A consumer proposal is one of Canada’s best solutions for dealing with debt.

If your bills are too much to handle and you’re looking for an easier way to pay off debt without filing for bankruptcy, a consumer proposal may be for you.

This guide to consumer proposals tells you what you need to know to determine if a consumer proposal may be a good debt relief solution for you. If you’d like to discuss how a consumer proposal can help you get rid of debt and see how it can compare to other options, call 1-866-747-0660 to book a free consultation.

What Is A Consumer Proposal?

A consumer proposal is a legally binding agreement between you and your creditors to repay a percentage of what you owe in exchange for full debt forgiveness. A consumer proposal is a proceeding under the Bankruptcy and Insolvency Act and is administered by a Licensed Insolvency Trustee.

About Consumer Proposals in Canada

- 70-80% – Potential debt savings after filing a consumer proposal in Canada

- $250,000 – Maximum unsecured debt limit for filing (excluding home mortgage)

- 5 years – Maximum length of time to make proposal payments

- 0% – Interest charged on debts once a consumer proposal is filed

- 6 years – Maximum time from date of filing a proposal stays on your credit report

- 100,000 – 110,000 – Number of Canadians who file consumer proposals annually (as of 2024)

- 80% – Percentage of insolvencies that are consumer proposals (vs bankruptcy – as of 2024)

At Hoyes Michalos, we’ve helped over 200,000 Canadians find debt relief since 1999. Our team of Licensed Insolvency Trustees can guide you through the consumer proposal process and help you negotiate with creditors to reduce debts by up to 80%.

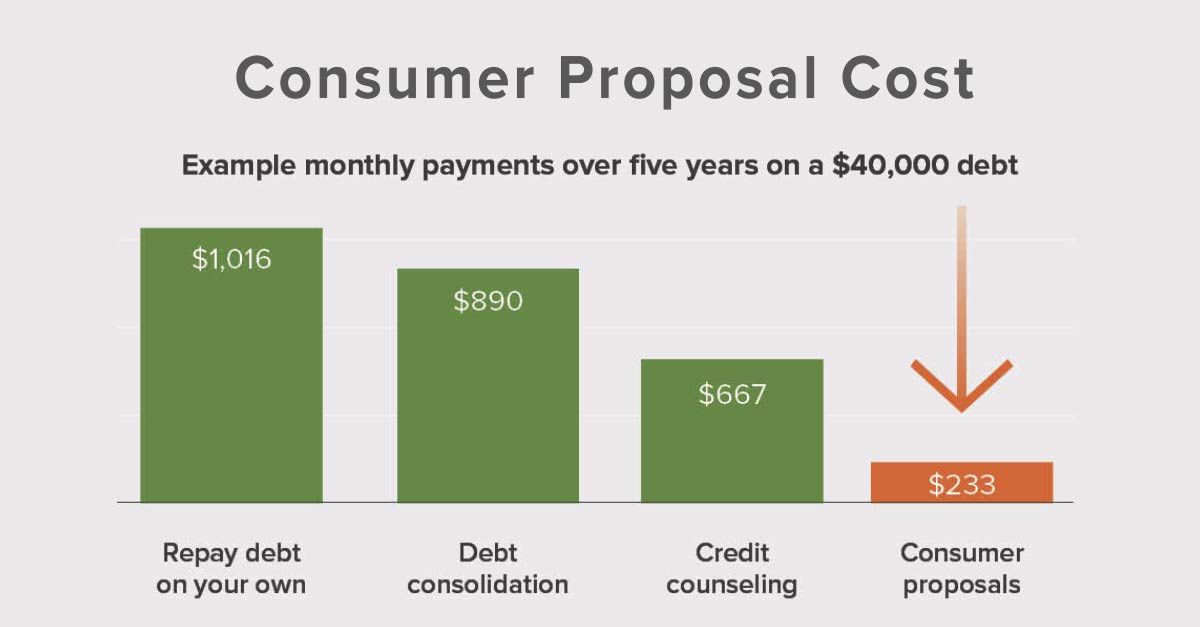

How Much Does a Consumer Proposal Cost?

