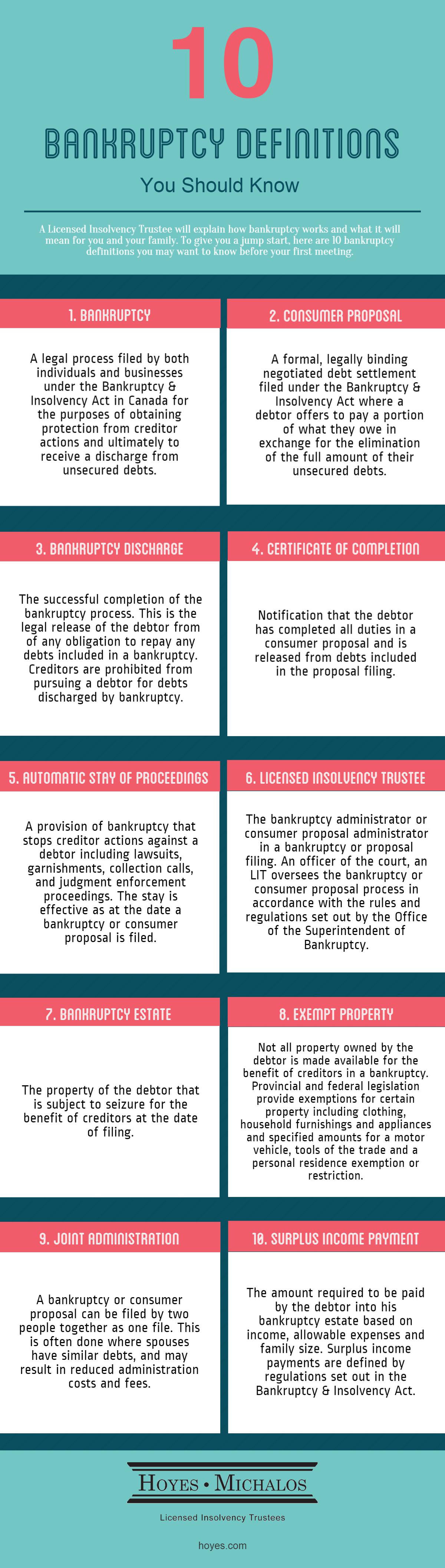

As licensed insolvency trustees, we will explain how the bankruptcy process works and what it will mean for you and your family. To help you understand more about personal bankruptcy here are 10 bankruptcy definitions you may want to know before your first meeting.

View the infographic or scroll to the bottom for a text version and links to more information.

Bankruptcy: A legal process filed by both individuals and businesses under the Bankruptcy & Insolvency Act in Canada for the purposes of obtaining protection from creditor actions and ultimately to receive a discharge from unsecured debts.

Consumer Proposal: a formal, legally binding negotiated debt settlement filed under the Bankruptcy & Insolvency Act where a debtor offers to pay a portion of what they owe in exchange for the elimination of the full amount of their unsecured debts.

Bankruptcy Discharge: The successful completion of the bankruptcy process. This is the legal release of the debtor from of any obligation to repay any debts included in a bankruptcy. Creditors are prohibited from pursuing a debtor for debts discharged by bankruptcy.

Certificate of Completion. Notification that the debtor has completed all duties in a consumer proposal and is released from debts included in the proposal filing.

Automatic Stay of Proceedings: A provision of bankruptcy that stops creditor actions against a debtor including lawsuits, garnishments, collection calls and judgment enforcement proceedings. The stay is effective as at the date a bankruptcy or consumer proposal is filed.

Licensed Insolvency Trustee: The bankruptcy administrator or consumer proposal administrator in a bankruptcy or proposal filing. An officer of the court, an LIT oversees the bankruptcy or consumer proposal process in accordance with the rules and regulations set out by the Office of the Superintendent of Bankruptcy.

Bankruptcy Estate: The property of the debtor that is subject to seizure for the benefit of creditors at the date of filing.

Exempt Property: Not all property owned by the debtor is made available for the benefit of creditors in a bankruptcy. Provincial and federal legislation provide exemptions for certain property including clothing, household furnishings and appliances and specified amounts for a motor vehicle, tools of the trade and a personal residence exemption or restriction.

Joint Administration: A bankruptcy or consumer proposal can be filed by two people together as one combined file. This is often done where spouses have similar debts, and may result in reduced administration costs and fees.

Surplus Income Payment: The amount required to be paid by the debtor into his bankruptcy estate based on income, allowable expenses and family size. Surplus income payments are defined by regulations set out in the Bankruptcy & Insolvency Act.