?

There are two factors to consider here: how much protection from creditor actions you receive under your debt relief program and what your legal obligations are.

- Credit counselling does not protect you or stop creditor actions. Creditors must agree, and any creditor can continue to call or pursue a wage garnishment.

- Debt settlement also provides no protection from creditor actions. Creditors can, and will, pursue further legal action before you can reach any agreement.

- Only a bankruptcy or consumer proposal provides immediate protection from actions taken by your unsecured creditors. Collection calls, court actions, and wage garnishments stop.

How Does Debt Relief Option Affect Your Credit Score?

All debt relief options affect your credit score to varying degrees.

- A debt management plan appears on your credit report and remains for 2-3 years after completion.

- Multiple applications for a debt consolidation loan, and high debt balances, will negatively impact your credit score. But, this will improve only if you pay down your debt.

- Debt settlement will damage your credit, especially if you are advised to stop making payments while the debt consultant attempts to negotiate debt relief with your creditors.

- A consumer proposal will remain on your credit report for 3 years after completion.

- A first-time bankruptcy will remain on your credit report for 7 years after discharge.

How Successful Is the Debt Relief Program?

Your success rate will vary by provider and by your commitment to the program.

- Credit counselling agencies report a success rate which can range from 20% to 99% depending on how affordable your payments are and whether or not they deal with all your debt problems.

- The Canadian Bankers Association states that only 10% of debt settlement programs are accepted by creditors.

- Most personal bankruptcies in Ontario end in 9 months with full discharge from debts.

- At Hoyes Michalos, 99% of consumer proposals are accepted by creditors.

If you’re considering a debt relief solution, a good place to start is to speak to a Licensed Insolvency Trustee. He or she will explain the risks and benefits of each option and help you understand how every debt solution will affect your financial situation.