A consumer proposal is a form of debt settlement which means you pay back less than you owe.

- Your monthly payments are based on what you can afford and what creditors will accept – typically between 20-70% of your total unsecured debt

- There are no upfront fees or hidden costs – the Licensed Insolvency Trustee’s fees are already included in your monthly payment amount

- You can spread your payments over up to 5 years (60 months) to keep monthly payments manageable

Here are some typical scenarios:

With $40,000 in debt:

- Minimum payments on debts: $1,100/month

- Possible proposal payment: $233/month

- Total debt reduced to $14,000 over 60 months

With $80,000 in debt:

- Minimum payments on debts: $2,100/month

- Possible proposal payment: $467/month

- Total debt reduced to $28,000 over 60 months

See how much you can save by using our consumer proposal calculator:

Enter Your Total Unsecured Debt

| Options To Eliminate Your Debt |

Monthly Payment (approximate) Over 5 Years |

Total Cost Over 5 Years |

Total Savings Over 5 Years |

|---|---|---|---|

|

Consumer Proposal Pay Less than Principal Debt Amount |

|

||

|

Credit Counselling No Principal Reduction |

|

||

|

Debt Consolidation Added Interest Costs |

|

||

|

Repay Debt on Your Own Added Interest Costs |

|

Need help with your debt?

Book a Free Consultation

What Debts Are Included in a Consumer Proposal?

A consumer proposal eliminates unsecured debts including:

- Credit card debt

- Bank loans

- High interest personal loans

- Unsecured lines of credit

- Payday loans

- Overdrafts

- Income tax debt, HST, GST and other tax debts

- Student loans (if you’ve been out of school for 7 years)

- Outstanding bill payments

- Accounts in collection

However, some debts are not included in a consumer proposal :

Secured Debts: A consumer proposal does not affect your mortgage or car loan. You must continue to pay your secured creditors if you want to keep those assets.

Non-Dischargeable Debts: Child support, alimony, court fines, and penalties are not dischargeable under bankruptcy law and cannot be included in your proposal.

Recent Student Loans: Government student loans can only be included if you’ve been out of school for more than 7 years.

Pros and Cons of Canada’s Consumer Proposal Plans

A consumer debt proposal is the only debt settlement program sanctioned by the Canadian government. This makes it a safer debt settlement solution than informal options through a debt consultant or credit consolidation company.

Advantages of a Consumer Proposal

As the #1 alternative to filing bankruptcy, a consumer debt proposal provides several benefits over other debt relief options:

- Reduce your debts by up to 70% and get out of debt sooner.

- You will be out of debt in 3 to 5 years.

- Keep all your assets, including any equity in your home.

- Consolidate debts into one, easy to make, affordable, monthly payment.

- Freeze interest on your debts.

- Legally bind all creditors to your offer if the majority agree.

- Stop calls from collection agencies

- Stop legal action and lawsuits

- Stop wage garnishments.

- Once accepted, your payment terms do not change even if your income increases.

- You avoid bankruptcy.

Disadvantages of Consumer Proposals

If you cannot repay your debts, the advantages of a consumer proposal almost always outweigh any disadvantages. However, there are some short-term negative consequences of filing a consumer proposal:

- It will lower your credit score initially

- Your creditors may not approve your proposal; however, this is rare – 99% of consumer proposals are accepted.

- If you miss three consecutive payments, it will be automatically annulled, and your debts will return.

- Some debts are excluded, including secured debts, child support, alimony, fines, debts due to fraud and some student loans.

What Happens to My Assets in a Consumer Proposal?

One of the main advantages of a consumer proposal is that you keep your assets. You maintain ownership and control of your house, car, investments, and other assets throughout the proposal process. The value of any equity in your assets will impact how much you must offer for your proposal to be accepted, but this formal debt proposal allows you to retain ownership.

Can I keep my house if I file a consumer proposal?

