Money management is hard. That’s why so many people don’t do it. Over the years at many credit counselling sessions with clients I’ve explained budgeting, and spreadsheets, and budgeting apps, and lots of other techniques to manage money. Some of my clients love the process of recording every transaction. Others, not so much.

So, what can you do if you want to keep track of your money, but don’t have the time or the inclination to keep a spreadsheet or spending journal?

I’ll tell you you cheat your way to financial success.

And yes, I admit it, that’s a “clickbait” title, designed to get you to listen to this podcast.

If you look in the dictionary, there are two definitions for the word “cheat”.

- The first definition is to “act dishonestly”; that’s not what I’m going to talk about today.

- The second definition of the word cheat is to “avoid something undesirable by luck or skill”, like “she cheated death in that car crash”.

That’s the kind of cheating I want to talk about today: avoiding something undesirable by using skill.

What is undesirable when it comes to money management?

Over the last 20 years I’ve personally met with over 10,000 people in financial trouble, and I can tell you from experience that, for many people, money management itself is undesirable.

Let’s take a test.

How much have you spent at the grocery store in the last month? Some of you will say “I have no idea”. Some you will answer that question by saying “that’s easy, I keep track of every dollar I spend, so I can look it up on my spreadsheet and give you an exact answer”.

There are two opposite ends to the money management spectrum: people who love to track their spending and budget, and people who don’t.

Which kind of person are you?

If you like to keep a budget, and track your spending, great. Keep doing it. If it works for you, that’s all that matters.

But what if you are the kind of person whose dream in life was not to grow up to be an accountant? What if you are not a detail oriented person when it comes to money. What if you don’t want to have to pause for two minutes after buying a coffee to record the transaction in your notebook, or on your spending app?

I believe it is possible to manage your money without taking the time to record every single transaction as they happen.

I believe you can cheat your way to financial success.

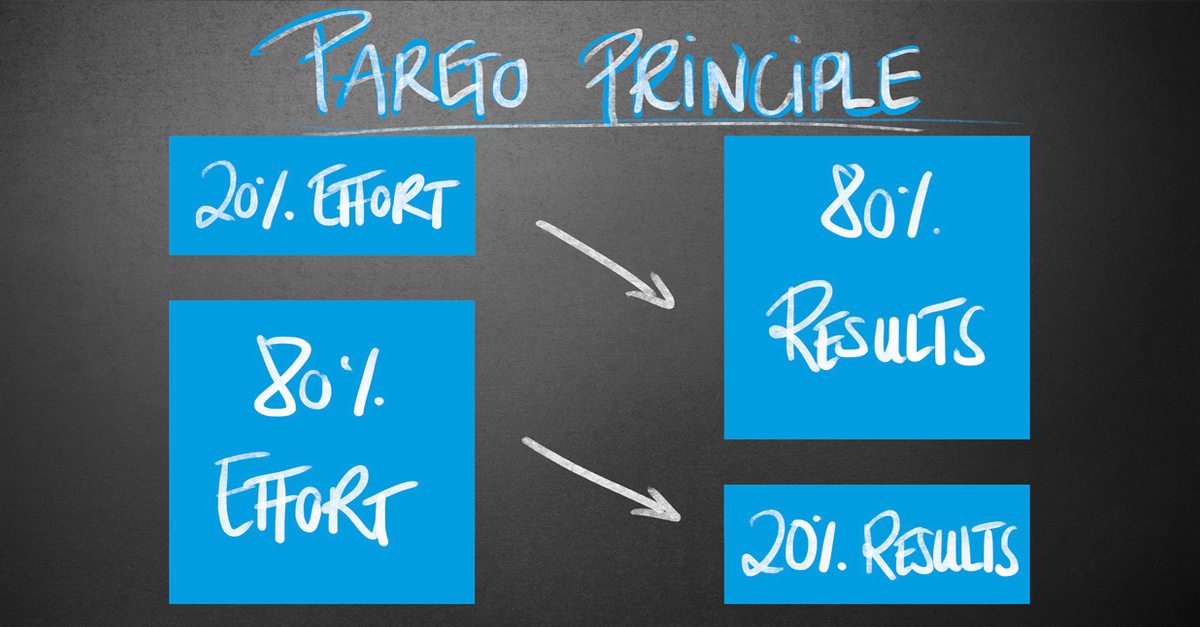

The secret to cheating is to use the Pareto Principle, also known as the 80/20 rule.

