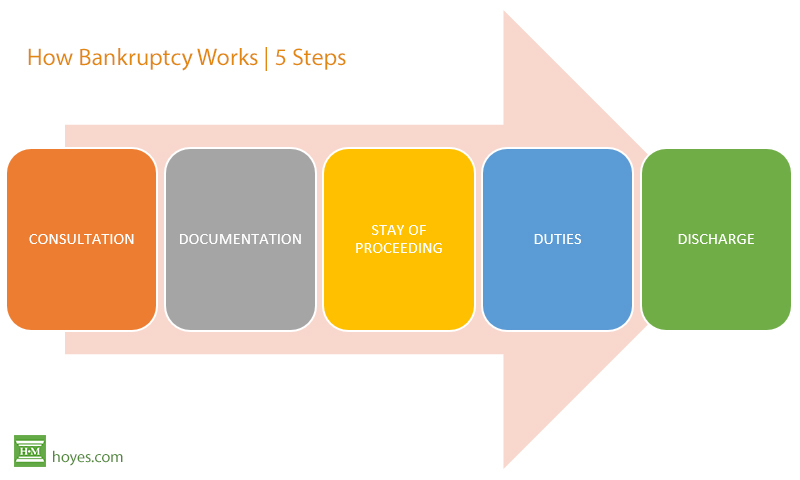

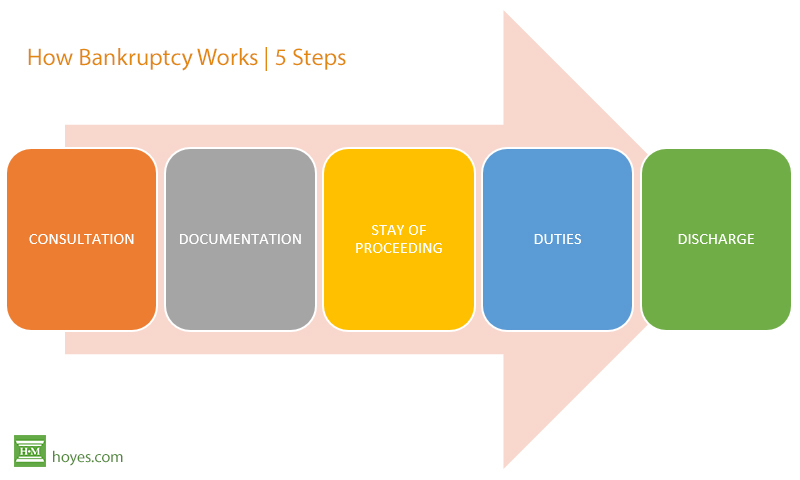

The process of personal bankruptcy in Canada can be broken down into five basic steps:

- Consultation with a Licensed Insolvency Trustee

- Preparation of documentation

- Filing and achievement of the stay of proceedings

- Completion of bankrupt’s duties

- Discharge and elimination of debts

Below we detail how Canadian bankruptcies work and what is involved in declaring a bankruptcy procedure in Canada. You may also be interested in our related article 4 stages of a consumer proposal.

Table of Contents

How does the bankruptcy process work?

Personal bankruptcy is a legal process which allows you to be discharged from most of your debts.

Once filed, non-exempt property of the debtor is given to a Licensed Insolvency Trustee who then sells it and distributes the money among the debtor’s creditors in settlement of the debt.

Step 1: Contact a Licensed Insolvency Trustee

Bankruptcy in Canada can be declared by any individual who owes at least $1,000 and is insolvent. However, bankruptcy is not the right solution for everyone.

The first step in the bankruptcy process is to contact a Licensed Insolvency Trustee for a free consultation.

Your trustee’s role in the consultation process is to assess your financial situation to see if you meet the requirements for bankruptcy and if bankruptcy makes sense. The trustee will ask questions about your debts, what you own and your household budget and will provide you advice on all your debt relief options including alternatives to bankruptcy.