Yes, you can keep your house when filing a consumer proposal as long as you maintain your mortgage payments. If you have significant equity in your home, a proposal often makes more sense than personal bankruptcy.

Will I lose my car in a consumer proposal?

You can keep your car in a consumer proposal regardless of the value. If you have a car loan, you’ll need to continue making payments directly to your lender.

How Does a Consumer Proposal Affect Your Credit?

As with any debt repayment program, including a debt management plan, a consumer proposal will impact your credit rating for a short while. When you file a consumer proposal will remain on your credit report for three years from completion or 6 years from the date you filed, whichever comes first.

Do I have to give up my credit cards in a consumer proposal?

Yes, you must surrender your credit cards to your LIT when you file a consumer proposal. However, most people can get a secured credit card during their proposal.

Will I be able to get a loan in a consumer proposal?

While a consumer proposal impacts your ability to obtain new credit initially, you can begin rebuilding your credit during your proposal. Initially, lenders will see you as a high risk, and you may have to pay higher interest rates. However, if you follow the credit rebuilding steps provided during your free credit counselling sessions, you should see significant improvement in your credit score soon after completion. Many people find they can qualify for a larger loan and even a mortgage within 2 years of completing their proposal.

How Does a Consumer Proposal Work?

Step 1: Free Consultation

The decision to file a consumer proposal begins with a debt assessment with a Licensed Insolvency Trustee to help you determine if a consumer proposal is the best way out of debt for you. Your trustee will discuss alternatives, including credit counselling, a debt management plan, debt consolidation and bankruptcy.

Once you choose to make a consumer proposal to your creditors, the basics of the proposal process are as follows:

Step 2: Build Your Repayment Plan

Your trustee will recommend a payment plan that will balance what you can afford and what may be acceptable to your creditors.

Here is a typical example. Our average client owes roughly $50,000 in unsecured debts. They may offer to settle this debt for $17,400, payable over 60 months. Their monthly proposal payments would amount to $290, significantly less than the monthly minimum payments on their debts.

Payment plans are flexible. You can make a lump sum payment, pay monthly or based on your paycheque schedule. All proposals must be completed within five years, with 3 to 5-year terms being most common.

Step 3: File Paperwork and Documentation

Once you determine how much you want to offer your creditors, your trustee will prepare the required documents, which you will sign. Once signed, your proposal is filed with the government, and your creditors will be notified.

Step 4: Stay of Proceedings

When you file a consumer proposal, you gain immediate legal protection through a “stay of proceedings.” This court-ordered protection stops all collection actions against you, including:

- Wage garnishments

- Collection calls and letters

- Legal actions or lawsuits

- Frozen bank accounts

Step 5: Voting and Creditor Approval

Your creditors have 45 days to review your offer. They can accept your offer as is, reject your offer and ask for a creditors meeting. If less than 25% of creditors ask for a meeting, your proposal is deemed to be approved. If a meeting is required, votes are counted, and your proposal is approved if the majority (in dollar amount) accepts.

Step 5: Make Payments and Duties

A consumer proposal has far fewer duties than bankruptcy. You are required to make your scheduled proposal payments, attend two financial or credit counselling sessions and generally comply with any information requests by your trustee.

Step 6: Debt Elimination

Once all your proposal payments are made, you will receive a Certificate of Full Performance, which indicates that you have completed your proposal. At this point, your debts are eliminated, and you have a fresh start. You can begin the process of rebuilding your credit now that you are debt free.

Who Is Eligible To File a Consumer Proposal?

As a federally regulated program, proposals have specific requirements you must meet to qualify to file a consumer proposal in Canada:

- You must be able to afford to pay a portion of your debts;

- You must be insolvent, meaning your debts must be greater than the value of any assets you own, or you can no longer keep up with debt payments as they become due;

- Your unsecured debt must not exceed $250,000 (not including your mortgage);

- You must be a resident of Canada or have property in Canada.