Vilfredo Pareto was an Italian engineer and economist who died almost a hundred years ago, and he was the first to discover that many things in life follow what we now call the Pareto Principle. In simple terms, 80% of the effects come from 20% of the causes. Business managers know that, in many businesses, 80% of the sales come from 20% of the clients. That makes sense; if you have a few big customers, they can be responsible for a lot of your sales.

Put another way, the Pareto Principle also means that 80% of the results come from 20% of the effort.

Here’s another example: in computer software, Microsoft realized that by fixing the top 20% of reported bugs, 80% of related errors and computer crashes could be eliminated.

So what does this have to do with money management? It’s simple. A small amount of effort produces big results.

You could make a budget and savings system, (whether it be jars, envelopes or separate bank accounts) and allocate money each pay for each of your bills. So if your $100 hydro bill is due on the fifth of each month, and this month you get paid bi-weekly on the 10th and 24th of the month, you could decide to allocate $75 from your first paycheque and $25 from your second paycheque to your hydro bill. You could set up a little accounting system, or perhaps columns on a spreadsheet, so you know how much money in each pile is allocated for each item so that you know whether or not you have enough when the bill comes due. You could repeat the process for every other bill you have. That sounds complicated to me, and I am a chartered accountant.

So how can you get 80% of the results for only 20% of the effort?

How can you get your hydro bill paid for minimum effort?

The answer is, you cheat.

Instead of making up some complicated budgeting system, just pay your bills as often as you get paid.

So if you get paid every two weeks, pay half of your hydro bill every two weeks.

Pull out your last hydro bill. It probably shows your invoice history on it, so you can figure out how much you typically pay each month. If you are on an equal billing program, it’s really easy. If not, do your best estimate of what your bill will be over the next few months.

Then, go to your online banking app, go to bill payments, select hydro, and set up a recurring payment for the correct amount for the next few months. The trick is that if your hydro bill is $100 per month, and you get paid every two weeks, set it up to automatically pay $50 every two weeks, on payday.

You repeat the process for all of your other monthly bills.

Now is this system as good as if you actually reviewed your bill each month, and paid the exact amount owing on the exact due date?

No, it’s only 80% as good, but that’s the point. You get 80% of the benefit, meaning your hydro bill gets paid on time, but it’s only 20% of the effort of allocating the payment each month.

The point is that you are the boss. You get to decide how much effort you want to put into money management. If you like tracking every dollar, great, do it. If not, you can set your bills on auto pay, and get most of the benefit for a lot less work.

And yes, I realize there are some bills that this may not work for. You can set up your mortgage to come out on every payday, but your landlord probably doesn’t want you to send money every two weeks. No problem, you can set up an account at one of those online banks that don’t charge any fees, and transfer half of your rent every two weeks to that account, and then your landlord can go into that account on the first of the month to take their payment.

And I also realize that in my example of paying half of your bill every two weeks you will end up overpaying, because there are two months of the year where you get three paycheques.

Cool. That means that at the end of the year you will be one month ahead on all of your bills. That’s great if you get laid off, because now you have an emergency fund and you didn’t have to do any work to create it.

That’s a perfect illustration of the 80/20 rule. You get a lot of benefit for minimal work.

As an aside, the 80/20 rule is not just for money. It works in most areas of life.

If you want to get into better physical condition, you can go to the gym and work out every day. By the time you drive to the gym, do your workout, have a shower, and come home, that’s probably two hours of time. You will probably get great results.

So how do you get 80% of the results with only 20% of the effort?

You cheat.

You don’t go to the gym, but you do little things during your regular day. You take the stairs instead of the elevator. Instead of parking your car at the front door to your office, you park at the far end of the parking lot. You go for a walk at lunch. If you want to work out, do some push ups and sit-ups in the morning when you get up. It only takes a few minutes. No driving to the gym.

Will that make you an Olympic athlete? No, of course not, you are only doing 20%, or less, of the work of an athlete, so you can’t expect the same results. But compared to doing nothing, you probably get 80% better results.

Want to lose weight? You could count calories and make a detailed meal plan, or just throw out all of they junk food in your house; that gets you a lot of the results with less of the effort.

Want to be a good investor? You could study every stock and mutual fund, or you could use a robo advisor or hire a financial advisor. I’m not an expert in robo advisors or financial planners, so I don’t know what’s right for you, but there are ways to use less effort but still achieve good results.

The point is that, in many cases, you can get close to 80% of the benefit by putting in only 20% of the effort.

Why does this matter?

Because managing your money can seem overwhelming. Budgeting is hard. Investing is hard. But if you realize that you can get 80% of the benefit with only 20% of the work, the challenge does not seem so daunting.

It’s doable.

You can do it.