You should know that before declaring bankruptcy, there are some common mistakes to avoid before filing like taking out a new loan, for example.

Step 2: Complete Bankruptcy Forms and Documentation

If you decide to declare bankruptcy, the next step is to pull together all the necessary paperwork and complete the required government forms to file your bankruptcy petition. This typically begins with a bankruptcy application form from your trustee (click here for our Fresh Start Bankruptcy Application).

The trustee will then draft the legal documents for the court including:

- A Statement of Affairs (Form 79) which lists your assets, debts, income and expenses. It also includes your address, marital status, household size and disposition of any assets before bankruptcy.

- An Assignment of Assets (Form 21) which is the document that assigns all of your eligible assets to the benefit of your creditors.

It is important that you complete these bankruptcy forms accurately and honestly. These documents are signed by you to ensure that they are correct.

Step 3: Your Documents Are Filed and Your Creditors Are Notified

After you sign your documents they are filed electronically by your trustee with the federal government. You are considered bankrupt when these forms are filed with the court and a file number (or estate number) is issued.

Filing with the Official Receiver creates the automatic stay of proceeding that prohibits creditors from pursuing you to collect on your debts.

Your trustee will then begin the process to notify your creditors. Notices may be sent electronically, by fax or by mail. That means your creditors find out fairly quickly that you have filed bankruptcy and collection calls and other actions should stop. If they do not, speak to your trustee about how to proceed.

If your wages have been garnished, or a garnishment order has been issued, your trustee will also immediately notify your employer to stop the garnishment.

Bankruptcy deals with unsecured creditors like credit card debt, payday loans, tax debt to Canada Revenue Agency and certain student loan debt. Your trustee will provide you with information on what debts are included and excluded and how to continue to meet any obligations to your secured creditors like a car loan or mortgage.

Step 4: Complete your Bankruptcy Duties

The objective of bankruptcy is to eliminate your debts. To obtain your discharge, you must complete certain bankruptcy duties including:

- surrender certain assets and your credit cards;

- attend two credit counselling sessions;

- send proof of income and expenses to the trustee monthly;

- make payments including if required surplus income payments;

- provide information needed to file necessary tax returns.

Your trustee will file two tax returns during your bankruptcy – a pre-bankruptcy return covering the period up to the date of bankruptcy and a post-bankruptcy tax return to the period to December 31 while you are bankrupt. While you lose tax refunds as part of the bankruptcy process, you keep all HST / GST cheques and child tax benefits.

Very few bankruptcies in Canada require a creditors’ meeting, less than 1 in 1000. If creditors request a meeting, your trustee will prepare a report for the court and you will be required to attend.

Step 5: Obtain Discharge from Bankruptcy

Most personal bankruptcies in Canada end in an automatic discharge. How long you will be bankrupt depends on the completion of your duties, how much you make, and if you have filed bankruptcy before. For a first time bankrupt, with no surplus income, a bankruptcy can be finished in as early as 9 months.

Your discharge is the most important step, since your bankruptcy discharge is what eliminates your unsecured debts. You have a fresh start.

After your debts are discharged, you can continue the process of rebuilding your credit and finances. A note of your bankruptcy will be removed from your credit report six years after your date of discharge. Some people are able to obtain a credit card during bankruptcy although we do not recommend taking on new credit while bankrupt.

Consult a Licensed Insolvency Trustee Near You

As you can see the bankruptcy process in Canada is a safe and regulated procedure. It is not as bad as you may think and can be a very good option for individuals if you can’t pay your debts.

Under Canadian bankruptcy law only a federally licensed trustee can file bankruptcy for you.

If you are considering bankruptcy in Ontario, contact Hoyes Michalos for a free, no-obligation consultation where we’ll answer any questions you have.

Hoyes Michalos & Associates provides personal bankruptcy services in the following locations

In Canada, you can find a reputable trustee at https://bankruptcy-canada.com/trustee/