The first time it happens, it’s alarming to learn that your bank seized money from your chequing or savings account to pay off a debt you owe them. What the bank has done is exercised its right of offset.

Other creditors also have a legal right of offset, including the Canada Revenue Agency. In this post, I explain what the right of offset is, who can use this for collection or debt recovery, and what you can do about it.

Table of Contents

Understanding setoff provisions

In law, set-off is a legal technique where any creditor can net monies owing between the two same parties.

In banking, the “right of offset” (or right of set-off as it’s sometimes called) gives institutions the power to take money from your bank account to offset against any debt you owe to them. When you borrow from your bank, you owe them a debt. When you deposit money in your bank account, they owe you that money back. The bank can net these balances if you fall behind on your loan payments.

It is within your financial institution’s rights to access any money in your bank account to pay a delinquent account and:

- they do not need a court order,

- they do not have to notify you ahead of time,

- they do not need your permission, and

- money can be taken from your checking, savings, or investment account.

Most financial institutions will have a clause in their account, loan and credit card agreements with terms and conditions letting you know what the right of offset in banking policy is and when they enforce it. For example, TD bank’s offset clause states, “We may debit a positive balance in your Account to repay any debt, obligation, or liability that you owe to any TD Bank Group member (called right of set-off).”

How much can a bank take?

Most credit unions and banks have the right to offset and can exercise this right at their discretion, and as many times as they need to.

Your bank can take as much money as is in your account, up to the amount of the debt owing. There is no obligation for the bank to leave any funds in your account if you owe more than is on deposit with them. If more money is deposited in your account later, for example, your next paycheque, they can scoop that money as soon as it arrives as many times as they need to until the debt is paid in full.

Having money withdrawn from your account can leave you short for other bill payments causing further NSF charges, missed payments and further financial hardship.

Overwhelmed by debt? We can help.

Can the right of offset be used with joint accounts?

In general, a right of offset can only apply if:

- You owe money on your own, or you and a third party owe the debt (a joint debt)

- You hold the account with the same bank

Sometimes the right of offset can be used with a joint bank account according to the terms of your account agreement. For example, the same TD account agreement gives them to right to set-off debts you owe them even if “One or more joint Account holders owe the debt, obligation, or liability, whether alone or together with a third party”.

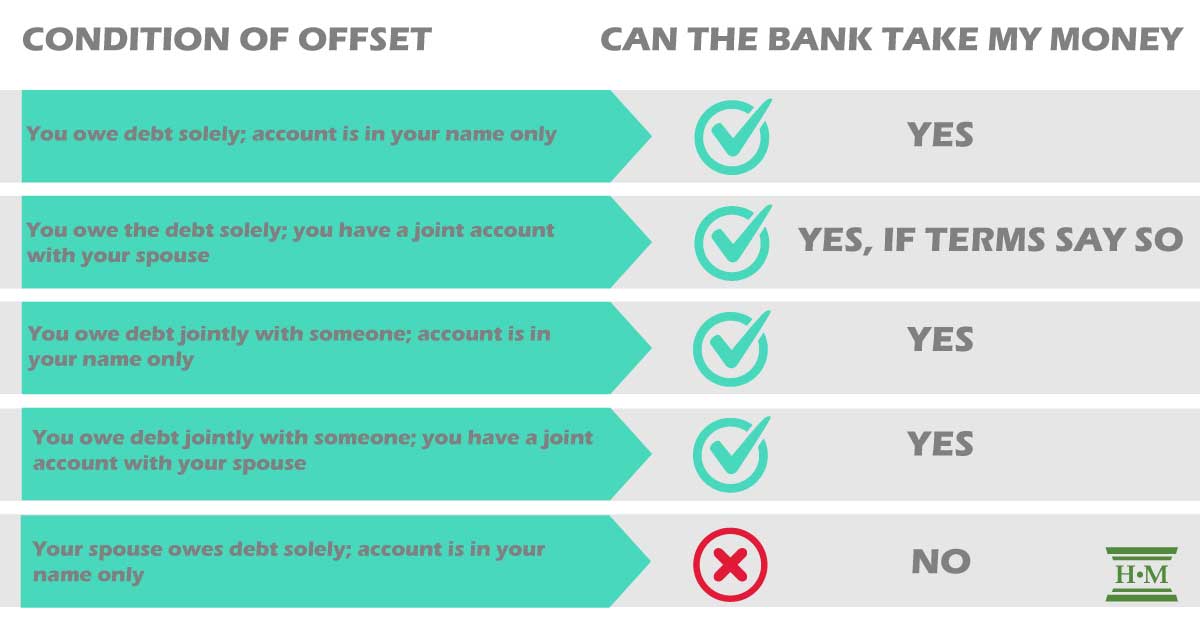

This whole concept of joint debts vs joint accounts gets complicated. Let’s look at a few examples. In all cases you owe and have an account at the same bank.

| Conditions for Offset | Can the bank take money from my account |

| You owe the debt solely; account is in your name only | Yes |

| You owe the debt solely; you have a joint account with your spouse | Yes, if terms say so |

| You owe debt jointly with someone; account is in your name only | Yes |

| You owe debt jointly with someone; you have a joint account with your spouse | Yes |

| Your spouse owes debt solely; account is in your name only | No |

In other words, if you owe the debt and you and your spouse have a joint account at the same bank, TD can take money for your debt from your joint bank account.

What other creditors have the right of offset?

Third-party creditors

Generally, the right to set off balances cannot be used if the debt is with a third party (some other creditor) to collect from your bank account. The right of set-off means that the debt and account are between the same two parties.

For other creditors or debt collectors to take money from your bank account, they must first go to court to get a formal garnishment order or request to freeze your bank account.

For example, if you owe money to Rogers, they cannot ask the bank to withdraw money from your account without taking legal action to obtain a judgement and then getting a court order to freeze your account. This is rarely done for small debts but may be done by large creditors.

If your bank receives an order from a judge allowing a creditor or debt collector to garnish your bank account based on an unpaid debt you owe, the bank must collect that money. The bank will garnish the money from your account and send it to the court-ordered collector. The bank does not have to tell you about the pending garnishment ahead of time.

Canada Revenue Agency

The CRA has two strong powers around collection and set-off.

First, CRA can freeze your bank account without a court order. This is not the same as a right of offset but certainly has the same effect of limiting your access to funds.

Second, the Canadian government has a statutory right of offset that allows them to withhold money due to you from one government agency to repay monies owing to another agency. For example, CRA can keep your tax refund or HST credits to reduce payments you owe them for tax debts or Canada Student Loans.

What is the solution & can you avoid having money taken from your account?

If the bank or CRA uses their set-off rights to collect on a debt, it is a strong warning sign that you are experiencing financial problems. A bank exercises the right of offset when a customer depositor doesn’t repay a debt due to the bank. While they do not need to notify you when they intend to withdraw money from your bank account, they have likely previously sent demand notices to pay or have made collection calls.

The first and most common solution is to switch your bank account over to another bank that is not holding your debt instrument. Move to a bank that you don’t have a debt with, or they too will be able to apply their right of offset. This is why it’s recommended that you bank at more than one bank.

While this will stop the withdrawals from your account, it does not deal with the underlying debt problem. Depending on the amount of debt you owe and your ability to repay, you may want to consider formal debt relief options, including:

Only a consumer proposal or bankruptcy will provide you with creditor protection from further collection actions.

If you would like some advice regarding dealing with collection calls or creditor enforcement, including a right of offset, book a free consultation with one of our debt experts.