Citizenship is not a requirement to file a consumer proposal. You can be a permanent resident or residing in Canada under a work permit or other immigration status.

You must work with a Licensed Insolvency Trustee in Ontario who will guide you through the process and ensure you meet all eligibility requirements.

Consumer Proposals vs Other Debt Relief Solutions

In Canada, a consumer proposal is one of several debt solutions available to help people get out of debt. However, as the number one alternative to bankruptcy, a consumer proposal is becoming the safest and most common route to debt relief.

Should I File a Consumer Proposal or Bankruptcy?

Roughly 8 out of 10 Canadians filing for debt relief choose consumer proposals as an alternative to bankruptcy.

A consumer proposal is often the better choice if you have a stable income, want to keep your assets, and can afford monthly payments, as it has less impact on your credit and allows you to keep assets while typically reducing your debt by 60-70%. Bankruptcy might be more suitable if you have little to no income to make monthly payments, don’t have significant assets to protect, or need immediate relief from overwhelming debt, though it has a longer-lasting impact on your credit and requires surrendering certain assets.

Here are the main differences between a consumer proposal and bankruptcy:

| Consumer Proposal | Bankruptcy | |

| Assets | Keep all assets | Must surrender non-exempt assets; may lose investments and home equity |

| Tax Refunds | Keep all tax refunds | Must surrender refunds during bankruptcy |

| Monthly Payments | Fixed payment based on what you can afford | Payments vary based on income – may increase if income rises |

| Length | Up to 5 years maximum | As little as 9 months but up to 21 months for first bankruptcy |

| Credit Rating | R7 rating for 1-3 years after completion | R9 rating for 6-7 years after discharge |

| Income Changes | Payments stay the same if income increases | Payments increase if you earn more (surplus income) |

Consumer Proposal vs Debt Consolidation

Unlike debt consolidation loans, a consumer proposal reduces your total debt and provides legal protection from creditors. You don’t need a good credit rating to qualify, and interest charges stop completely.

Consumer Proposal vs Credit Counselling

A debt management plan, available through a credit counsellor, can help you repay 100% of your debt over time but doesn’t provide legal protection or debt reduction. A consumer proposal legally reduces your debt while protecting you from creditor’ actions.

More Frequently Asked Questions

Filing a consumer proposal can be a complex process, and it’s natural to have many questions about how it works and what to expect. Here are answers to some of the most commonly asked questions.

-

What happens if my proposal is rejected?

-

What happens if I miss a payment on my consumer proposal?

-

What happens if my income increases during my proposal?

-

Will my spouse be affected by my consumer proposal?

-

Can I include CRA debt in my consumer proposal?

-

How long does the consumer proposal process take?

-

Can I pay off my consumer proposal early?

-

What happens after I finish paying off my consumer proposal?

For more information on consumer proposals in Canada and how they work, visit our consumer proposal FAQ page or read our consumer proposal blog.

Contact a Licensed Insolvency Trustee in Canada

Consumer proposals can only be filed with a Licensed Insolvency Trustee in Canada. All LITs are registered with the Office of the Superintendent of Bankruptcy, including Hoyes Michalos.

Beware of unlicensed debt consultants as many charge unnecessary up-front or referral fees. A credit counsellor or unlicensed debt consultant cannot provide consumer proposal services legally. Never pay fees to an outside consultant to help you prepare any paperwork.

As a Licensed Insolvency Trustee, Hoyes Michalos is licensed to file consumer proposals.

- All consultations are free

- We will meet with you as often as you need

- We explain all your debt relief options

- We’ll find a solution you can afford

- We have a 99% acceptance rate for consumer proposals we file

Hoyes Michalos & Associates provides consumer proposal services in the following locations

Other service areas

We offer the convenience of phone and video-conferencing services in the following additional locations:

More about consumer proposals in Canada on our blog:

- Filing a joint consumer proposal with your spouse

- Consumer proposal issues when you are self-employed

- What is a registered consumer proposal?

Find out how to file a consumer proposal in Canada or contact us for a free consultation.